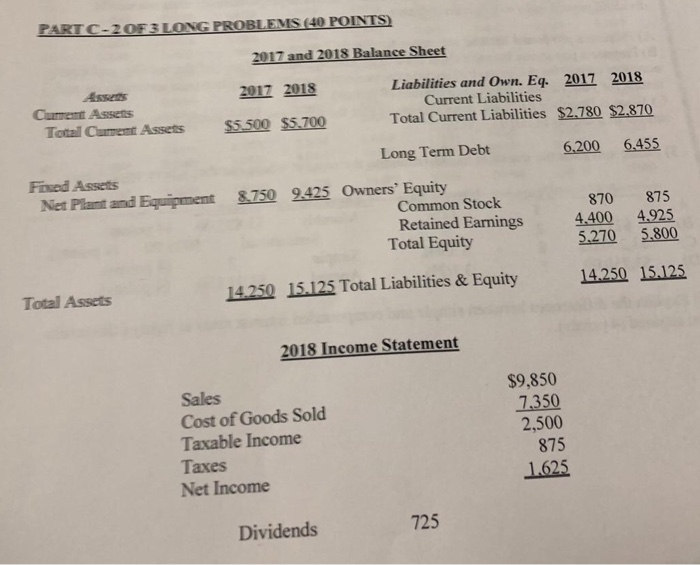

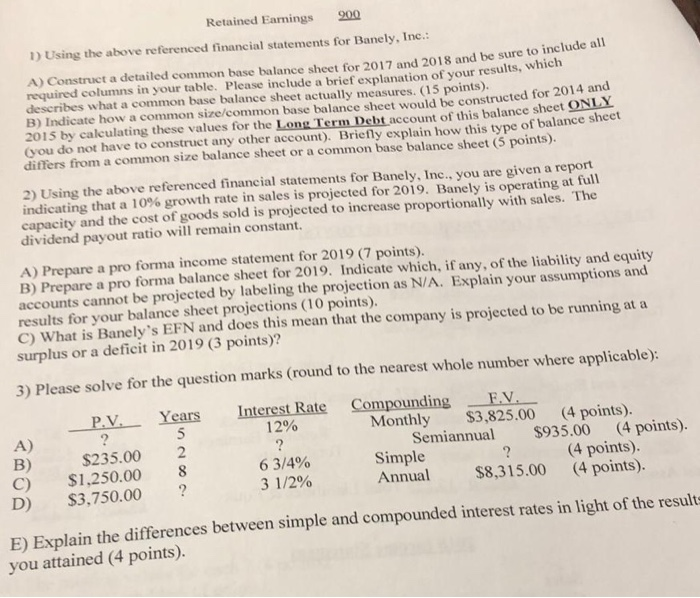

PART C-2OF 3 LONG PROBLEMS (40 POINTS) 2017 and 2018 Balance Sheet 2017 2018 Liabilities and Own. Eq. 2017 2018 Current Liabilities Total Current Liabilities $2,780 $2,870 Assets Curent Assets $5.500 $5.700 Total Curent Assets 6.200 Long Term Debt 6.455 Fixed Assets 9425 Owners' Equity &750 Net Plant and Equipment Common Stock Retained Earnings Total Equity 870 875 4.400 5.270 4.925 5.800 14.250 15.125 14.250 15.125 Total Liabilities & Equity Total Assets 2018 Income Statement $9,850 7.350 2,500 875 Sales Cost of Goods Sold Taxable Income Taxes Net Income 1.625 725 Dividends Retained Eamings 900 1) Using the above referenced financial statements for Banely, Ine.: A) Construct a detailed common base balance sheet for 2017 and 2018 and be sure to include al required columns in your table. Please include a brief explanation of your results, which describes what a common base balance sheet actually measures. (15 points). B) Indicate how a common size/common base balance sheet would be constructed for 2014 and 2015 by calculating these values for the Long Term Debt account of this balance sheet ONLY Cyou do not have to construct any other account). Briefly explain how this type of balance sheet differs from a common size balance sheet or a common base balance sheet (5 points). 2) Using the above referenced financial statements for Banely, Inc., you are given a report indicating that a 10% growth rate in sales is projected for 2019. Banely is operating at full capacity and the cost of goods sold is projected to increase proportionally with sales. The dividend payout ratio will remain constant. A) Prepare a pro forma income statement for 2019 (7 points). B) Prepare a pro forma balance sheet for 2019. Indicate which, if any, of the liability and equity accounts cannot be projected by labeling the projection as N/A. Explain your assumptions and results for your balance sheet projections (10 points). C) What is Banely's EFN and does this mean that the company is projected to be running at a surplus or a deficit in 2019 (3 points)? 3) Please solve for the question marks (round to the nearest whole number where applicable): Interest Rate Compounding Monthly Semiannual F.V. $3,825.00 P.V. Years ? (4 points). $935.00 12% ? 6 3/4% 5 A) B) C) D) (4 points). (4 points). (4 points). 2 $235.00 $1,250.00 $3,750.00 Simple Annual $8.315.00 3 1/2% E) Explain the differences between simple and compounded interest rates in light of the results you attained (4 points)