Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part D a) Bank B reported a debt to equity ratio of 8.5 at the end of year 2019 . If the bank's total assets

part D

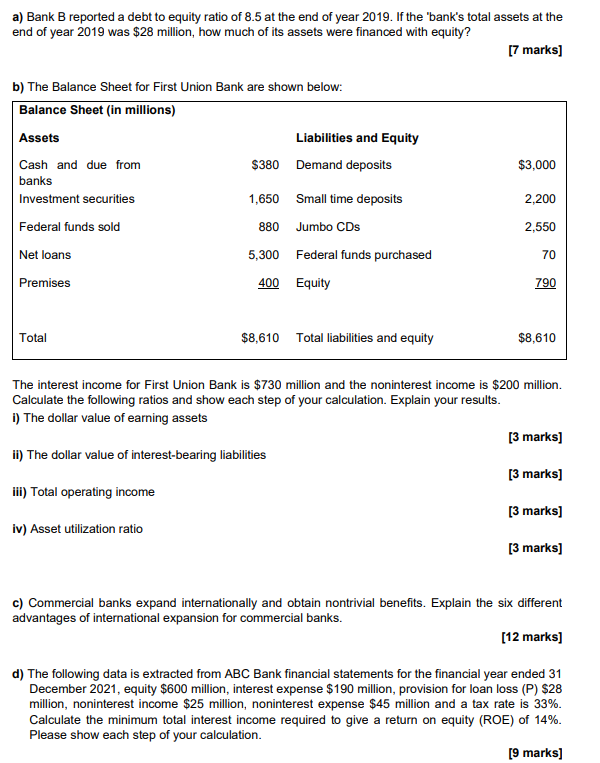

a) Bank B reported a debt to equity ratio of 8.5 at the end of year 2019 . If the "bank's total assets at the end of year 2019 was $28 million, how much of its assets were financed with equity? [7 marks] b) The Balance Sheet for First Union Bank are shown below: The interest income for First Union Bank is $730 million and the noninterest income is $200 million. c) Commercial banks expand internationally and obtain nontrivial benefits. Explain the six different advantages of international expansion for commercial banks. [12 marks] d) The following data is extracted from ABC Bank financial statements for the financial year ended 31 December 2021 , equity $600 million, interest expense $190 million, provision for loan loss (P)$28 million, noninterest income $25 million, noninterest expense $45 million and a tax rate is 33%. Calculate the minimum total interest income required to give a return on equity (ROE) of 14%. Please show each step of your calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started