Question

PART I INSTRUCTIONS: Management has asked with your assistance in conducting a traditional costing allocation of manufacturing overhead to each product in order to assess

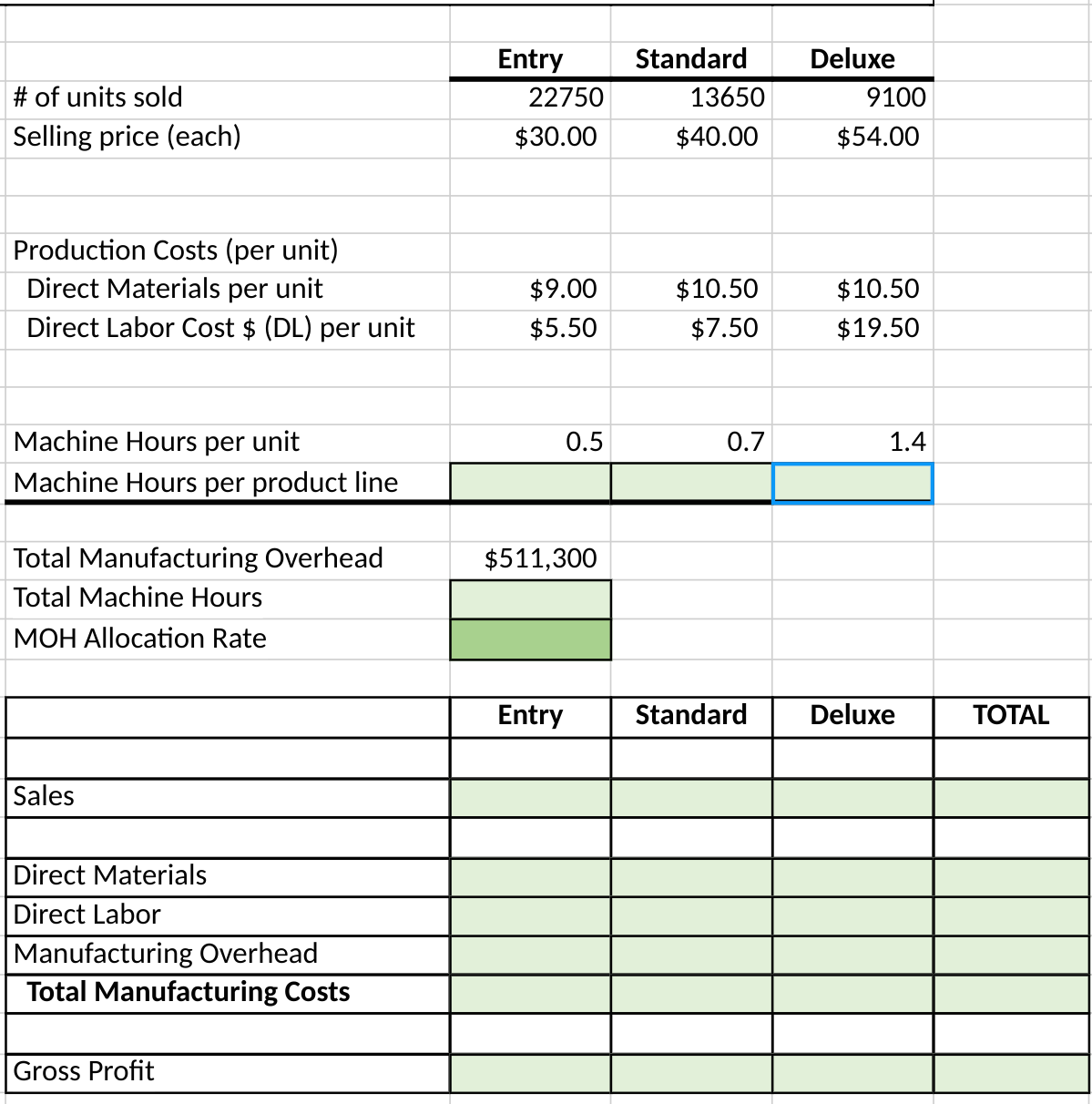

PART I INSTRUCTIONS: Management has asked with your assistance in conducting a traditional costing allocation of manufacturing overhead to each product in order to assess profitability.

REQUIRED: -Allocate overhead to each product line based on Machine Hours - Assume that estimated MOH and Estimated Machine Hours are equal to Actual MOH and Machine Hours -Compute Gross Profit for each of the company's product lines by filling in the GREEN cells below. -The QUIZ may ask you to conduct sensitivity analysis on certain parameters so be sure you are coding your cells dynanmically (using formulas to link to inputs).

\# of units sold \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Entry } & Standard & \multicolumn{1}{|c|}{ Deluxe } \\ \hline 22750 & 13650 & 9100 \\ \hline$30.00 & $40.00 & $54.00 \\ \hline \end{tabular} Production Costs (per unit) Direct Materials per unit Direct Labor Cost $(DL) per unit \begin{tabular}{|r|r|r|} \hline$9.00 & $10.50 & $10.50 \\ \hline$5.50 & $7.50 & $19.50 \\ \hline \end{tabular} Machine Hours per unit \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{0.5} & 0.7 & 1.4 \\ \hline & & \\ \hline \end{tabular} Total Manufacturing Overhead Total Machine Hours MOH Allocation Rate \begin{tabular}{|} $511,300 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Entry & Standard & Deluxe & TOTAL \\ \hline & & & & \\ \hline Sales & & & & \\ \hline & & & & \\ \hline Direct Materials & & & & \\ \hline Direct Labor & & & & \\ \hline Manufacturing Overhead & & & & \\ \hline Total Manufacturing Costs & & & & \\ \hline & & & & \\ \hline Gross Profit & & & & \\ \hline \end{tabular} \# of units sold \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Entry } & Standard & \multicolumn{1}{|c|}{ Deluxe } \\ \hline 22750 & 13650 & 9100 \\ \hline$30.00 & $40.00 & $54.00 \\ \hline \end{tabular} Production Costs (per unit) Direct Materials per unit Direct Labor Cost $(DL) per unit \begin{tabular}{|r|r|r|} \hline$9.00 & $10.50 & $10.50 \\ \hline$5.50 & $7.50 & $19.50 \\ \hline \end{tabular} Machine Hours per unit \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{0.5} & 0.7 & 1.4 \\ \hline & & \\ \hline \end{tabular} Total Manufacturing Overhead Total Machine Hours MOH Allocation Rate \begin{tabular}{|} $511,300 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Entry & Standard & Deluxe & TOTAL \\ \hline & & & & \\ \hline Sales & & & & \\ \hline & & & & \\ \hline Direct Materials & & & & \\ \hline Direct Labor & & & & \\ \hline Manufacturing Overhead & & & & \\ \hline Total Manufacturing Costs & & & & \\ \hline & & & & \\ \hline Gross Profit & & & & \\ \hline \end{tabular}

\# of units sold \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Entry } & Standard & \multicolumn{1}{|c|}{ Deluxe } \\ \hline 22750 & 13650 & 9100 \\ \hline$30.00 & $40.00 & $54.00 \\ \hline \end{tabular} Production Costs (per unit) Direct Materials per unit Direct Labor Cost $(DL) per unit \begin{tabular}{|r|r|r|} \hline$9.00 & $10.50 & $10.50 \\ \hline$5.50 & $7.50 & $19.50 \\ \hline \end{tabular} Machine Hours per unit \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{0.5} & 0.7 & 1.4 \\ \hline & & \\ \hline \end{tabular} Total Manufacturing Overhead Total Machine Hours MOH Allocation Rate \begin{tabular}{|} $511,300 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Entry & Standard & Deluxe & TOTAL \\ \hline & & & & \\ \hline Sales & & & & \\ \hline & & & & \\ \hline Direct Materials & & & & \\ \hline Direct Labor & & & & \\ \hline Manufacturing Overhead & & & & \\ \hline Total Manufacturing Costs & & & & \\ \hline & & & & \\ \hline Gross Profit & & & & \\ \hline \end{tabular} \# of units sold \begin{tabular}{|r|r|r|} \hline \multicolumn{1}{|c|}{ Entry } & Standard & \multicolumn{1}{|c|}{ Deluxe } \\ \hline 22750 & 13650 & 9100 \\ \hline$30.00 & $40.00 & $54.00 \\ \hline \end{tabular} Production Costs (per unit) Direct Materials per unit Direct Labor Cost $(DL) per unit \begin{tabular}{|r|r|r|} \hline$9.00 & $10.50 & $10.50 \\ \hline$5.50 & $7.50 & $19.50 \\ \hline \end{tabular} Machine Hours per unit \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{0.5} & 0.7 & 1.4 \\ \hline & & \\ \hline \end{tabular} Total Manufacturing Overhead Total Machine Hours MOH Allocation Rate \begin{tabular}{|} $511,300 \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Entry & Standard & Deluxe & TOTAL \\ \hline & & & & \\ \hline Sales & & & & \\ \hline & & & & \\ \hline Direct Materials & & & & \\ \hline Direct Labor & & & & \\ \hline Manufacturing Overhead & & & & \\ \hline Total Manufacturing Costs & & & & \\ \hline & & & & \\ \hline Gross Profit & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started