Question

Part II: Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at

Part II: Bonds

1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at date of issue. The bond details can be found on the Bonds & Ratings Information tab in the spreadsheet.

What is the total haircut in USD on the positions in the accompanying spreadsheet as of 2017-12-31?

EXHIBIT #1

(c)(2) Definitions: Net Capital (Continued)

(vi) SECURITIES HAIRCUTS (Continued)

(B) MUNICIPALS

(1) In the case of any municipal security which has a scheduled maturity at date of issue of 731 days or less and which is issued at par value and pays interest at maturity, and which is not traded flat or in default as to principal or interest, the applicable percentages of the market value on the greater of the long or short position in each of the categories specified below are:

(i) Less than 30 days to maturity..0%

(ii) 30 days but less than 91 days to maturity1/8 of 1%

(iii) 91 days but less than 181 days to maturity.1/4 of 1%

(iv) 181 days but less than 271 days to maturity..3/8 of 1%

(v) 271 days but less than 366 days to maturity1/2 of 1%

(vi) 366 days but less than 456 days to maturity3/4 of 1%

(vii) 456 days but less than 732 days to maturity.. 1%

(2) In the case of any municipal security, other than those specified in paragraph

(c)(2)(vi)(B)(1), which is not traded flat or in default as to principal or interest, the applicable percentages of the market value of the greatest of the long or short position in each of the categories specific below are:

(i) Less than 1 year to maturity..1%

(ii) 1 year but less than 2 years to maturity.2%

(iii) 2 years but less than 3 years to maturity..3%

(iv) 3 years but less than 5 years to maturity..4%

(v) 5 years but less than 7 years to maturity...5%

(vi) 7 years but less than 10 years to maturity.5 %

(vii) 10 years but less than 15 years to maturity6% (viii) 15 years but less than 20 years to maturity6 %

(ix) 20 years or more to maturity.7%

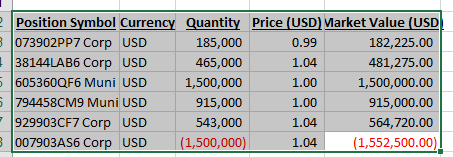

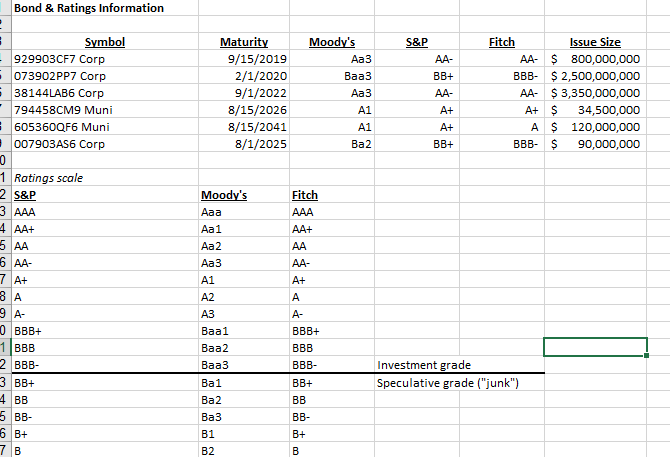

Bond \& Ratings Information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started