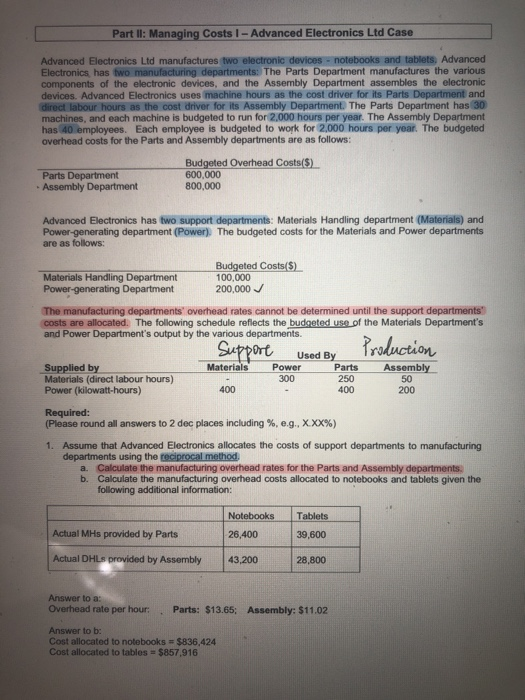

Part II: Managing Costs 1 - Advanced Electronics Ltd Case Advanced Electronics Ltd manufactures two electronic devices - notebooks and tablets. Advanced Electronics has two manufacturing departments: The Parts Department manufactures the various components of the electronic devices, and the Assembly Department assembles the electronic devices. Advanced Electronics uses machine hours as the cost driver for its Parts Department and direct labour hours as the cost driver for its Assembly Department. The Parts Department has 30 machines, and each machine is budgeted to run for 2.000 hours per year. The Assembly Department has 40 employees. Each employee is budgeted to work for 2.000 hours per year. The budgeted overhead costs for the Parts and Assembly departments are as follows: Parts Department - Assembly Department Budgeted Overhead Costs($) 600,000 800,000 Advanced Electronics has two support departments: Materials Handling department (Materials) and Power-generating department (Power) The budgeted costs for the Materials and Power departments are as follows: Production Budgeted Costs($) Materials Handling Department 100,000 Power-generating Department 200,000 The manufacturing departments overhead rates cannot be determined until the support departments costs are allocated. The following schedule reflects the budgeted use of the Materials Department's and Power Department's output by the various departments. Support Used By Supplied by Materials Power Parts Assembly Materials (direct labour hours) 300 250 50 Power (kilowatt-hours) 400 400 200 Required: (Please round all answers to 2 dec places including %, e.g., XXX%) 1. Assume that Advanced Electronics allocates the costs of support departments to manufacturing departments using the reciprocal method a. Calculate the manufacturing overhead rates for the Parts and Assembly departments b. Calculate the manufacturing overhead costs allocated to notebooks and tablets given the following additional information: Notebooks Tablets Actual MHs provided by Parts 26,400 39,600 Actual DHLs provided by Assembly 43,200 28,800 Answer to a: Overhead rate per hour Parts: $13.65; Assembly: $11.02 Answer to b: Cost allocated to notebooks $836,424 Cost allocated to tables - $857,916