Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part II: Open Ended Accounting Problems Instructions: Determine a final numerical answer for each question. You will record your ANSWERS ONLY on THPS-2 Answer Submission

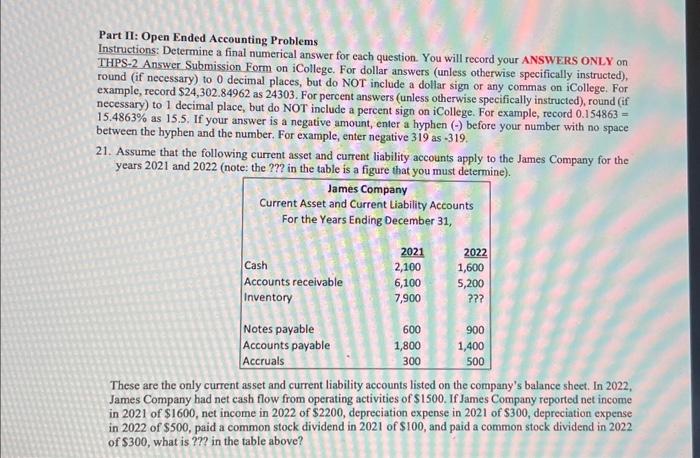

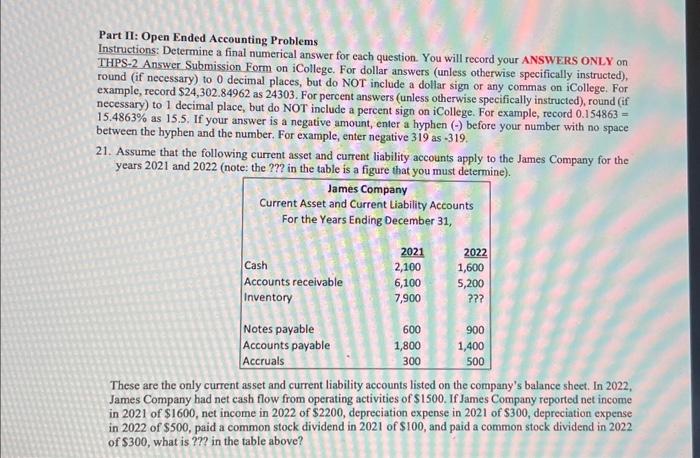

Part II: Open Ended Accounting Problems Instructions: Determine a final numerical answer for each question. You will record your ANSWERS ONLY on THPS-2 Answer Submission Form on iCollege. For dollar answers (unless otherwise specifically instructed), round (if necessary) to 0 decimal places, but do NOT include a dollar sign or any commas on iCollege. For example, record \$24,302.84962 as 24303 . For percent answers (unless otherwise specifically instructed), round (if necessary) to 1 decimal place, but do NOT include a percent sign on iCollege. For example, record 0.154863= 15.4863% as 15.5 . If your answer is a negative amount, enter a hyphen () before your number with no space between the hyphen and the number. For example, enter negative 319 as -319 . 21. Assume that the following current asset and current liability accounts apply to the James Company for the years 2021 and 2022 (note: the ??? in the table is a figure that you must determine). These are the only current asset and current liability accounts listed on the company's balance sheet. In 2022 , James Company had net cash flow from operating activities of \$1500. If James Company reported net income in 2021 of $1600, net income in 2022 of $2200, depreciation expense in 2021 of \$300, depreciation expense in 2022 of \$500, paid a common stock dividend in 2021 of \$100, and paid a common stock dividend in 2022 of $300, what is??? in the table above

Part II: Open Ended Accounting Problems Instructions: Determine a final numerical answer for each question. You will record your ANSWERS ONLY on THPS-2 Answer Submission Form on iCollege. For dollar answers (unless otherwise specifically instructed), round (if necessary) to 0 decimal places, but do NOT include a dollar sign or any commas on iCollege. For example, record \$24,302.84962 as 24303 . For percent answers (unless otherwise specifically instructed), round (if necessary) to 1 decimal place, but do NOT include a percent sign on iCollege. For example, record 0.154863= 15.4863% as 15.5 . If your answer is a negative amount, enter a hyphen () before your number with no space between the hyphen and the number. For example, enter negative 319 as -319 . 21. Assume that the following current asset and current liability accounts apply to the James Company for the years 2021 and 2022 (note: the ??? in the table is a figure that you must determine). These are the only current asset and current liability accounts listed on the company's balance sheet. In 2022 , James Company had net cash flow from operating activities of \$1500. If James Company reported net income in 2021 of $1600, net income in 2022 of $2200, depreciation expense in 2021 of \$300, depreciation expense in 2022 of \$500, paid a common stock dividend in 2021 of \$100, and paid a common stock dividend in 2022 of $300, what is??? in the table above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started