Question

Part II: Problems (25 Points Total) Answer on this document, in the space provided. Use the back of the sheet if you need additional

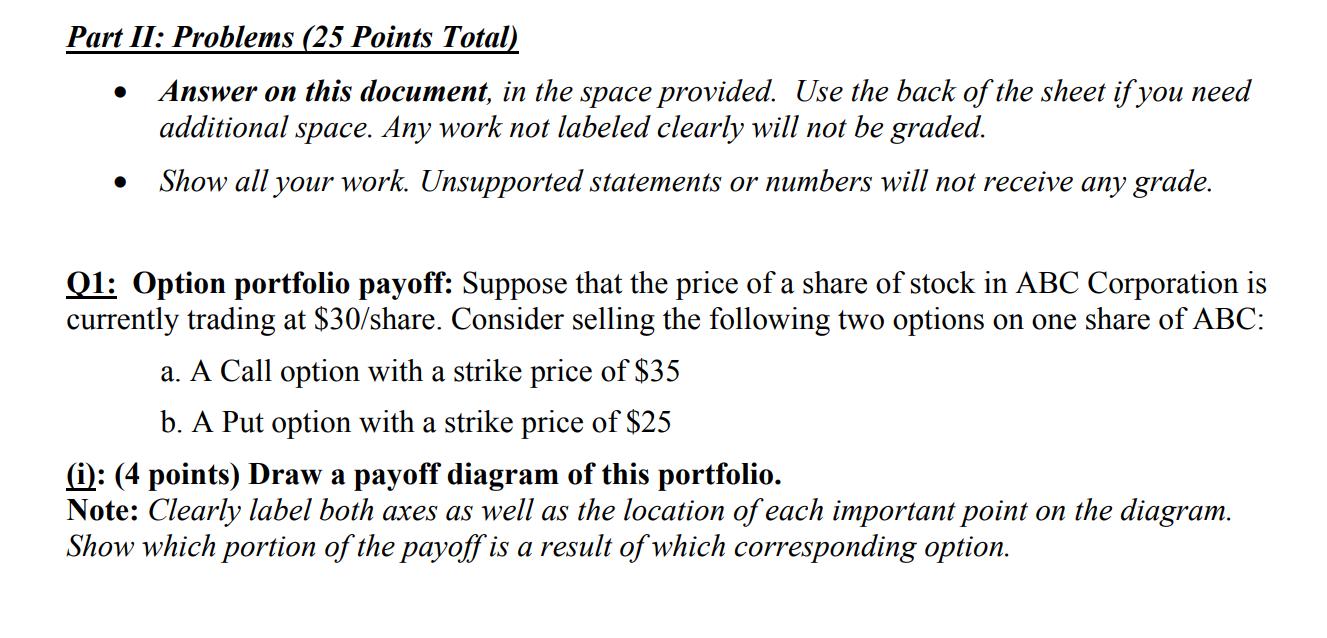

Part II: Problems (25 Points Total) Answer on this document, in the space provided. Use the back of the sheet if you need additional space. Any work not labeled clearly will not be graded. Show all your work. Unsupported statements or numbers will not receive any grade. Q1: Option portfolio payoff: Suppose that the price of a share of stock in ABC Corporation is currently trading at $30/share. Consider selling the following two options on one share of ABC: a. A Call option with a strike price of $35 b. A Put option with a strike price of $25 (i): (4 points) Draw a payoff diagram of this portfolio. Note: Clearly label both axes as well as the location of each important point on the diagram. Show which portion of the payoff is a result of which corresponding option.

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App