Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part Six Financial Analysis and Planning Table 19.5. A negative cash requirement implies a positive cash flow from operations. b The interest rate on the

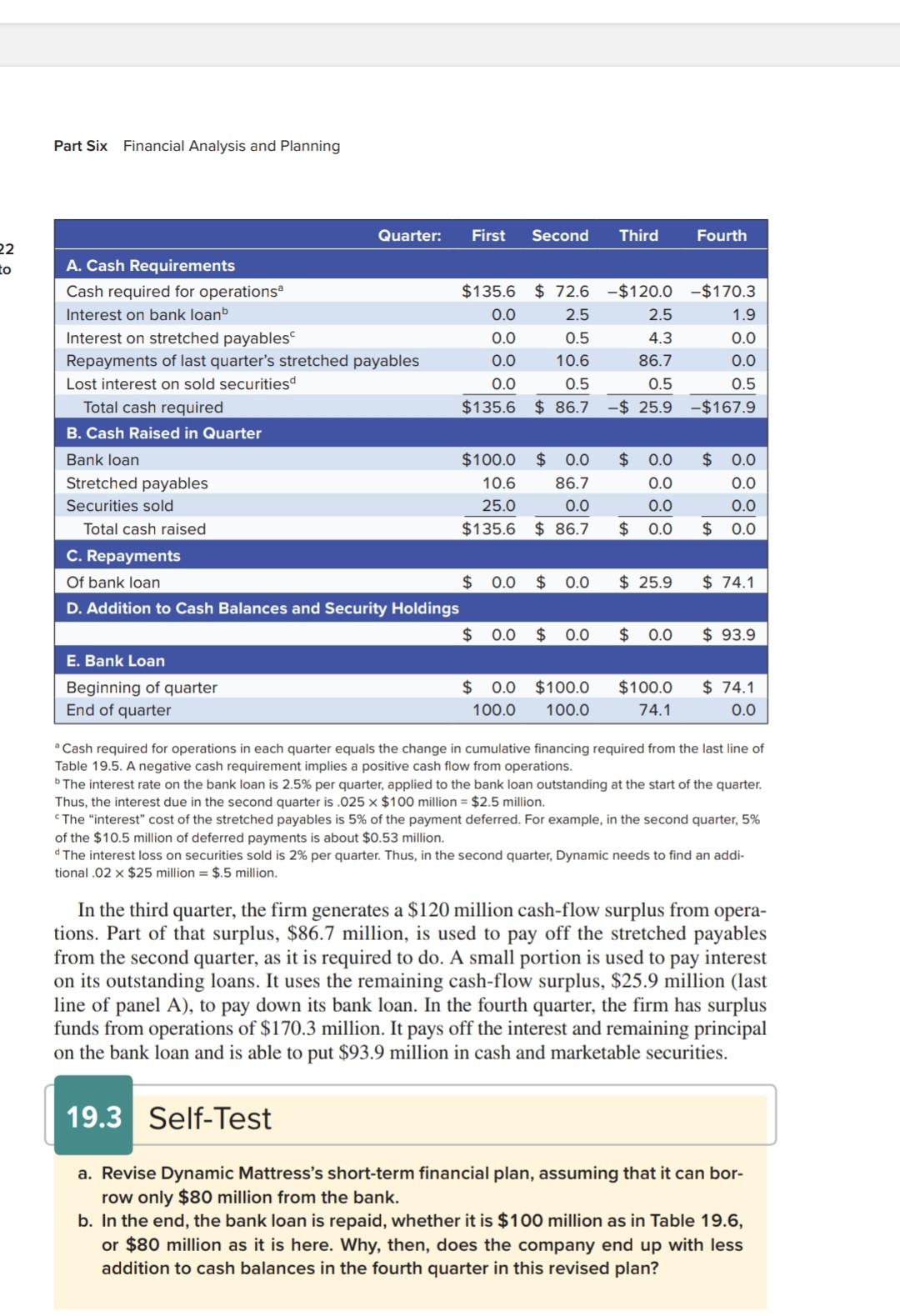

Part Six Financial Analysis and Planning Table 19.5. A negative cash requirement implies a positive cash flow from operations. b The interest rate on the bank loan is 2.5% per quarter, applied to the bank loan outstanding at the start of the quarter. Thus, the interest due in the second quarter is .025$100 million =$2.5 million. 'The "interest" cost of the stretched payables is 5% of the payment deferred. For example, in the second quarter, 5% of the $10.5 million of deferred payments is about $0.53 million. d The interest loss on securities sold is 2% per quarter. Thus, in the second quarter, Dynamic needs to find an additional .02$25 million =$.5 million. In the third quarter, the firm generates a $120 million cash-flow surplus from operations. Part of that surplus, $86.7 million, is used to pay off the stretched payables from the second quarter, as it is required to do. A small portion is used to pay interest on its outstanding loans. It uses the remaining cash-flow surplus, \$25.9 million (last line of panel A), to pay down its bank loan. In the fourth quarter, the firm has surplus funds from operations of $170.3 million. It pays off the interest and remaining principal on the bank loan and is able to put $93.9 million in cash and marketable securities. a. Revise Dynamic Mattress's short-term financial plan, assuming that it can borrow only $80 million from the bank. b. In the end, the bank loan is repaid, whether it is $100 million as in Table 19.6, or $80 million as it is here. Why, then, does the company end up with less addition to cash balances in the fourth quarter in this revised plan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started