Answered step by step

Verified Expert Solution

Question

1 Approved Answer

partb Assuming today was 1 January 2019. You are the chief financial officer of a US-based company which manufactures and distributes office supplies. As the

partb

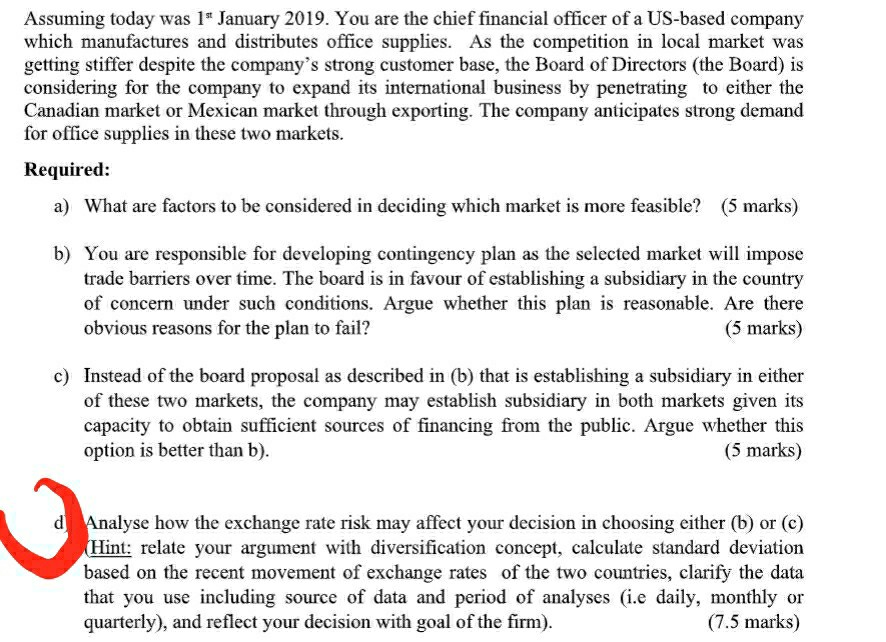

Assuming today was 1" January 2019. You are the chief financial officer of a US-based company which manufactures and distributes office supplies. As the competition in local market was getting stiffer despite the company's strong customer base, the Board of Directors (the Board) is considering for the company to expand its international business by penetrating to either the Canadian market or Mexican market through exporting. The company anticipates strong demand for office supplies in these two markets. Required: Instead of the board proposal as described in (b) that is establishing a subsidiary in either of these two markets, the company may establish subsidiary in both markets given its capacity to obtain sufficient sources of financing from the public. Argue whether this option is better than b). Assuming today was 1" January 2019. You are the chief financial officer of a US-based company which manufactures and distributes office supplies. As the competition in local market was getting stiffer despite the company's strong customer base, the Board of Directors (the Board) considering for the company to expand its international business by penetrating to either the Canadian market or Mexican market through exporting. The company anticipates strong demand for office supplies in these two markets. Required: You are responsible for developing contingency plan as the selected market will impose trade barriers over time. The board is in favour of establishing a subsidiary in the country of concern under such conditions. Argue whether this plan is reasonable. Are there obvious reasons for the plan to fail? (5 marks) Assuming today was 1* January 2019. You are the chief financial officer of a US-based company which manufactures and distributes office supplies. As the competition in local market was getting stiffer despite the company's strong customer base, the Board of Directors (the Board) is considering for the company to expand its international business by penetrating to either the Canadian market or Mexican market through exporting. The company anticipates strong demand for office supplies in these two markets. Required: a) What are factors to be considered in deciding which market is more feasible? (5 marks) b) You are responsible for developing contingency plan as the selected market will impose trade barriers over time. The board is in favour of establishing a subsidiary in the country of concern under such conditions. Argue whether this plan is reasonable. Are there obvious reasons for the plan to fail? (5 marks) c) Instead of the board proposal as described in (b) that is establishing a subsidiary in either of these two markets, the company may establish subsidiary in both markets given its capacity to obtain sufficient sources of financing from the public. Argue whether this option is better than b). (5 marks) d Analyse how the exchange rate risk may affect your decision in choosing either (b) or (0) (Hint: relate your argument with diversification concept, calculate standard deviation based on the recent movement of exchange rates of the two countries, clarify the data that you use including source of data and period of analyses (i.e daily, monthly or quarterly), and reflect your decision with goal of the firm). (7.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started