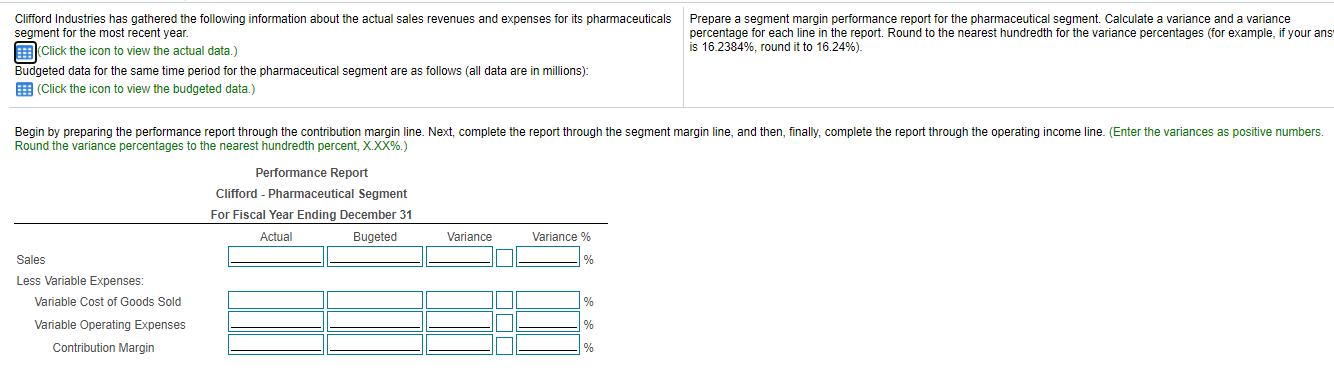

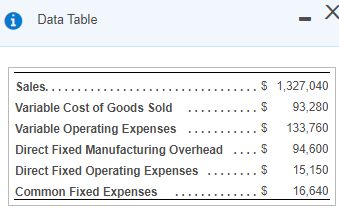

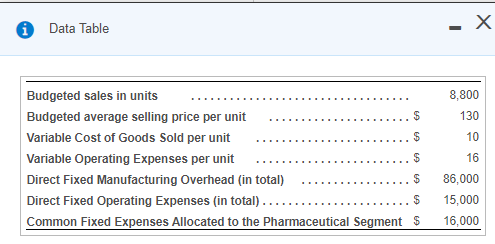

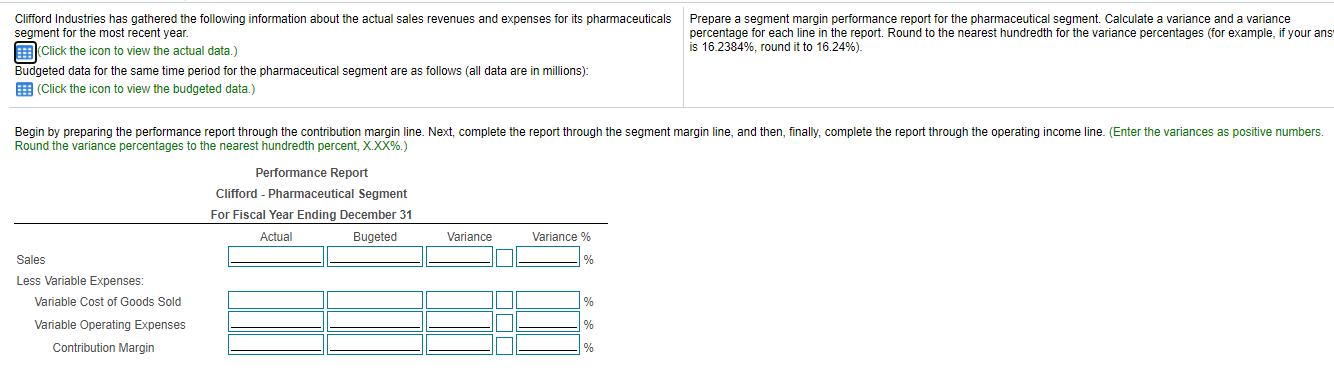

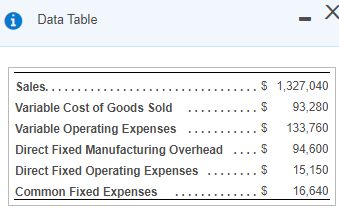

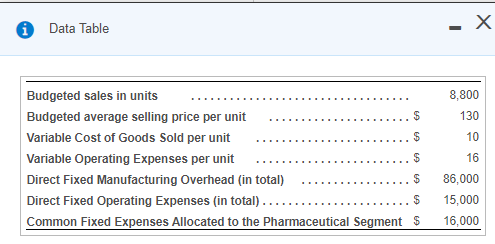

Prepare a segment margin performance report for the pharmaceutical segment. Calculate a variance and a variance percentage for each line in the report. Round to the nearest hundredth for the variance percentages (for example, if your ans is 16.2384%, round it to 16.24%). Clifford Industries has gathered the following information about the actual sales revenues and expenses for its pharmaceuticals segment for the most recent year. (Click the icon to view the actual data.) Budgeted data for the same time period for the pharmaceutical segment are as follows (all data are in millions): (Click the icon to view the budgeted data.) Begin by preparing the performance report through the contribution margin line. Next, complete the report through the segment margin line, and then, finally, complete the report through the operating income line. (Enter the variances as positive numbers. Round the variance percentages to the nearest hundredth percent, X.XX%.) Performance Report Clifford - Pharmaceutical Segment For Fiscal Year Ending December 31 Actual Bugeted Variance Variance % Sales Less Variable Expenses: Variable Cost of Goods Sold Variable Operating Expenses Contribution Margin Data Table Sales... Variable Cost of Goods Sold Variable Operating Expenses Direct Fixed Manufacturing Overhead Direct Fixed Operating Expenses Common Fixed Expenses $ 1,327,040 $ 93,280 $ 133,760 94,600 $ 15,150 $ 16,640 Data Table - X 8,800 130 10 Budgeted sales in units Budgeted average selling price per unit $ Variable Cost of Goods Sold per unit $ Variable Operating Expenses per unit Direct Fixed Manufacturing Overhead (in total) $ Direct Fixed Operating Expenses (in total). Common Fixed Expenses Allocated to the Pharmaceutical Segments $ 16 A GA 86,000 15,000 16,000 Prepare a segment margin performance report for the pharmaceutical segment. Calculate a variance and a variance percentage for each line in the report. Round to the nearest hundredth for the variance percentages (for example, if your ans is 16.2384%, round it to 16.24%). Clifford Industries has gathered the following information about the actual sales revenues and expenses for its pharmaceuticals segment for the most recent year. (Click the icon to view the actual data.) Budgeted data for the same time period for the pharmaceutical segment are as follows (all data are in millions): (Click the icon to view the budgeted data.) Begin by preparing the performance report through the contribution margin line. Next, complete the report through the segment margin line, and then, finally, complete the report through the operating income line. (Enter the variances as positive numbers. Round the variance percentages to the nearest hundredth percent, X.XX%.) Performance Report Clifford - Pharmaceutical Segment For Fiscal Year Ending December 31 Actual Bugeted Variance Variance % Sales Less Variable Expenses: Variable Cost of Goods Sold Variable Operating Expenses Contribution Margin Data Table Sales... Variable Cost of Goods Sold Variable Operating Expenses Direct Fixed Manufacturing Overhead Direct Fixed Operating Expenses Common Fixed Expenses $ 1,327,040 $ 93,280 $ 133,760 94,600 $ 15,150 $ 16,640 Data Table - X 8,800 130 10 Budgeted sales in units Budgeted average selling price per unit $ Variable Cost of Goods Sold per unit $ Variable Operating Expenses per unit Direct Fixed Manufacturing Overhead (in total) $ Direct Fixed Operating Expenses (in total). Common Fixed Expenses Allocated to the Pharmaceutical Segments $ 16 A GA 86,000 15,000 16,000