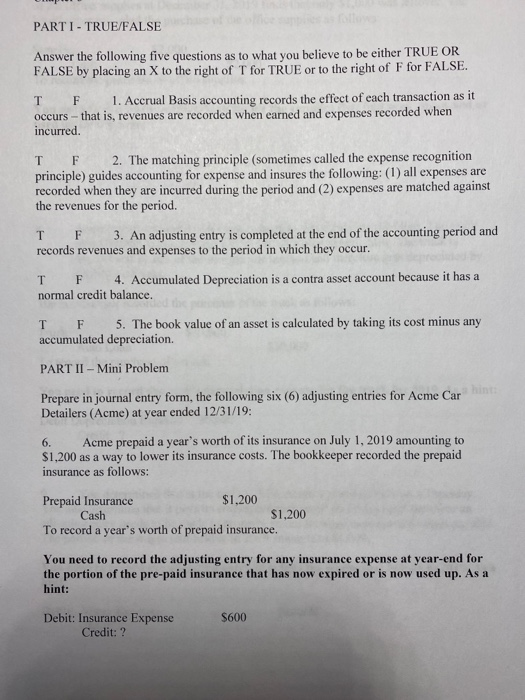

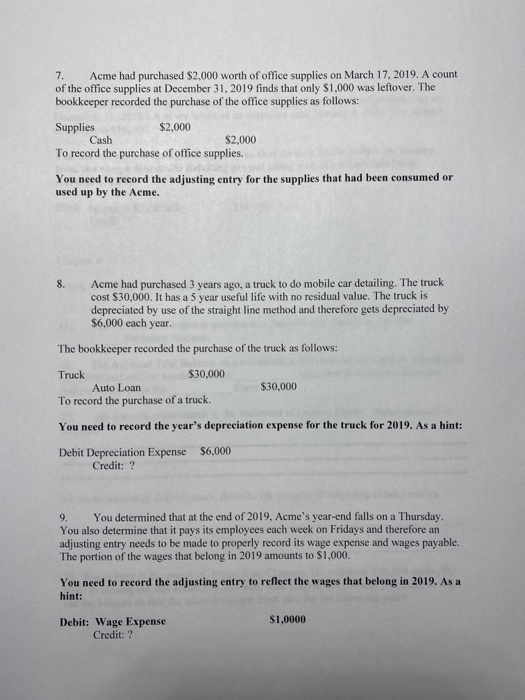

PARTI - TRUE/FALSE Answer the following five questions as to what you believe to be either TRUE OR FALSE by placing an X to the right of T for TRUE or to the right of F for FALSE. T F 1. Accrual Basis accounting records the effect of each transaction as it occurs - that is, revenues are recorded when earned and expenses recorded when incurred. T F 2. The matching principle (sometimes called the expense recognition principle) guides accounting for expense and insures the following: (1) all expenses are recorded when they are incurred during the period and (2) expenses are matched against the revenues for the period. T F 3. An adjusting entry is completed at the end of the accounting period and records revenues and expenses to the period in which they occur. T F 4. Accumulated Depreciation is a contra asset account because it has a normal credit balance. T F 5. The book value of an asset is calculated by taking its cost minus any accumulated depreciation. PART II - Mini Problem Prepare in journal entry form, the following six (6) adjusting entries for Acme Car Detailers (Acme) at year ended 12/31/19: 6. Acme prepaid a year's worth of its insurance on July 1, 2019 amounting to $1,200 as a way to lower its insurance costs. The bookkeeper recorded the prepaid insurance as follows: Prepaid Insurance $1,200 Cash $1,200 To record a year's worth of prepaid insurance. You need to record the adjusting entry for any insurance expense at year-end for the portion of the pre-paid insurance that has now expired or is now used up. As a hint: Debit: Insurance Expense Credit: ? S600 7. Acme had purchased $2,000 worth of office supplies on March 17, 2019. A count of the office supplies at December 31, 2019 finds that only $1,000 was leftover. The bookkeeper recorded the purchase of the office supplies as follows: Supplies $2,000 Cash $2,000 To record the purchase of office supplies. You need to record the adjusting entry for the supplies that had been consumed or used up by the Acme. 8. Acme had purchased 3 years ago, a truck to do mobile car detailing. The truck cost $30,000. It has a 5 year useful life with no residual value. The truck is depreciated by use of the straight line method and therefore gets depreciated by $6,000 each year. The bookkeeper recorded the purchase of the truck as follows: Truck $30,000 Auto Loan To record the purchase of a truck. $30,000 You need to record the year's depreciation expense for the truck for 2019. As a hint: Debit Depreciation Expense $6,000 Credit: ? 9. You determined that at the end of 2019. Acme's year-end falls on a Thursday You also determine that it pays its employees each week on Fridays and therefore an adjusting entry needs to be made to properly record its wage expense and wages payable. The portion of the wages that belong in 2019 amounts to $1.000. You need to record the adjusting entry to reflect the wages that belong in 2019. As a hint: Debit: Wage Expense $1,0000 Credit