Answered step by step

Verified Expert Solution

Question

1 Approved Answer

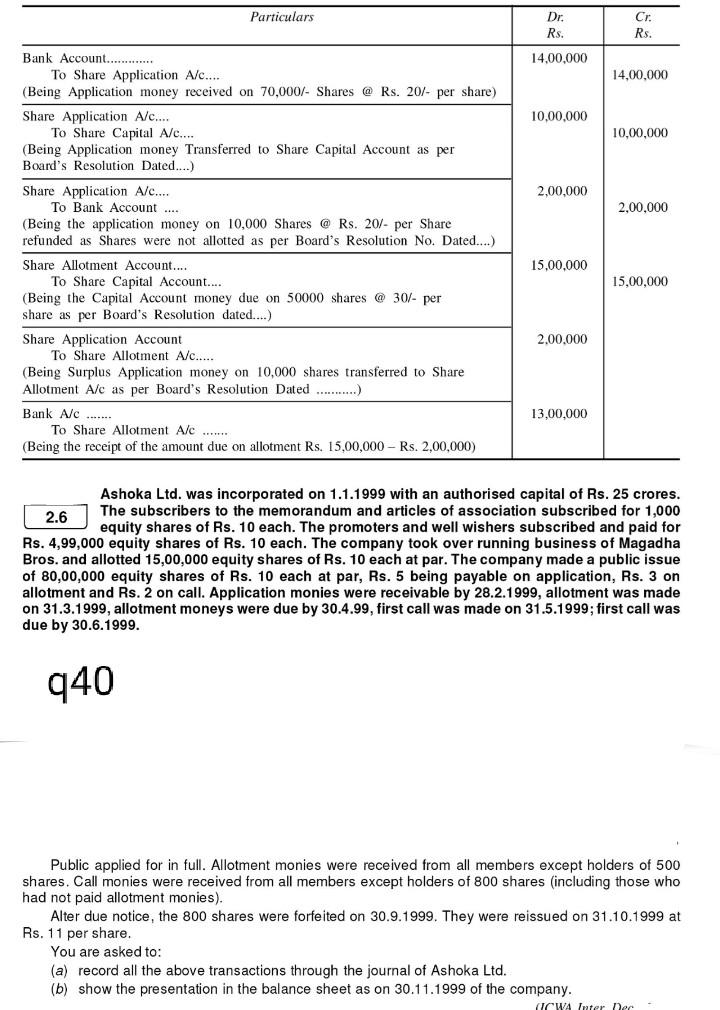

Particulars Dr. Rs. Cr. Rs. 14,00,000 14,00,000 10,00.000 10,00,000 2,00,000 2,0,00 2.0.000 2,00,000 Bank Account............ To Share Application A/c.... (Being Application money received on 70,000/-

Particulars Dr. Rs. Cr. Rs. 14,00,000 14,00,000 10,00.000 10,00,000 2,00,000 2,0,00 2.0.000 2,00,000 Bank Account............ To Share Application A/c.... (Being Application money received on 70,000/- Shares @ Rs. 20/- per share) Share Application A/c.... To Share Capital A/c.... (Being Application money Transferred to Share Capital Account as per Board's Resolution Dated....) Share Application A/c.... To Bank Account .... (Being the application money on 10,000 Shares @ Rs. 20/- per Share refunded as Shares were not allotted as per Board's Resolution No. Dated....) Share Allotment Account.... To Share Capital Account.... (Being the Capital Account money due on 50000 shares @ 30/- per share as per Board's Resolution dated....) Share Application Account To Share Allotment A/c..... (Being Surplus Application money on 10,000 shares transferred to share Allotment A/c as per Board's Resolution Dated ..........) Bank A/c ....... To Share Allotment Alc ....... (Being the receipt of the amount due on allotment Rs. 15,00,000 - Rs. 2,00,000) 15,00,000 15,00,000 2.00.000 13,00,000 Ashoka Ltd. was incorporated on 1.1.1999 with an authorised capital of Rs. 25 crores. 2.6 The subscribers to the memorandum and articles of association subscribed for 1,000 equity shares of Rs. 10 each. The promoters and well wishers subscribed and paid for Rs. 4,99,000 equity shares of Rs. 10 each. The company took over running business of Magadha Bros. and allotted 15,00,000 equity shares of Rs. 10 each at par. The company made a public issue of 80,00,000 equity shares of Rs. 10 each at par, Rs. 5 being payable on application, Rs. 3 on allotment and Rs. 2 on call. Application monies were receivable by 28.2.1999, allotment was made on 31.3.1999, allotment moneys were due by 30.4.99, first call was made on 31.5.1999; first call was due by 30.6.1999. 940 Public applied for in full. Allotment monies were received from all members except holders of 500 shares. Call monies were received from all members except holders of 800 shares (including those who had not paid allotment monies). Alter due notice, the 800 shares were forfeited on 30.9.1999. They were reissued on 31.10.1999 at Rs. 11 per share. You are asked to: (a) record all the above transactions through the journal of Ashoka Ltd. (b) show the presentation in the balance sheet as on 30.11.1999 of the company. (ICWA Inter nec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started