Question

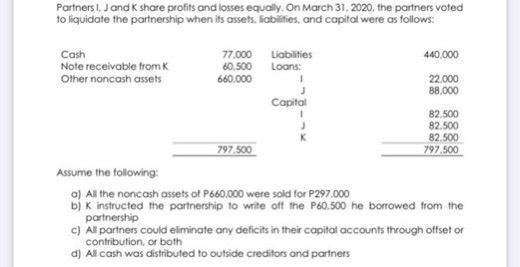

Partners I. Jand K share profits and losses equally. On March 31, 2020, the partners voted to liquidate the partnership when its assets. iabifies,

Partners I. Jand K share profits and losses equally. On March 31, 2020, the partners voted to liquidate the partnership when its assets. iabifies, and capital were as follows: Cash Note receivable from K Other noncash assets 77.000 Liabities 60.500 Loans: 660.000 440,000 22.000 88.000 Copital 82.500 82.500 82.500 797.500 797.500 Assume the following: a) Al the noncash assets of P660.000 were sold for P297.000 b K instructed the partnership to write off the P60.500 he borrowed from the partnership c) Al partners could eliminate any deficits in their capital accounts through offset or contribution, or both d) Al cash was distributed to outside creditos and partners

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries K TAL Capital 82500 82500 82500 247500 Loss on realization ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Susan S. Hamlen, Ronald J. Huefner, James A. Largay III

2nd edition

1934319309, 978-1934319307

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App