Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Partnership BPE's profits and losses are shared equally among the three partners. The adjusted basis of Partner E's interest in the partnership on January

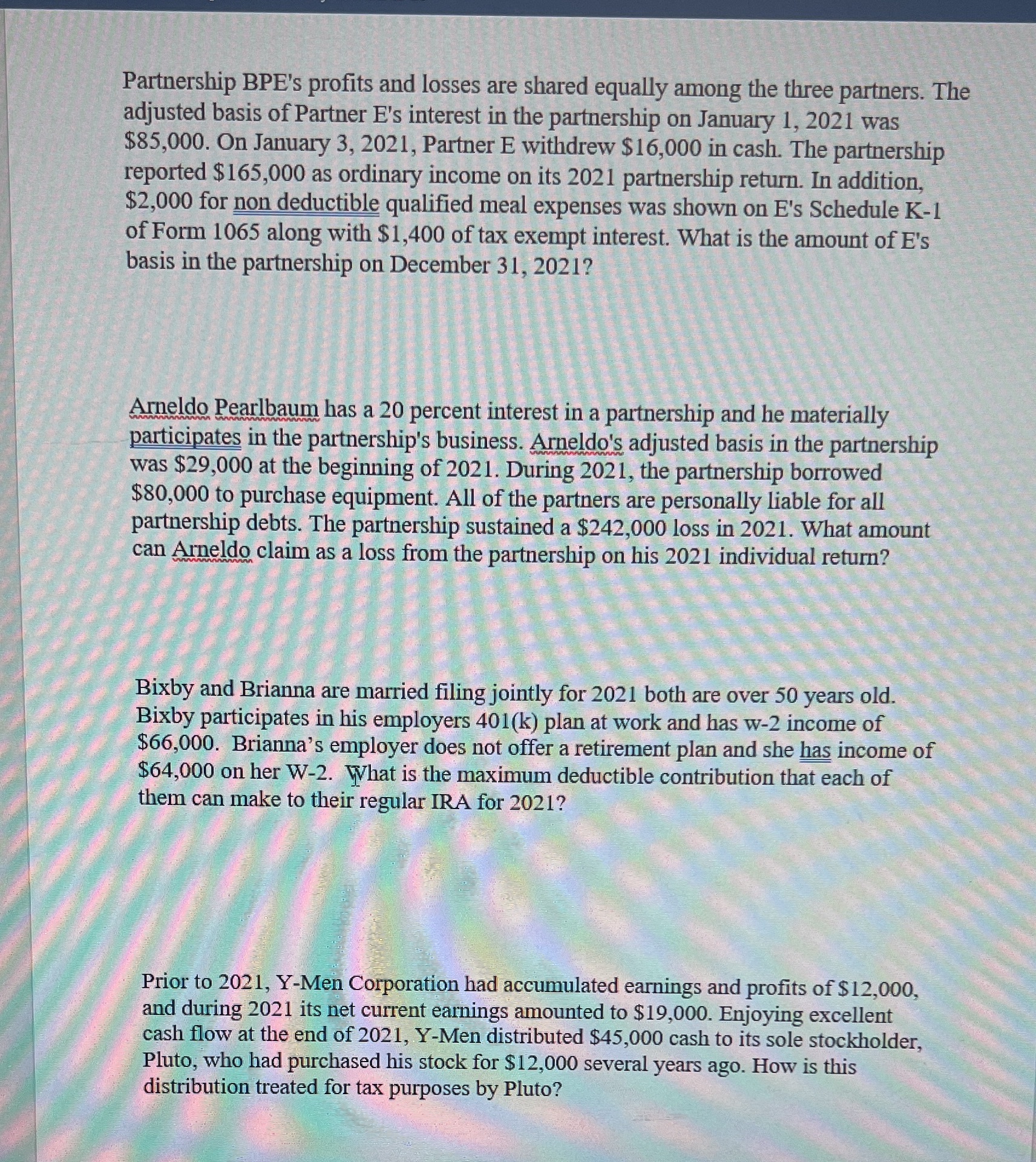

Partnership BPE's profits and losses are shared equally among the three partners. The adjusted basis of Partner E's interest in the partnership on January 1, 2021 was $85,000. On January 3, 2021, Partner E withdrew $16,000 in cash. The partnership reported $165,000 as ordinary income on its 2021 partnership return. In addition, $2,000 for non deductible qualified meal expenses was shown on E's Schedule K-1 of Form 1065 along with $1,400 of tax exempt interest. What is the amount of E's basis in the partnership on December 31, 2021? Arneldo Pearlbaum has a 20 percent interest in a partnership and he materially wwwwwwwwwwwwwww participates in the partnership's business. Arneldo's adjusted basis in the partnership was $29,000 at the beginning of 2021. During 2021, the partnership borrowed $80,000 to purchase equipment. All of the partners are personally liable for all partnership debts. The partnership sustained a $242,000 loss in 2021. What amount can Arneldo claim as a loss from the partnership on his 2021 individual return? www Bixby and Brianna are married filing jointly for 2021 both are over 50 years old. Bixby participates in his employers 401(k) plan at work and has w-2 income of $66,000. Brianna's employer does not offer a retirement plan and she has income of $64,000 on her W-2. What is the maximum deductible contribution that each of them can make to their regular IRA for 2021? Prior to 2021, Y-Men Corporation had accumulated earnings and profits of $12,000, and during 2021 its net current earnings amounted to $19,000. Enjoying excellent cash flow at the end of 2021, Y-Men distributed $45,000 cash to its sole stockholder, Pluto, who had purchased his stock for $12,000 several years ago. How is this distribution treated for tax purposes by Pluto?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate Partner Es basis in the partnership on December 31 2021 we need to consider the following Starting basis on January 1 2021 85000 Cash w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started