Answered step by step

Verified Expert Solution

Question

1 Approved Answer

partnership CD is owned 50% by C and 50% by D. If C sells an asse and recognizes a $1,000 loss on the sale, will

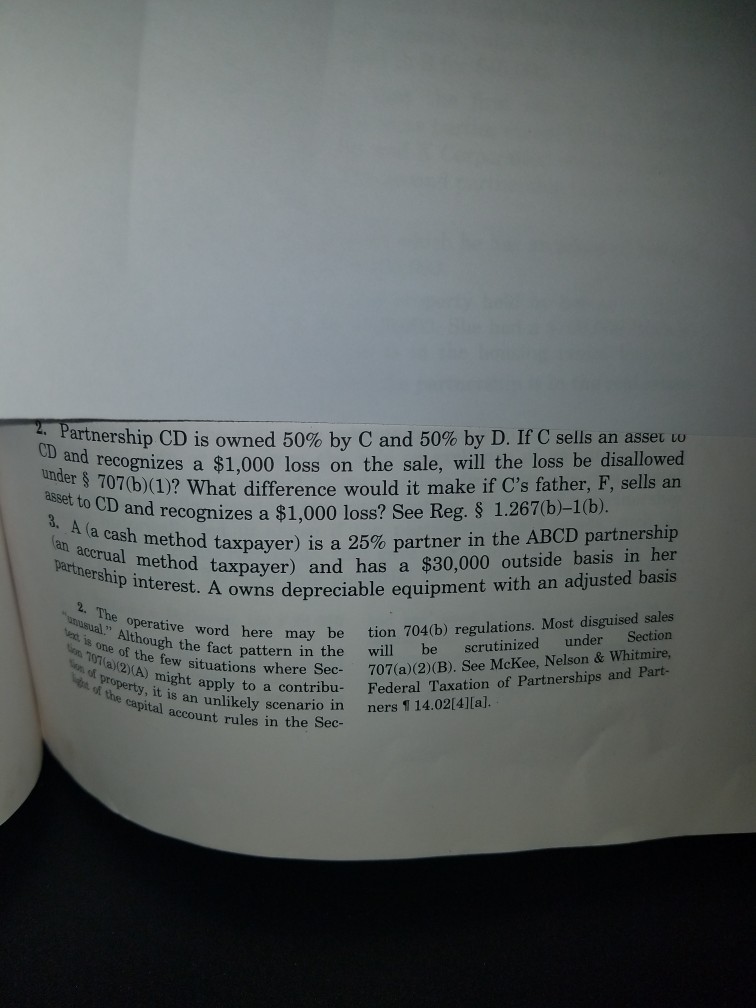

partnership CD is owned 50% by C and 50% by D. If C sells an asse and recognizes a $1,000 loss on the sale, will the loss be disallowed CD (b)(1)? What difference would it make if C's father, F, sells an CD and recognizes a $1,000 loss? See Reg. S 1.267(b)-1(b). (a cash m ethod taxpayer) is a 25% partner in the ABCD partnership taxpayer) and has a $30,000 outside basis in her A owns depreciable equipment with an adjusted basis an accrual method an 2. The e operative word n of the few situations a0 the fe act pattern in the will be scrutinized under Section roertmights where Sec- 707(a)(2)(B). See McKee, Nelson & Whitmire, here may be tion 704(b) regulations. Most disguised sales l one Although a(2) may m ef Sec- Federal Taxation of Partnerships and Part- to a contribu- y, it is an unlikely scenario in tof the capital ners accounty scenario in ners 114.02 41lal. account rules in the Sec- partnership CD is owned 50% by C and 50% by D. If C sells an asse and recognizes a $1,000 loss on the sale, will the loss be disallowed CD (b)(1)? What difference would it make if C's father, F, sells an CD and recognizes a $1,000 loss? See Reg. S 1.267(b)-1(b). (a cash m ethod taxpayer) is a 25% partner in the ABCD partnership taxpayer) and has a $30,000 outside basis in her A owns depreciable equipment with an adjusted basis an accrual method an 2. The e operative word n of the few situations a0 the fe act pattern in the will be scrutinized under Section roertmights where Sec- 707(a)(2)(B). See McKee, Nelson & Whitmire, here may be tion 704(b) regulations. Most disguised sales l one Although a(2) may m ef Sec- Federal Taxation of Partnerships and Part- to a contribu- y, it is an unlikely scenario in tof the capital ners accounty scenario in ners 114.02 41lal. account rules in the Sec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started