Question

Parts 1 and 2 are done correctly, and provide the information for parts 3 and 4 which I need help on Question 3: Calculate Danas

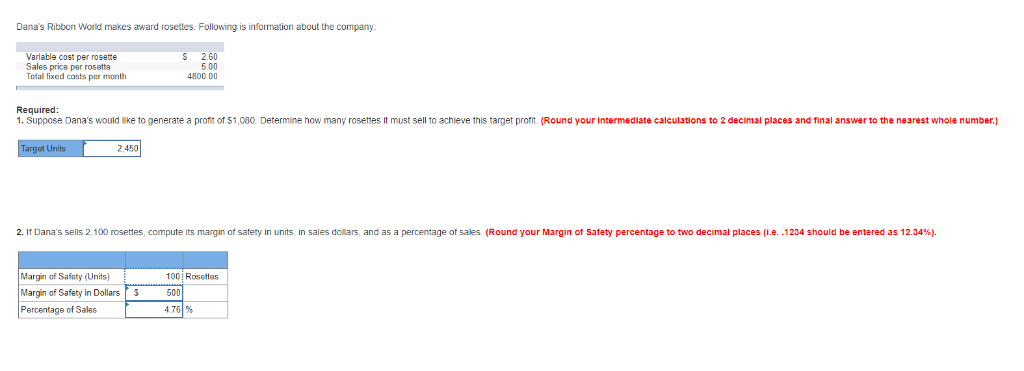

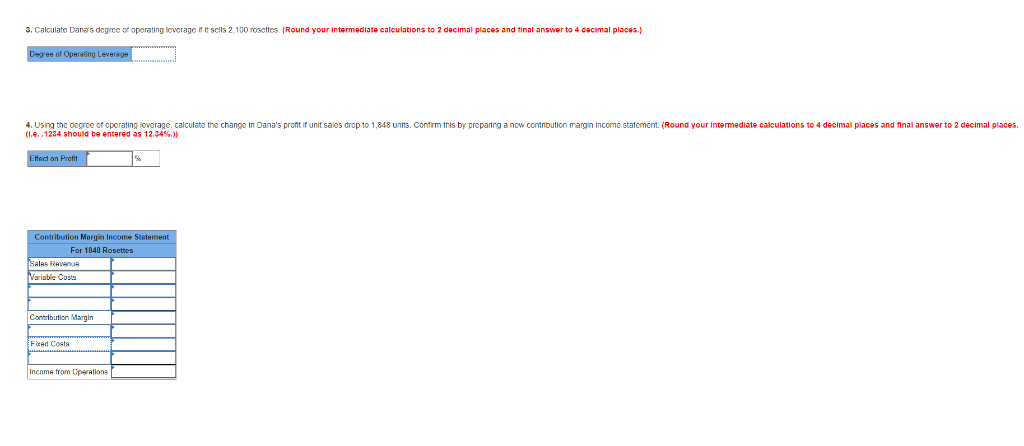

Parts 1 and 2 are done correctly, and provide the information for parts 3 and 4 which I need help on Question 3: "Calculate Danas degree of operating leverage if it sells 2,100 rosettes. (Round your intermediate calculations to 2 decimal places and final answer to 4 decimal places.)"

Question 4: "Using the degree of operating leverage, calculate the change in Danas profit if unit sales drop to 1,848 units. Confirm this by preparing a new contribution margin income statement. (Round your intermediate calculations to 4 decimal places and final answer to 2 decimal places. (i.e. .1234 should be entered as 12.34%.))"

Dana's Ribbon World makes award rosettes. Following is information about the company Variable cost per rosette Sales prica per rosette Total fixed casts per month S 2.60 5.00 4800 00 Required: 1. Suppose Dana's would like to generate a proft of $1,080. Determine how many rosettes it must sell to achieve this target profit (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole number.) 2.450 2. If Danas sells 2,100 rosettes, compute its margin of satety in units, in sales dollars, and as a percentage of sales. (Round your Margin of safety percentage to two decimal places (Le. -1234 should be entered as 12.34%) Margin of Safaty (Units) Margin of Safety in Dollars500 Percentage of Salas 100 Rosettes 4761% 3. Calculate Dana's degree or operating leverage " n sc is 2100 rosettes [Round your intermediate eaiculations to 2 decimal places and final answer to 4 decimal places.) Dana's oc 4. Usina the dogree or operating leverage, calculate the change in Dana's pront if unit sales drop 10 1,848 unlts. Confirm this by preparng a new contnbution margin Income statement. (Le, .1234 should be entered as 12.34%.)) (Round your Intermediat proparing a calculations to 4 decimal places and final answer to 2 decimal places 34%. Effact on For 1848 Rosettes ariable Costs Contribution Margin Ficed Coats Income from CperationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started