Answered step by step

Verified Expert Solution

Question

1 Approved Answer

parts D & E Homework 4 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or

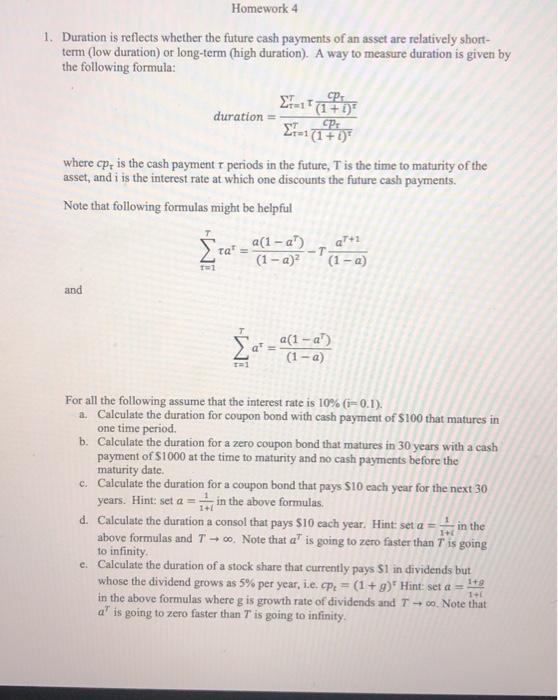

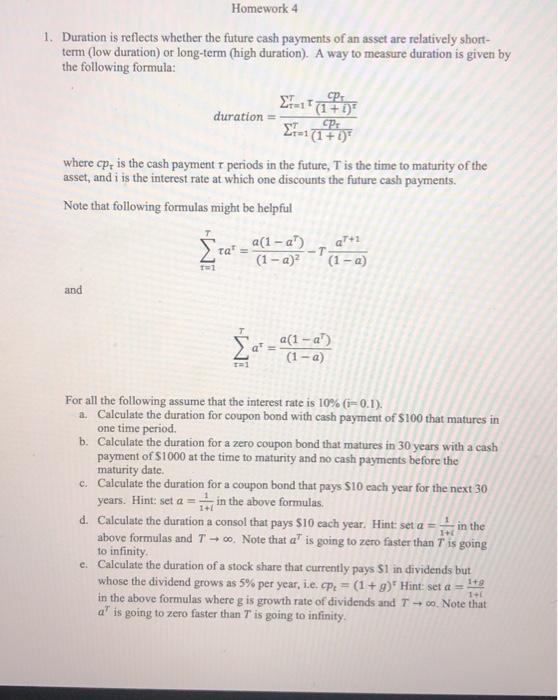

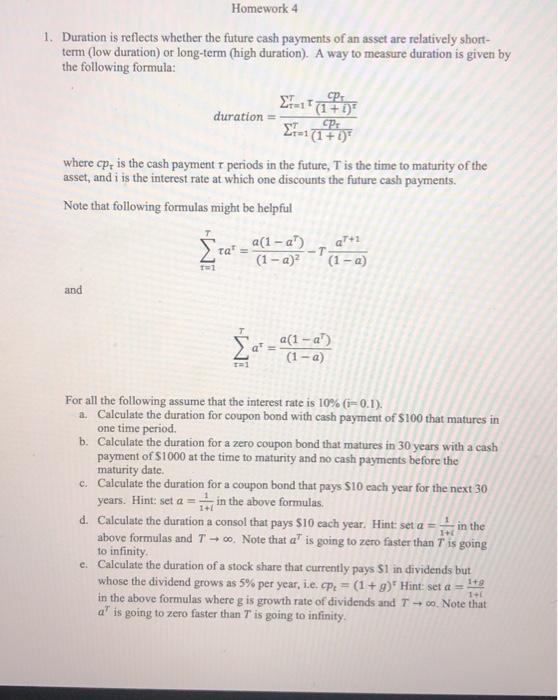

parts D & E  Homework 4 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: CP duration CPI *=1 (1+0) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful -1 ant ta ' - a(-a (1-2) -T (1-a) 1 and a a(1-a) (1-2) For all the following assume that the interest rate is 10% (i=0.1). 2. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = 1+ in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a = in the above formulas and T +0. Note that a' is going to zero faster than t' is going to infinity c. Calculate the duration of a stock share that currently pays S1 in dividends but whose the dividend grows as 5% per year, i.e. cp2 = (1+g) Hint: set a = in the above formulas where g is growth rate of dividends and T - 0 Note that a" is going to zero faster than 7" is going to infinity 1+9 11 Homework 4 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: CP duration CPI *=1 (1+0) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful -1 ant ta ' - a(-a (1-2) -T (1-a) 1 and a a(1-a) (1-2) For all the following assume that the interest rate is 10% (i=0.1). 2. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = 1+ in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a = in the above formulas and T +0. Note that a' is going to zero faster than t' is going to infinity c. Calculate the duration of a stock share that currently pays S1 in dividends but whose the dividend grows as 5% per year, i.e. cp2 = (1+g) Hint: set a = in the above formulas where g is growth rate of dividends and T - 0 Note that a" is going to zero faster than 7" is going to infinity 1+9 11

Homework 4 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: CP duration CPI *=1 (1+0) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful -1 ant ta ' - a(-a (1-2) -T (1-a) 1 and a a(1-a) (1-2) For all the following assume that the interest rate is 10% (i=0.1). 2. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = 1+ in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a = in the above formulas and T +0. Note that a' is going to zero faster than t' is going to infinity c. Calculate the duration of a stock share that currently pays S1 in dividends but whose the dividend grows as 5% per year, i.e. cp2 = (1+g) Hint: set a = in the above formulas where g is growth rate of dividends and T - 0 Note that a" is going to zero faster than 7" is going to infinity 1+9 11 Homework 4 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: CP duration CPI *=1 (1+0) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful -1 ant ta ' - a(-a (1-2) -T (1-a) 1 and a a(1-a) (1-2) For all the following assume that the interest rate is 10% (i=0.1). 2. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = 1+ in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a = in the above formulas and T +0. Note that a' is going to zero faster than t' is going to infinity c. Calculate the duration of a stock share that currently pays S1 in dividends but whose the dividend grows as 5% per year, i.e. cp2 = (1+g) Hint: set a = in the above formulas where g is growth rate of dividends and T - 0 Note that a" is going to zero faster than 7" is going to infinity 1+9 11

parts D & E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started