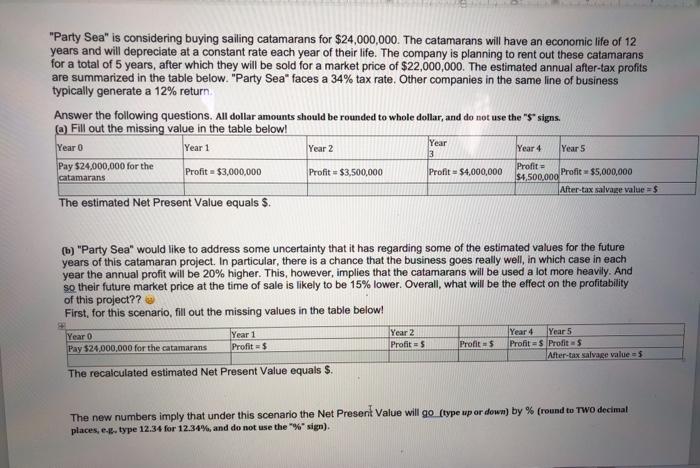

"Party Sea" is considering buying sailing catamarans for $24,000,000. The catamarans will have an economic life of 12 years and will depreciate at a constant rate each year of their life. The company is planning to rent out these catamarans for a total of 5 years, after which they will be sold for a market price of $22,000,000. The estimated annual after-tax profits are summarized in the table below. "Party Sea" faces a 34% tax rate. Other companies in the same line of business typically generate a 12% return Answer the following questions. All dollar amounts should be rounded to whole dollar, and do not use the "S" signs. @) Fill out the missing value in the table below! Year 1 Year 2 Year 5 Pay $24,000,000 for the Profit Profit = $3,000,000 Profit = $3,500,000 Profit $5,000,000 After-tax salvage value =$ The estimated Net Present Value equals $. Year 0 Year 3 Year 4 Profit $4,000,000 catamarans $4,500,000 (b) "Party Sea" would like to address some uncertainty that it has regarding some of the estimated values for the future years of this catamaran project. In particular, there is a chance that the business goes really well , in which case in each year the annual profit will be 20% higher. This, however, implies that the catamarans will be used a lot more heavily. And so their future market price at the time of sale is likely to be 15% lower. Overall, what will be the effect on the profitability of this project?? First, for this scenario, fill out the missing values in the table below! Year 0 Year 1 Year 2 Year 4 Year 5 Profit=$ Profits Pay $24,000,000 for the catamarans Profits Profit= Profit After-tax salvage value = 5 The recalculated estimated Net Present Value equals S. The new numbers imply that under this scenario the Net Present Value will go (type up or down) by % (round to Two decimal places, e.type 12.34 for 12.34%, and do not use the "%sign). "Party Sea" is considering buying sailing catamarans for $24,000,000. The catamarans will have an economic life of 12 years and will depreciate at a constant rate each year of their life. The company is planning to rent out these catamarans for a total of 5 years, after which they will be sold for a market price of $22,000,000. The estimated annual after-tax profits are summarized in the table below. "Party Sea" faces a 34% tax rate. Other companies in the same line of business typically generate a 12% return Answer the following questions. All dollar amounts should be rounded to whole dollar, and do not use the "S" signs. @) Fill out the missing value in the table below! Year 1 Year 2 Year 5 Pay $24,000,000 for the Profit Profit = $3,000,000 Profit = $3,500,000 Profit $5,000,000 After-tax salvage value =$ The estimated Net Present Value equals $. Year 0 Year 3 Year 4 Profit $4,000,000 catamarans $4,500,000 (b) "Party Sea" would like to address some uncertainty that it has regarding some of the estimated values for the future years of this catamaran project. In particular, there is a chance that the business goes really well , in which case in each year the annual profit will be 20% higher. This, however, implies that the catamarans will be used a lot more heavily. And so their future market price at the time of sale is likely to be 15% lower. Overall, what will be the effect on the profitability of this project?? First, for this scenario, fill out the missing values in the table below! Year 0 Year 1 Year 2 Year 4 Year 5 Profit=$ Profits Pay $24,000,000 for the catamarans Profits Profit= Profit After-tax salvage value = 5 The recalculated estimated Net Present Value equals S. The new numbers imply that under this scenario the Net Present Value will go (type up or down) by % (round to Two decimal places, e.type 12.34 for 12.34%, and do not use the "%sign)