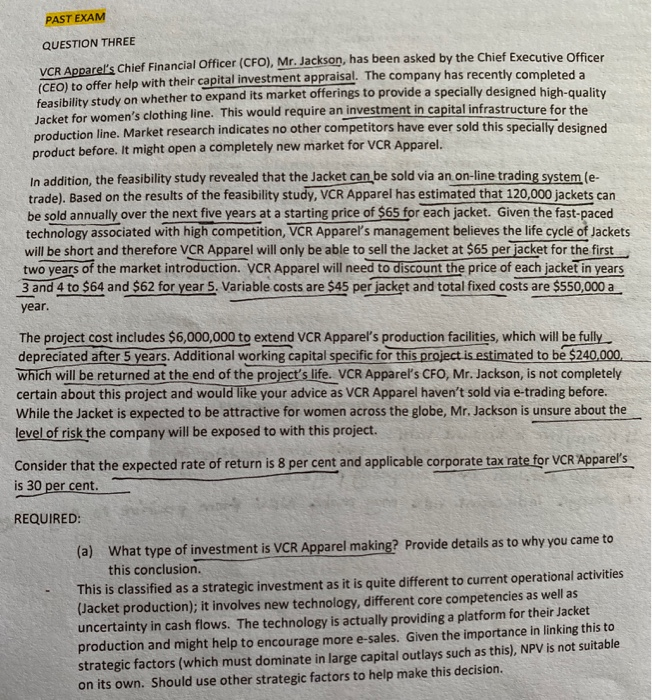

PAST EXAM QUESTION THREE VCR Apparel's Chief Financial Officer (CFO), Mr. Jackson, has been asked by the Chief Executive Officer (CEO) to offer help with their capital investment appraisal. The company has recently completed a feasibility study on whether to expand its market offerings to provide a specially designed high-quality Jacket for women's clothing line. This would require an investment in capital infrastructure for the production line. Market research indicates no other competitors have ever sold this specially designed product before. It might open a completely new market for VCR Apparel. In addition, the feasibility study revealed that the Jacket can be sold via an on-line trading system (e- trade). Based on the results of the feasibility study, VCR Apparel has estimated that 120,000 jackets can be sold annually over the next five years at a starting price of $65 for each jacket. Given the fast-paced technology associated with high competition, VCR Apparel's management believes the life cycle of Jackets will be short and therefore VCR Apparel will only be able to sell the Jacket at $65 per jacket for the first two years of the market introduction. VCR Apparel will need to discount the price of each jacket in years 3 and 4 to $64 and $62 for year 5. Variable costs are $45 per jacket and total fixed costs are $550,000 a year. The project cost includes $6,000,000 to extend VCR Apparel's production facilities, which will be fully depreciated after 5 years. Additional working capital specific for this project is estimated to be $240,000, which will be returned at the end of the project's life. VCR Apparel's CFO, Mr. Jackson, is not completely certain about this project and would like your advice as VCR Apparel haven't sold via e-trading before. While the Jacket is expected to be attractive for women across the globe, Mr. Jackson is unsure about the level of risk the company will be exposed to with this project. Consider that the expected rate of return is 8 per cent and applicable corporate tax rate for VCR Apparel's is 30 per cent. REQUIRED: (a) What type of investment is VCR Apparel making? Provide details as to why you came to this conclusion. This is classified as a strategic investment as it is quite different to current operational activities (Jacket production); it involves new technology, different core competencies as well as uncertainty in cash flows. The technology is actually providing a platform for their Jacket production and might help encourage more e-sales. Given the importance in linking this to strategic factors (which must dominate in large capital outlays such as this), NPV is not suitable on its own. Should use other strategic factors to help make this decision