Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paul and Maria had the following transactions during the year: Paul received $2,500 unemployment compensation. While laid off, Paul traveled to California and was

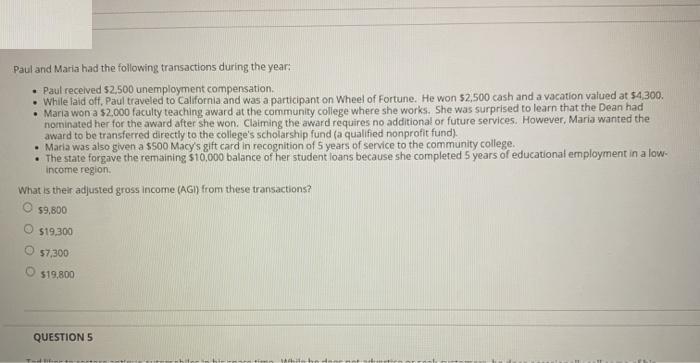

Paul and Maria had the following transactions during the year: Paul received $2,500 unemployment compensation. While laid off, Paul traveled to California and was a participant on Wheel of Fortune. He won $2,500 cash and a vacation valued at $4,300. Maria won a $2,000 faculty teaching award at the community college where she works. She was surprised to learn that the Dean had nominated her for the award after she won. Claiming the award requires no additional or future services. However, Maria wanted the award to be transferred directly to the college's scholarship fund (a qualified nonprofit fund). Maria was also given a $500 Macy's gift card in recognition of 5 years of service to the community college. The state forgave the remaining $10,000 balance of her student loans because she completed 5 years of educational employment in a low- income region. What is their adjusted gross incorme (AGI) from these transactions? O $9,800 O $19.300 $7,300 $19,800 QUESTION 5 the de

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Using the provided information we have to find Adjusted Gross Income AGI Adjuste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started