Question

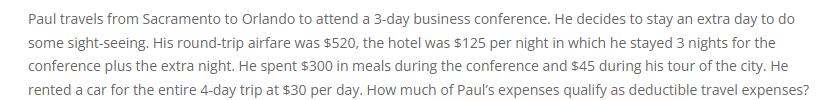

Paul travels from Sacramento to Orlando to attend a 3-day business conference. He decides to stay an extra day to do some sight-seeing. His

Paul travels from Sacramento to Orlando to attend a 3-day business conference. He decides to stay an extra day to do some sight-seeing. His round-trip airfare was $520, the hotel was $125 per night in which he stayed 3 nights for the conference plus the extra night. He spent $300 in meals during the conference and $45 during his tour of the city. He rented a car for the entire 4-day trip at $30 per day. How much of Paul's expenses qualify as deductible travel expenses?

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Note You ane able to deduct the air fare and the hoter far...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App