Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paul will recognize income of _______________ and will have a basis in his partnership of ______________ and will be allocated a gain of____________ Xavier will

Paul will recognize income of _______________ and will have a basis in his partnership of ______________ and will be allocated a gain of____________ Xavier will be allocated a gain of ______________ and a deduction for ordinary income and necessary business expense of_____________ The partnership basis in the building will be _____________

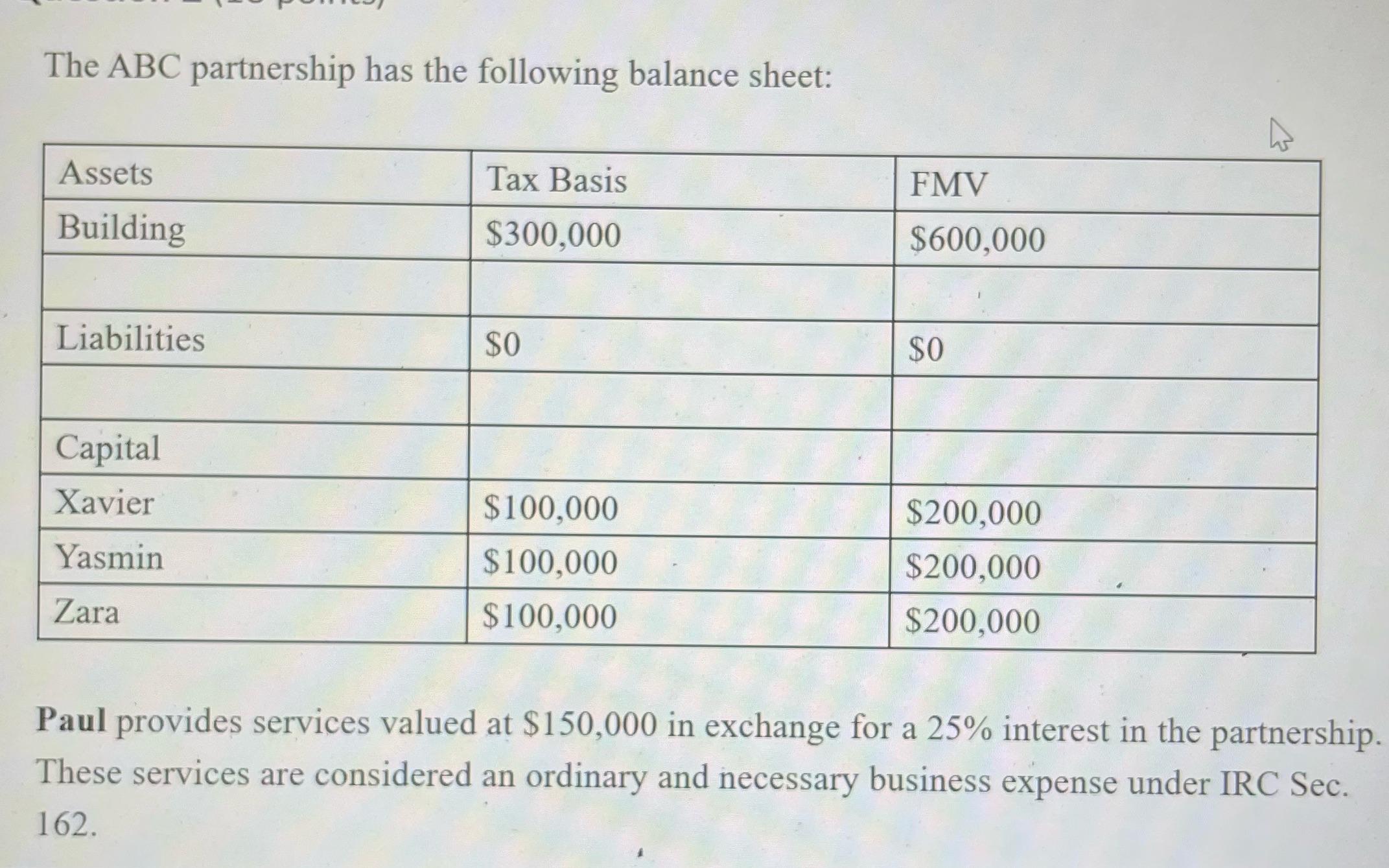

Paul will recognize income of _______________ and will have a basis in his partnership of ______________ and will be allocated a gain of____________ Xavier will be allocated a gain of ______________ and a deduction for ordinary income and necessary business expense of_____________ The partnership basis in the building will be _____________ The ABC partnership has the following balance sheet: Assets Building Liabilities Capital Xavier Yasmin Zara Tax Basis $300,000 SO $100,000 $100,000 $100,000 FMV $600,000 $0 $200,000 $200,000 $200,000 Paul provides services valued at $150,000 in exchange for a 25% interest in the partnership. These services are considered an ordinary and necessary business expense under IRC Sec. 162.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets work through the calculations based on the given information 1 Pauls Income and Basis The incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started