Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Widgets, Inc. has the option to invest in a new product line, code name: Super Fancy Widgets. The invest- ment costs $325 million if

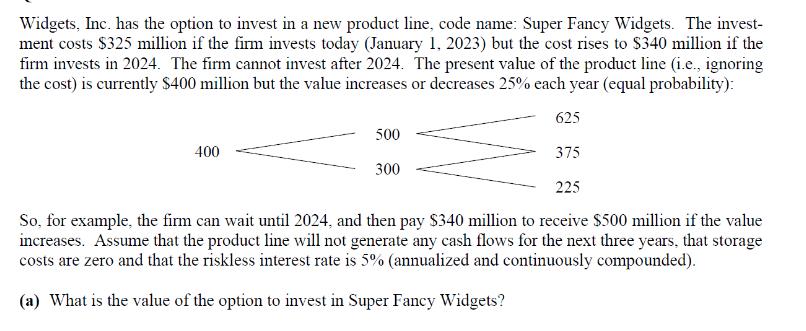

Widgets, Inc. has the option to invest in a new product line, code name: Super Fancy Widgets. The invest- ment costs $325 million if the firm invests today (January 1, 2023) but the cost rises to $340 million if the firm invests in 2024. The firm cannot invest after 2024. The present value of the product line (i.e., ignoring the cost) is currently $400 million but the value increases or decreases 25% each year (equal probability): 625 375 225 So, for example, the firm can wait until 2024, and then pay $340 million to receive $500 million if the value increases. Assume that the product line will not generate any cash flows for the next three years, that storage costs are zero and that the riskless interest rate is 5% (annualized and continuously compounded). (a) What is the value of the option to invest in Super Fancy Widgets? 400 500 300

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the option to invest in Super Fancy Widgets we can use the concept of a real options valuation method specifically the binom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started