Question

Paulson Manufacturing Company uses the perpetual inventory system to account for its manufacturing inventories. The following are Paulson's transatcions during July 2016: July 5 -

Paulson Manufacturing Company uses the perpetual inventory system to account for its manufacturing inventories. The following are Paulson's transatcions during July 2016: July 5 - Received material costing $2,000 from a supplier. The material was purchased on account.

July 9 - Requisitioned $6,000 of material for use in the factory, consisting of $5,000 of direct material and $1,000 of indirect material.

July 11 - Recorded the factory payroll: $13,500 of direct labor and $1,500 of indirect labor

July 17 - Incurred various overhead costs totalling $14,000. (Credit Accounts Payable)

July 20 - Applied $20,000 of manufacturing overhead to the products being manufactured

July 23 - Completed product costing $16,000 and moved it it to the warehouse

July 26 - Sold goods with a product cost of $3,000 on account for $5,000

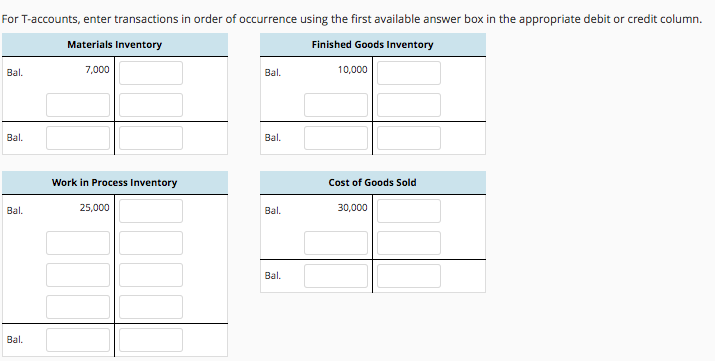

a. and b. Record the transactions listed above in general journal form, post relevant portions to the four T-accounts set-up below, and balance the four accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started