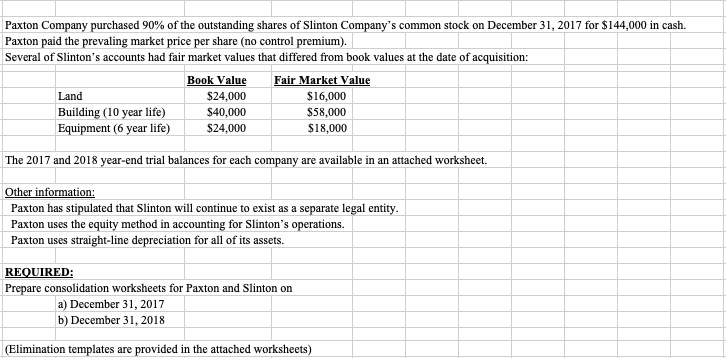

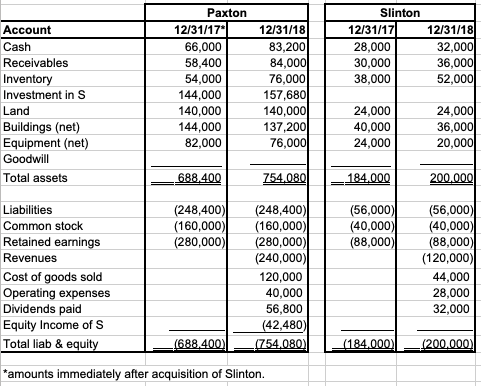

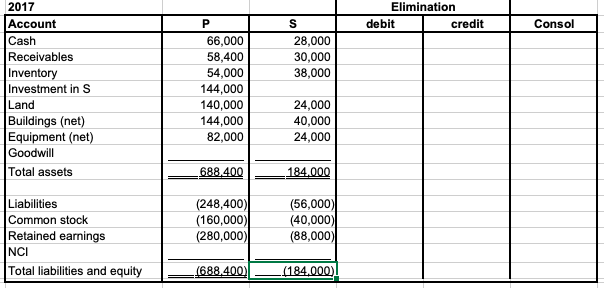

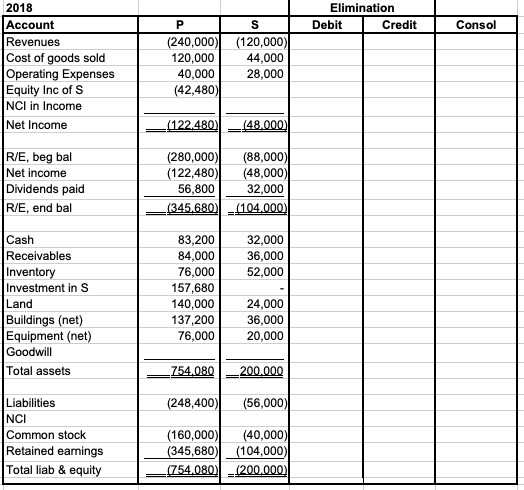

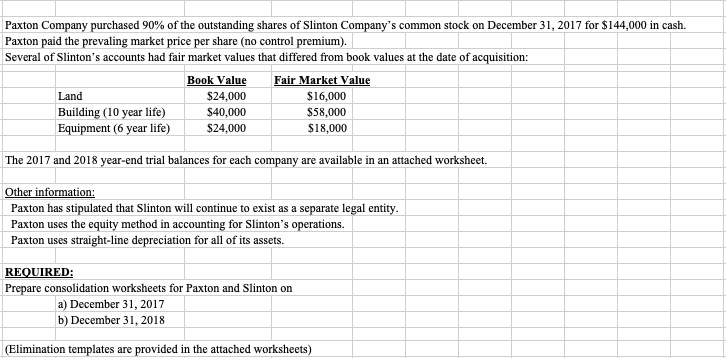

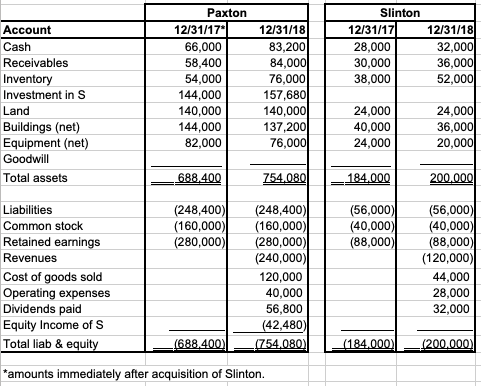

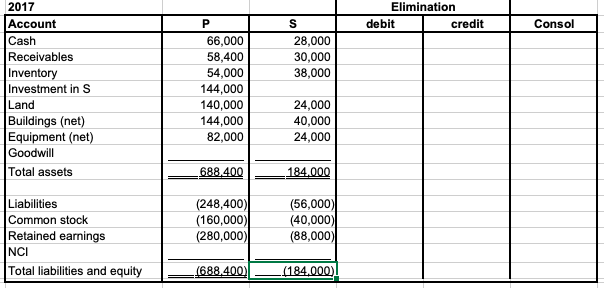

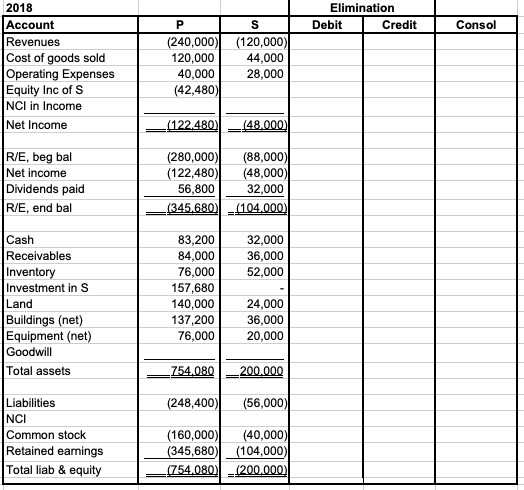

Paxton Company purchased 90% of the outstanding shares of slinton Company's common stock on December 31, 2017 for $144,000 in cash. Paxton paid the prevaling market price per share (no control premium) Several of Slinton's accounts had fair market values that differed from book values at the date of a cquisition Land Building (10 year life) Equipment (6 year life) Book Value $24,000 $40,000 $24,000 Fair Market Value $16,000 $58,000 $18,000 The 2017 and 2018 year-end trial balances for each company are available in an attached worksheet. er information Paxton has stipulated that Slinton will continue to exist as a separate legal e Paxton uses the equity method in accounting for Slinton's operations. Paxton uses straight-line depreciation for all of its assets. REQUIRED: Prepare consolidation worksheets for Paxton and Slinton on a) December 31, 2017 b) December 31, 2018 Elimination templates are provided in the attached worksheets) Paxton Slinton Account Cash Receivables Inventory Investment in S Land Buildings (net) Equipment (ne Goodwil Total assets 12/31/17* 66,000 58,400 54,000 144,000 140,000 144,000 82,000 12/31/18 83,200 12/31/17 28,000 30,000 38,000 12/31/18 32,000 36 52 84 76,000 157,680 140,000 137,200 24,000 40,000 24,000 24 36 20 76 75408Q184.000 200,000 (56,000 (40,000) Liabilities Common stock Retained earnings Revenues (56,000) (40,000) (280,000(280,000)(88,000 (88,000) (120,000) 44,000 28,000 32,000 (248,400) (248,400) (160,000(160,000) Cost of goods sold Operating expenses Dividends paid Equity Income of S Total liab & equ (240,000) 120,000 40,000 56,800 (42,480 amounts immediately after acquisition of Slinton 2017 Account Cash Receivables Inventory Investment in S Land Buildings (net) Equipment (net) Goodwil Total assets Elimination debit credit Consol 66,000 58,400 54,000 144,000 140,000 144,000 82,000 28,000 30,000 38,000 24,000 40,000 24,000 688400 Liabilities Common stock Retained earnings NCI Total liabilities and equity (248,400) (160,000) 280,000) (56,000 (40,000) 88,000 2018 Account Revenues Cost of goods sold Operating Expenses Equity Inc of S NCI in Income Net Income Elimination Debit Credit Consol 120,000 40,000 (42,480 (240,000)(120,000) 44,000 28,000 R/E, beg bal Net income Dividends paid R/E, end bal (280,000(88,000) 48,000 32,000 (122,480) 56,800 Cash Receivables Inventory Investment in S Land Buildings (net) Equipment (net) Goodwil Total assets 83,200 84,000 76,000 157,680 140,000 32,000 36,000 52,000 24,000 37,200 36,000 20,000 76,000 Liabilities NCI Common stock Retained earnings(345,680) Total liab & equity (248,400) (56,000) (160,000)40,000) (104,000)