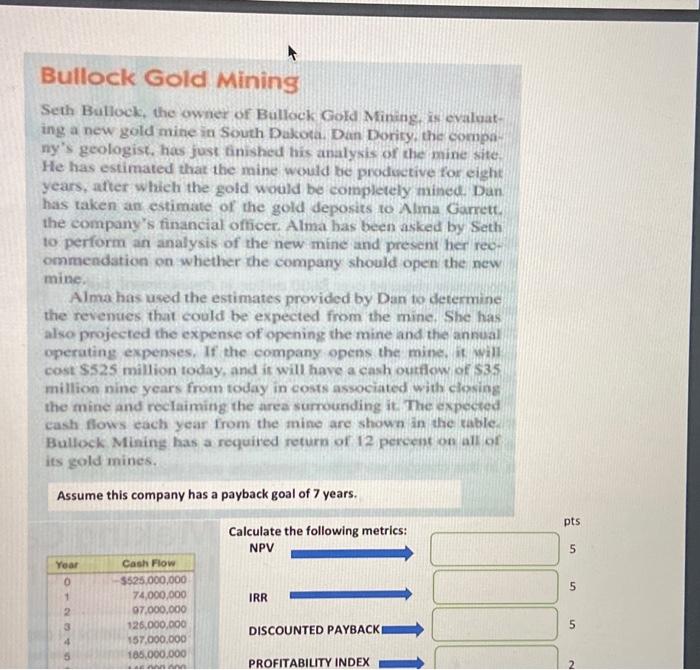

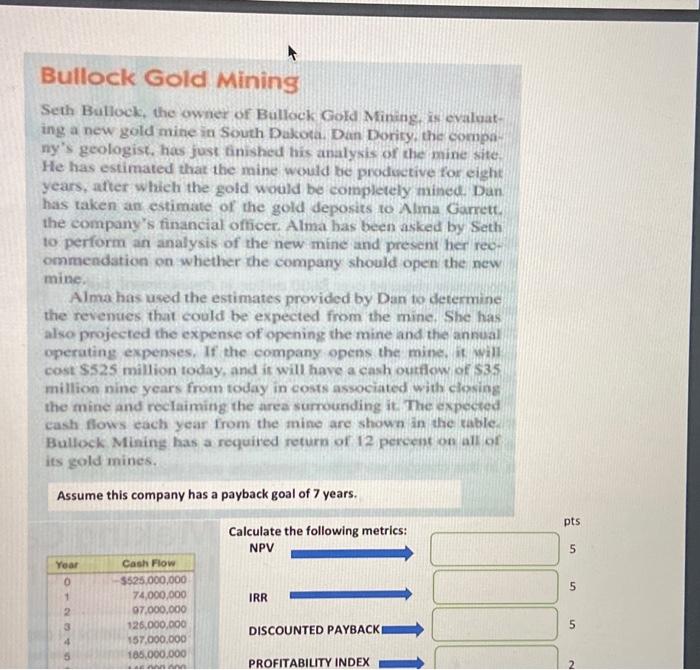

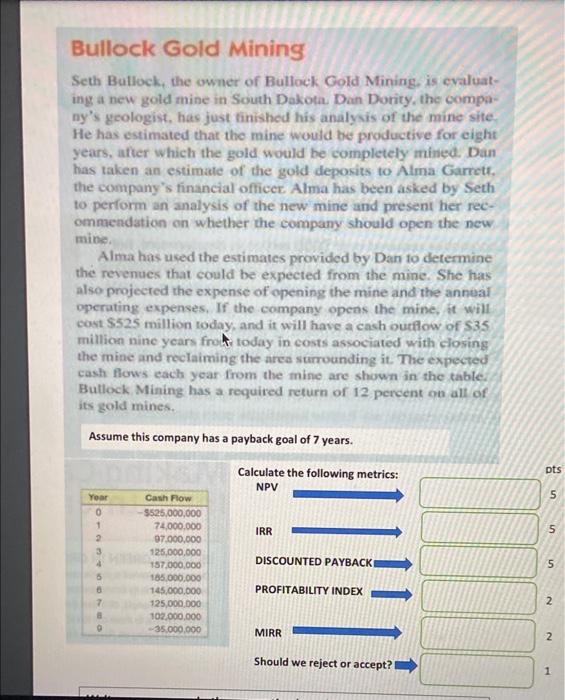

Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining is evaluat- ing a new gold mine in South Dakota Dan Dority, the compa ny's geologist, has just finished his analysis of the mine site He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett the company's financial officer. Alma bas been asked by Seth to perform an analysis of the new mine and present her reo- ommendation on whether the company should open the new mine. Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $525 million today, and it will have a cash outflow of $35 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the table. Bullock Mining has a required return of 12 percent on all of its gold mines. Assume this company has a payback goal of 7 years. pts Calculate the following metrics: NPV 5 5 Year 0 1 2 3 IRR Cash Flow $525.000.000 74,000,000 07.000.000 126.000.000 157.000.000 185.000.000 un DISCOUNTED PAYBACK PROFITABILITY INDEX 2 Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluat- ing a new gold mine in South Dakota Dan Dority, the compa- ny's geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett the company's financial officer. Alma has been asked by Seth to perform an analysis of the new mine and present her rec- ommendation on whether the company should open the new mine Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $525 million today, and it will have a cash outflow of $35 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the table Butlock Mining has a required return of 12 percent on all of its gold mines. Assume this company has a payback goal of 7 years. pts Calculate the following metrics: NPV 5 Year 0 1 2 IRR 5 Cash Flow 5525,000,000 74,000,000 97.000.000 125,000,000 157.000.000 185.000.000 145.000.000 125.000.000 102.000.000 - 35.000.000 min DISCOUNTED PAYBACK 5 5 PROFITABILITY INDEX 7 2 MIRR 2 2 Should we reject or accept? 1