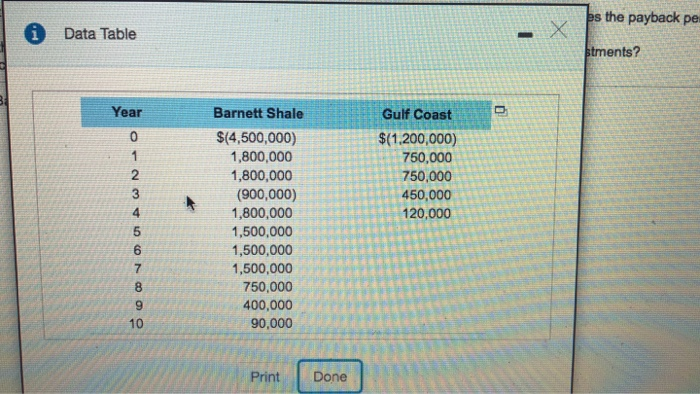

Payback period and NPV calculations) Energyanol and gas exploration and development company located in Farmington, New . The company show we hopes of finding and depot Therm is considering two different ring opportunitat have very reproduction Data Thesis in the Barn Shale region of cereas and the other is in the l ast The Barent Sha r es a much larger investment but provides a fosf o r much longer period of time than the Gulf Coast opportunity thaddition, the longer than he project res o nal expenditure year of the properto hace production throughout there's 10 year expected This expenditure involves pumping other waterco, down into the well in order to increase the flow of gas from the the speed shows t he projects are to m e Based on the pay which of the wolpears to be the best ? W hemins of the payback p aing That is what the back value crop of the Pas manentes Out of prove the presentes of terrement projects, what is the NPV of sever? d. What is your m other that w e created for the center of two investment ..Given the show information in the the p ack period of the Game Shale years oma place es the payback pe i Data Table stments? COAWNO Barnett Shale $(4,500,000) 1,800,000 1,800,000 (900,000) 1,800,000 1,500,000 1,500,000 1,500,000 750,000 400,000 90.000 Gulf Coast $(1,200,000) 750,000 750,000 450,000 120,000 FO Print (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering two different drilling opportunities that have very different production potentials. The first is in the Bamett Shale region of Central Texas and the other is in the Gulf Coast. The Barnett Shale project requires a much larger initial Investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO, down into the wells in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows