Answered step by step

Verified Expert Solution

Question

1 Approved Answer

payments are known as lump sums. We can solve for the future value or the present value of a lump sum as we discuss below.

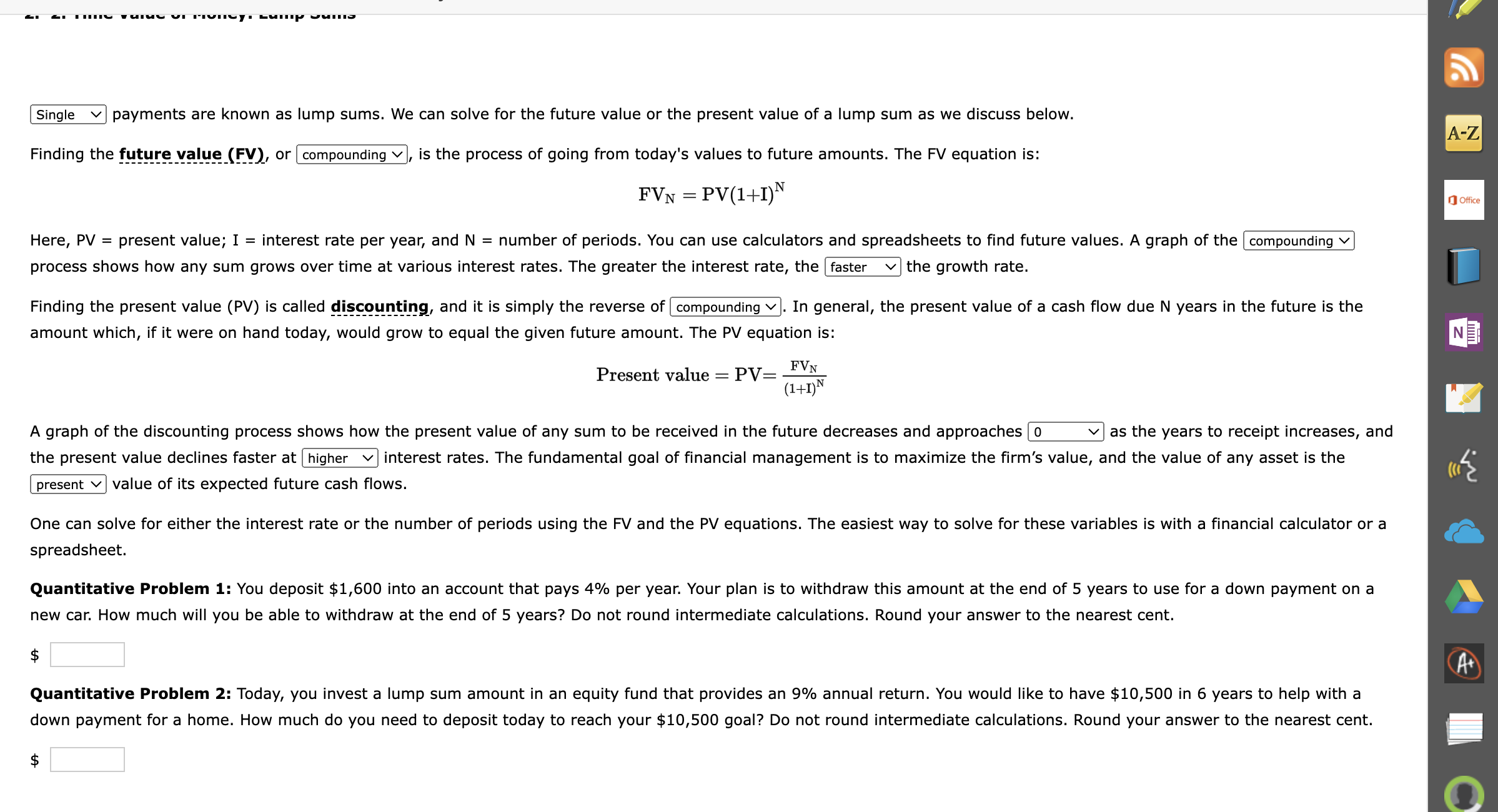

payments are known as lump sums. We can solve for the future value or the present value of a lump sum as we discuss below. Finding the future value (FV), or compounding , is the process of going from today's values to future amounts. The FV equation is: FVN=PV(1+I)N Here, PV= present value; I= interest rate per year, and N= number of periods. You can use calculators and spreadsheets to find future values. A graph of the process shows how any sum grows over time at various interest rates. The greater the interest rate, the faster the growth rate. Finding the present value (PV) is called discounting, and it is simply the reverse of compounding . In general, the present value of a cash flow due N years in the future is the amount which, if it were on hand today, would grow to equal the given future amount. The PV equation is: Presentvalue=PV=(1+I)NFVN A graph of the discounting process shows how the present value of any sum to be received in the future decreases and approaches as the years to receipt increases, anc the present value declines faster at interest rates. The fundamental goal of financial management is to maximize the firm's value, and the value of any asset is the value of its expected future cash flows. One can solve for either the interest rate or the number of periods using the FV and the PV equations. The easiest way to solve for these variables is with a financial calculator or a spreadsheet. Quantitative Problem 1: You deposit $1,600 into an account that pays 4% per year. Your plan is to withdraw this amount at the end of 5 years to use for a down payment on a new car. How much will you be able to withdraw at the end of 5 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ Quantitative Problem 2: Today, you invest a lump sum amount in an equity fund that provides an 9% annual return. You would like to have $10,500 in 6 years to help with a down payment for a home. How much do you need to deposit today to reach your $10,500 goal? Do not round intermediate calculations. Round your answer to the nearest cent. $

payments are known as lump sums. We can solve for the future value or the present value of a lump sum as we discuss below. Finding the future value (FV), or compounding , is the process of going from today's values to future amounts. The FV equation is: FVN=PV(1+I)N Here, PV= present value; I= interest rate per year, and N= number of periods. You can use calculators and spreadsheets to find future values. A graph of the process shows how any sum grows over time at various interest rates. The greater the interest rate, the faster the growth rate. Finding the present value (PV) is called discounting, and it is simply the reverse of compounding . In general, the present value of a cash flow due N years in the future is the amount which, if it were on hand today, would grow to equal the given future amount. The PV equation is: Presentvalue=PV=(1+I)NFVN A graph of the discounting process shows how the present value of any sum to be received in the future decreases and approaches as the years to receipt increases, anc the present value declines faster at interest rates. The fundamental goal of financial management is to maximize the firm's value, and the value of any asset is the value of its expected future cash flows. One can solve for either the interest rate or the number of periods using the FV and the PV equations. The easiest way to solve for these variables is with a financial calculator or a spreadsheet. Quantitative Problem 1: You deposit $1,600 into an account that pays 4% per year. Your plan is to withdraw this amount at the end of 5 years to use for a down payment on a new car. How much will you be able to withdraw at the end of 5 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ Quantitative Problem 2: Today, you invest a lump sum amount in an equity fund that provides an 9% annual return. You would like to have $10,500 in 6 years to help with a down payment for a home. How much do you need to deposit today to reach your $10,500 goal? Do not round intermediate calculations. Round your answer to the nearest cent. $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started