Payroll Accounting 2019 Bieg/Toland 29th Edition

7-12 Project Audit Test

DECEMBER 4 PAYROLL: (As you complete your work, answer the following questions for the December 3 and December 4 payroll.)

Payroll Register

1. What is the net pay for Joseph T. ONeill?

2. What is the amount of OASDI withheld for Norman A. Ryan?

3. What is the total net pay for all employees?

4. What is the total CIT withheld for all employees?

Journal

5. What is the amount of the debit to Employees SIT Payable on December 3?

6. What is the amount of the credit to Employees FIT Payable?

7. What is the amount of the debit to Payroll Taxes? General Ledger

8. What is the balance of SUTA Taxes PayableEmployer?

9. What is the balance of Employees CIT Payable?

10. What is the Cash account balance?

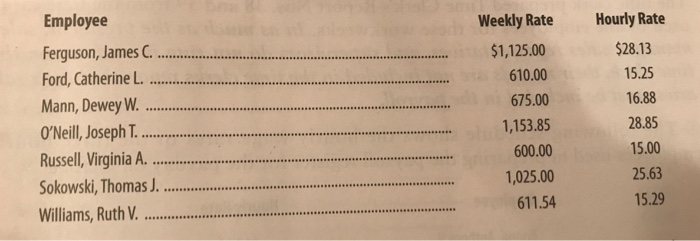

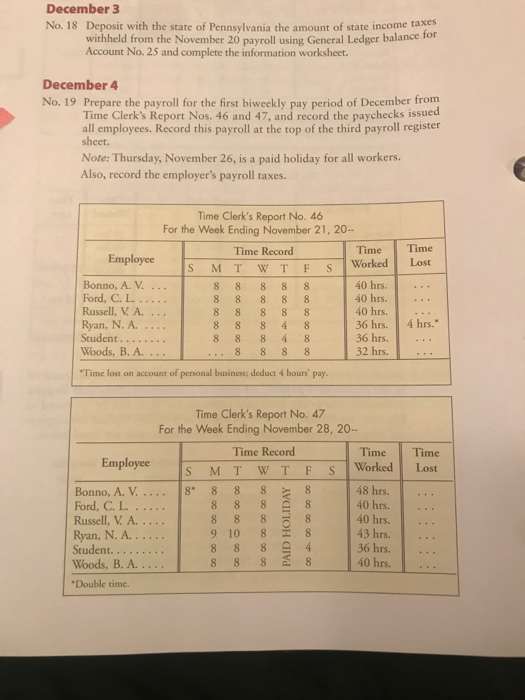

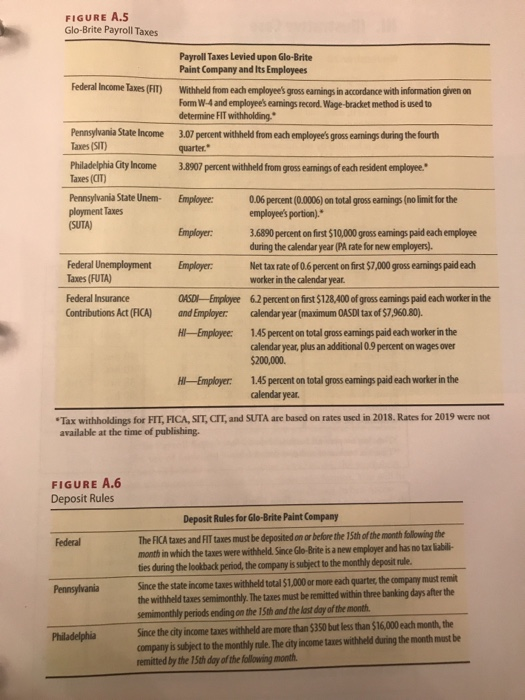

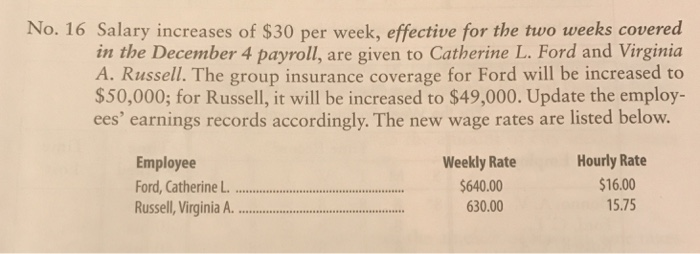

Hourly Rate Employee Ferguson, James Ford, Catherine L.... Mann, DeweyW. 0'Neill, Joseph . Russell, Virginia .. Sokowski, Thomas Williams, Ruth . Weekly Rate $1,125.00 610.00 675.00 1,153.85 600.00 1,025.00 611.54 $28.13 15.25 16.88 28.85 15.00 25.63 15.29 December 3 No. 18 Deposit with the state of Pennsylvania the amount of state income taxes withheld from the November 20 payroll using General Ledger balance for Account No. 25 and complete the information worksheet. December 4 No. 19 Prepare the payroll for the first biweekly pay period of December from Time Clerk's Report Nos. 46 and 47, and record the paychecks issued all employees. Record this payroll at the top of the third payroll register sheet. Note: Thursday, November 26, is a paid holiday for all workers. Also, record the employer's payroll taxes. Time Clerk's Report No. 46 For the Week Ending November 21, 20 Time Record Time Time Employee s M T W T F s I worked Lost Bonno, A. V. .. Ford, C. L. . .. Russell, V A. Ryan, N. A. Student. Woods, B. A 40 hrs. 40 hrs.. 40 hrs. 36 hrs. 4 hrs. 36 hrs. 32 hrs. Time lost on account of personal business; deduct 4 hours' pay Time Clerk's Report No. 47 For the Week Ending November 28, 20 Time Record Time Time EmployeeS SM T W T F slWorkedl Lost 48 hrs. 40 hrs. 40 hrs 43 hrs. 36 hrs. 40 hrs. 8 88 Bonno, A. V8 Ford, C. L. Russell, V. A. Ryan, N. A. Student. Woods, B. A.... Double time. 8 9 10 8 FIGURE A.S Glo-Brite Payroll Taxes Payroll Taxes Levied upon Glo-Brite Paint Company and Its Employees Federal Income lawes(FIT) Withheld from each employees gross eamings in accordance withinformation givencn Form W-4 and employee's eanings record. Wage-bracket method is used to determine FIT withholding Pennsylvania State Income Taxes (SIT) 3.07 percent withheld from each employee's gross earmings during the fourth quarter 3.8907 percent withheld from gross earnings of eac resident employee. Philadelphia City Income Taxes (CIT) Pennsylvania State Unem ployment Taxes (SUTA) Employee: 0.06 percent (0.0006) on total gross earnings (no limit for the employee's portion)." during the calendar year (PA rate for new employers). worker in the calendar year Employer:3.6890 percent on first $10,000 gross eamings paid each employee Federal Unemployment Employer.Net tax rate of 0.6 percent on first $7,000 gross earnings paid each Taxes (FUTA) Federal Insurance Contributions Act (RICA)and Employer: calendar year (maximum OASDI tax of $7,960.80). OASD Employee 62 percent on first $128,400 of gross earnings paid each worker in the HF-Employee: 1.45 percent on totalgross earnings paideachworker inte calendar year, plus an additional 0.9 percent on wages over $200,000. HI-Employer: 1.45 percent on total gross eamings paid each worker in the calendar year Tax withholdings for FT, FICA,ST,aT,and SUTA are based on rates used in 2018. Rates for 2019 were not available at the time of publishing. FIGURE A.6 Deposit Rules Deposit Rules for Glo-Brite Paint Company The FICA taxes and FIT axes must be deposited on or before the 15t of the month folowing the month in which the taxes were withheld Since Glo-Brite is a new employer and has no tax liabilil ties during the lookback period, the company is subject to the monthly depesitrule Since the state income taxes withheld total $1,000 or more eadh quarter, the company must remit the witheld taxes semimonthly, The taxes must be remitted within three banking days afterthe semimonthly periods ending on the 15th and the last day of the month Since the city income taxes withheld are more than $350 but less than $16,000 each month, the company is subject to the monthly nule. The city income taxes withheld during the month must be remitted by the 15th day of the following month Federal Pennsylvania Philadelphia No. 16 Salary increases of $30 per week, effective for the two weeks covered in the December 4 payroll, are given to Catherine L. Ford and Virginia A. Russell. The group insurance coverage for Ford will be increased to $50,000; for Russell, it will be increased to $49,000. Update the employ- ees' earnings records accordingly. The new wage rates are listed below. Hourly Rate $16.00 15.75 Employee Weekly Rate 640.00 630.00 Russell, Virginia