Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required (please show workings): 1. Prepare the Statement of Cash Flows for Pharmacy Adelaide Ltd for the year ended 30 June 2020 using the direct

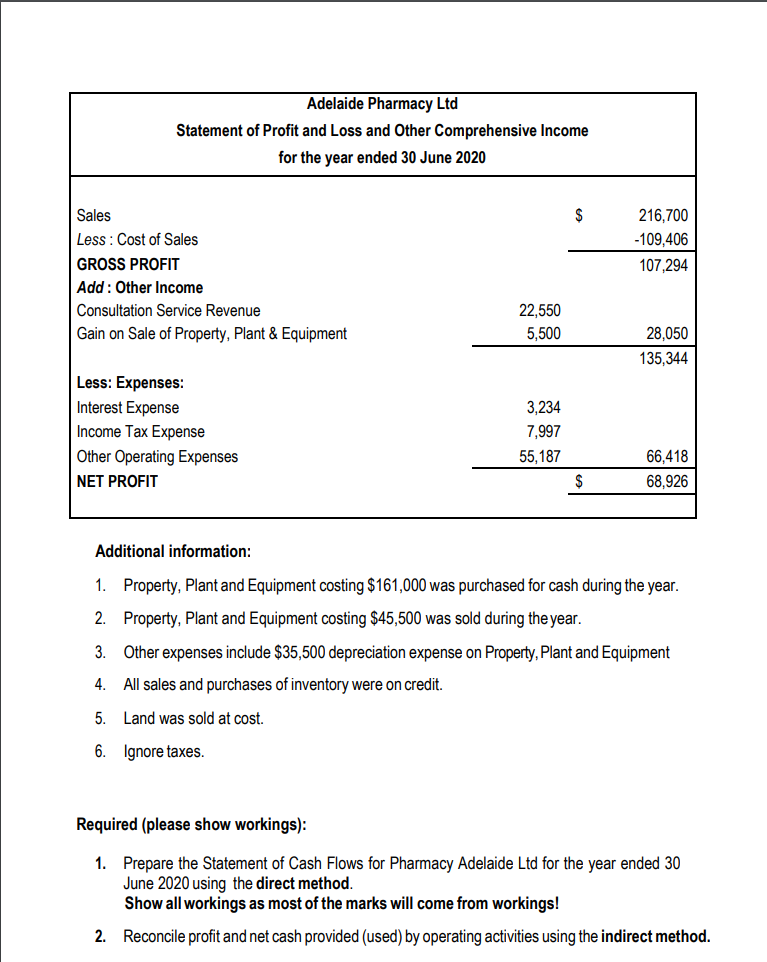

Required (please show workings): 1. Prepare the Statement of Cash Flows for Pharmacy Adelaide Ltd for the year ended 30 June 2020 using the direct method. Show allworkings as most of the marks will come from workings! 2. Reconcile profit and net cash provided (used) by operating activities using the indirect method.

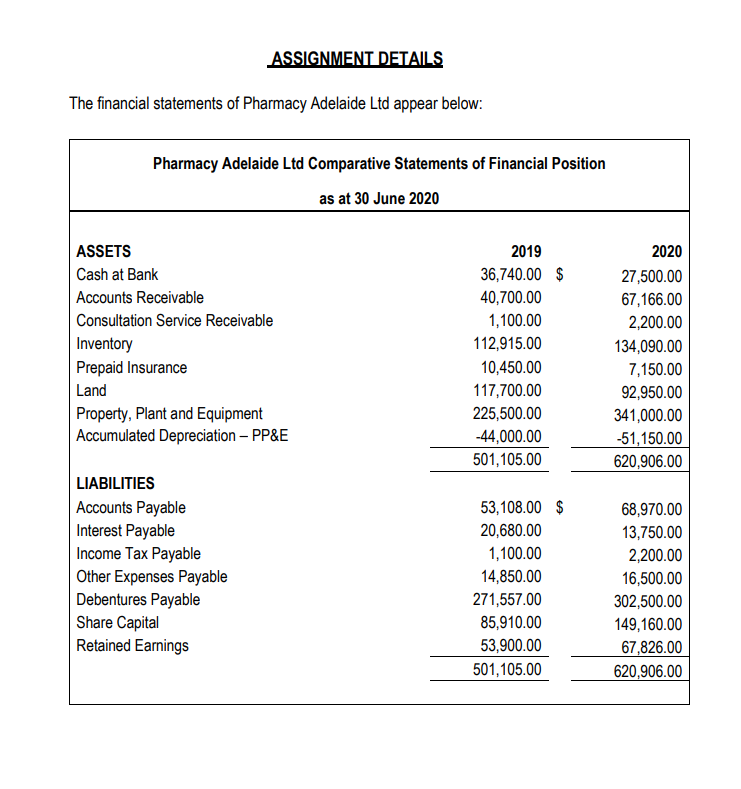

ASSIGNMENT DETAILS The financial statements of Pharmacy Adelaide Ltd appear below: Pharmacy Adelaide Ltd Comparative Statements of Financial Position as at 30 June 2020 ASSETS Cash at Bank Accounts Receivable Consultation Service Receivable Inventory Prepaid Insurance Land Property, Plant and Equipment Accumulated Depreciation - PP&E 2019 36,740.00 $ 40,700.00 1,100.00 112,915.00 10,450.00 117,700.00 225,500.00 -44,000.00 501,105.00 2020 27,500.00 67,166.00 2,200.00 134,090.00 7,150.00 92,950.00 341,000.00 -51,150.00 620,906.00 LIABILITIES Accounts Payable Interest Payable Income Tax Payable Other Expenses Payable Debentures Payable Share Capital Retained Earnings 53,108.00 $ 20,680.00 1,100.00 14,850.00 271,557.00 85,910.00 53,900.00 501,105.00 68,970.00 13,750.00 2,200.00 16,500.00 302,500.00 149,160.00 67,826.00 620,906.00 Adelaide Pharmacy Ltd Statement of Profit and Loss and Other Comprehensive Income for the year ended 30 June 2020 $ 216,700 -109,406 107,294 Sales Less: Cost of Sales GROSS PROFIT Add : Other Income Consultation Service Revenue Gain on Sale of Property, Plant & Equipment 22,550 5,500 28,050 135,344 Less: Expenses: Interest Expense Income Tax Expense Other Operating Expenses NET PROFIT 3,234 7,997 55,187 66,418 68,926 $ Additional information: 1. Property, Plant and Equipment costing $161,000 was purchased for cash during the year. 2. Property, Plant and Equipment costing $45,500 was sold during the year. 3. Other expenses include $35,500 depreciation expense on Property, plant and Equipment 4. All sales and purchases of inventory were on credit. 5. Land was sold at cost. 6. Ignore taxes. Required (please show workings): 1. Prepare the Statement of Cash Flows for Pharmacy Adelaide Ltd for the year ended 30 June 2020 using the direct method. Show all workings as most of the marks will come from workings! 2. Reconcile profit and net cash provided (used) by operating activities using the indirect methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started