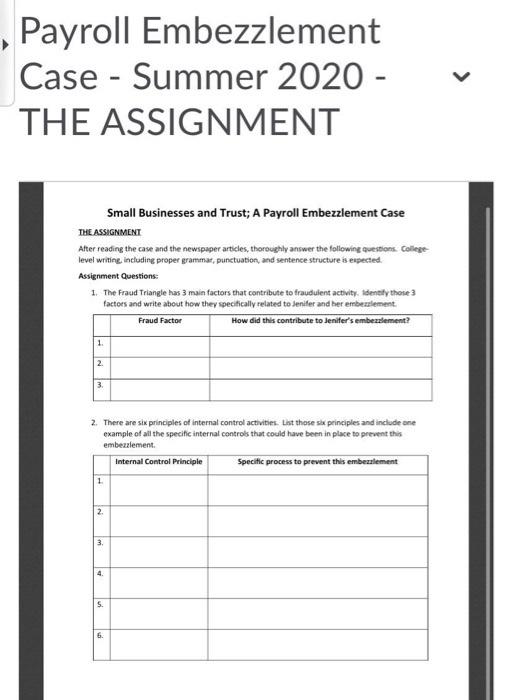

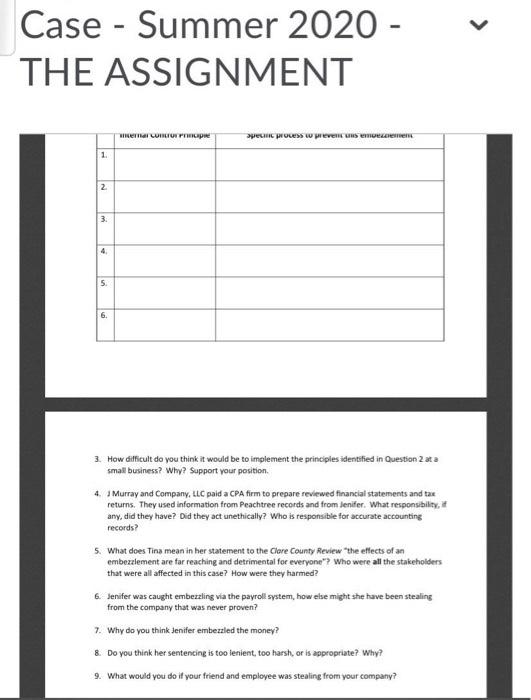

Payroll Embezzlement Case - Summer 2020 - THE CASE > Small Businesses and Trust; A Payroll Embezzlement Case THE STORY BEGINS The four women all left the courtroom with med emotions that day in March 2018. It was a relief the sentencing was over, and the judge gave the maximum sentence allowed, but it was heart breaking to hear a crying child as her mother is being taken to jail. They all still struggle to believe that someone could be so deceitful; but she was that deceitful and she never showed any remorse in the courtroom. As they sat down at the restaurant to eat lunch, Jole began the conversation with, "we will never see a cent of that $150,000 she took from us and they all agreed. At least the judge sentenced her to the maximum allowed", Kim said with a sigh. The case began 9 months earlier when Jackie made a phone call to a professional CPA and CMA she has known for years. Tina, would you be able to just take a look, I don't think the company's financial statements are correct, I think the CPA firm has made a mistake?" Jackie felt that the net income being reported on the financial statements was too high because they were always short on cash to pay their bills. "How can they say we have net income, when we don't have any money?" In fact, she had recently pulled money out of her personal 401k plan to loan to Murray & Co, LLC in order to keep the company going for her daughters sake, Jackie would do anything for her daughters, and they would do anything for Jackie THE COMPANY AND THE OFFICE Murray & Company is a privately heild LLC that has been in business for over 77 years. The two partners are sisters, Julie Bontrager and Kim Price. They inherited the business from their father several Payroll Embezzlement Case - Summer 2020 - THE CASE years ago and have been managing the business full time. The company is a wholesale tobacco, candy and novelties distributor in Mt. Pieasant, Mi and they service over 300 local small businesses. it is a family owned and operated business. Julie and Kim wear many different hats and manage everything from purchasing to customer service. Their mother, Jackie, along with Julie's daughter, both work in the office in accounts receivable. There is one bookkeeper at the company. She is not family, but they treat her as if she were She performs several duties, including payroll, accounts payable, processing credit card payments, making bank deposits, helping walk-in customers, and recording all cash transactions (payments and receipts) in their accounting software called Peachtree The bookkeeper also prepares the bank reconciliations and keep track of the cash budget in an Excel spreadsheet. Julie and Kim rely heavily on her and the Excel spreadsheet to determine how much product they can order and what bills they can pay. They make sure this spreadsheet balances to their bank balance on a regular basis. Their cash flow has been low lately and they don't want to bounce any checks. The bookkeeper also gives the financial transaction and payroll records that are in Peachtree to a local CPA firm. The CPA firm prepares reviewed financial statements from these records as well as the quarterly payroll tax returns and the annual federal income tax return from these same records. The bookkeeper's name is Jenifer Jerman and she is the mother of 3 children plus 2 step children. Jenifer has worked at ) Murray for 6 years and although occasionally there was some turmoil and stress in the office, she was trusted by everyone. She became a best friend to Kim and Jackie treated her like a 3* daughter. She was just like family. Payroll Embezzlement Case - Summer 2020 - THE CASE The main office is made up of a small room where all of them work: Julie, Kim, Jackie, Jenifer and Julie's daughter. For the most part, there are no walls or cubicles to separate them, so there is very little privacy. They work very closely together both physical and professionally THE DISCOVERY Tina, who is a practicing CPA and CMA, agreed to look at Murray's financials. She requested a balance sheet, income statement, the prior years' tax return, and a current bank reconciliation. One look at the most recent bank reconciliation from Peachtree and Tina knew something was wrong. The reconciliation, which should show $0 unreconciled differences, showed over $200,000 as an unreconciled difference". Tina's initial thought was that it was just human errors, so she told Jenifer they would need to figure it out and correct it. Tina offered to come back in a few weeks to work on it Then Jenifer quit. When Tina returned and began to investigate the "unreconciled difference", she compared the latest bank statement and bank reconciliation with the transactions that were recorded in Peachtret. It was immediately clear that there were checks that cleared the bank but not recorded in Peachtree. She requested to see copies of the cleared checks for that month and found that they were made out to the bookkeeper, Jenifer Jerman, Tina immediately talked to Julie and said, "I think you have an embezzlement". They both agreed to look at the next prior month to make sure, and again there were checks that cleared the bank made out to Jenifer Jerman that were not recorded in Peachtree. When they told Kim, she was so shocked, and she didn't really believe it for a couple of days. "Are you sure? Can you double check again?" How could her best friend steal from her? 3 Payroll Embezzlement Case - Summer 2020 - THE CASE - > The local police were contacted and statements were made by ste, kim, lackie and Tina, Tina began to perform the forensic accounting work which first involved preparing new bank reconciliations for each month for the last 5 years and tracking transactions throughout the financial statements. The Peachtree system was backed up and a copy was saved as evidence. The audit function of the Peachtree software was reviewed and it was found that there were hundreds of transactions that had been deleted. Upon further investigation, the items that were deleted from Peachtree were the extra payroll checks that were cashed by Jenifer. The forensic work to involved comparing Kim's signature to the signature on those checks. It appeared Jenifer forged the signature of Kim Price Tina concluded that Jenifer had entered additional firmous payroll hours to herselt in Peachtree, printed payroll checks in her name and then deleted the payroll records and the checks from Peachtree so that no record of them remained. She then forged Price's signature on those checks and cashed them. Jenifer covered up her embezzlement by making it appear as though she had performed a bank reconciliation, but she left "unreconciled differences be also covered up her embezled checks on the Excel spreadsheet by entering different employees' names for the checks that she had printed and cashed herself. This is the same Excel spreadsheet that lie and Kim rely on for cash management, the one that did te to the bank balance. As a result of the forensic accounting work, Tina's written statement to police included this appears that Jenifer Jerman prepared extra payroll checks to hersel, printed them, signed them as Kim Price, cashed them, and deleted those transactions out of Peachtree so that no one would know they were ever printed. These checkstanged in dollar amount from $220.28 to $420.85." She prepared up Payroll Embezzlement Case - Summer 2020 - THE CASE to 12 extra checks per month to herself. In a span of four years, Jenifer Jerman printed and cashed approximately 480 embezzled checks totaling $148,338 87. Jenifer Jerman was paying herselt mare than the salary amount of each of the owners When called in and questioned by police, Jenifer admitted on video to the embezzlement. She was arrested in July 2017 but posted bail and only spent a couple of hours in the county jail. Tina worked with the prosecuting attorney to help determine all the crimes that were committed and the resulting damages. Jenifer was charged in September 2017 with one felony count of embezzlement of $100,000 or more and with one felony count of forgery. She pled no contest in January 2018 and was sentenced on March 22, 2018 Kim said, "Now I understand how she could afford all the stuff she always bought for her kids and herself. We actually paid for all those cell phones, braces, and pedicures!" THE MANIPULATION Jenifer manipulated both the financial records and the people she worked with. She built up their trust and lied to their faces every day. While employed at / Murray, Jenifer became Kim's best friend and participated in their parties, took food to their homes, and shared stories about their kids. They completely trusted her. In 2014, well before the discovery of the embezzlement, Julie became extremely ill and was not expected to live. She lapsed into a coma and was placed on life support. During this time, Kim depended immensely on the staff at 1 Murray, especially Jenifer, to keep the business running Unfortunately, everyone now realizes that this dependence and trust gave Jenifer more opportunity They thought Jenifer had stepped up to the plate and was helping run the business in their absence, Payroll Embezzlement Case - Summer 2020 - THE CASE when she decided to accelerate her embezzlement by writing more checks to herself. After many months in the hospital, Julle recovered and was released to come home under the care of numerous therapists Shockingly, Jenifer printed all those extra checks for herself on a printer they all shared in the one room office. How could this have happened? Why didn't Kim and Julie realize so many checks were missing? Why didn't their outside CPA firm realize the cash balance was not correct on the balance sheet? In court, her attorney indicated that Jenifer had been undergoing psychiatric treatment for a long time due to the ansiety of committing the embezzlement, and yet she continued to embezzle. It came to light that she was manipulating her husband as well. He is the director of the 911 dispatch in the county which serves under the local Police department. When interviewed by a fellow police officer, he said he didn't know anything about her taking the money. Why didn't he realize she was spending three times as much money as she was supposed to be earning? THE DAY IN COURT Julie, Kim and Jackie were given the opportunity to give their victim's statement to the judge at the sentencing proceedings. They each told how the embezzlement hurt their business and their families, as well as the families of their employees. They told the judge that she was like family. I would have done anything for her, her family, and her kids" Kim expressed, "My hope is that her sentence sets an example and is a deterrent to her in the future and for many others who may try this type of behavior." Payroll Embezzlement Case - Summer 2020 - THE CASE Before giving his sentence, the Judge said in court, "what the defendant did in this matter was calculated. It was deceit- manipulative. This is someone that purposefully, intentionally and deceitfully created a system to take money for her own." He also said, Jenifer's sentence memorandum indicates that some of this could have been brought on by the financial toll of her husband's bankruptcy filing." but he explained that bankruptcy filing was not an excuse to steal. He continued to communicate his disgust by saying "the fact that the the owner was sick, and she stepped up her activity. The fact that she knowingly allowed the owner's mother to loan the company $140,000 to keep it afloat while she took money and continued to take money. It's just beyond imagination." In Jerman's sentence memorandum, it also stated that, "Ms. Jerman's priority became helping her family to live the life that she believed they deserved." The judge responded to that by saying that struck me as unbelievable to live the life that her family deserved, above and beyond their means after filing bankruptey and at the expense of the victims." "She decided that she and her family deserved to live a better lifestyle. That's just appalling to me." The judge sentenced her to the maximum amount he could, which was 30 months to 20 years for one count of embezzlement of $100,000 or more and 30 months to 14 years on a forgery charge. Her earliest parole release would be September 20", 2020. She was also ordered to pay restitution of more than $175,103.71, which will go directly to the victims in the case as well as an insurance company His final words directed to Jenifer were, the collateral effects of the Defendant's actions in the matter are huge. I feel sorry for her children. I feel sorry for her husband. I empathize with the victims in this matter. It's not just the owners of the business, it's the other employees, it's the vendors, and it's the customers of a 77-year-old business that questioned whether they should go back there. The 7 Payroll Embezzlement Case - Summer 2020 - THE CASE live a better lifestyle. That's just appalling to me." The judge sentenced her to the maximum amount he could, which was 30 months to 20 years for one count of embezzlement of $100,000 or more and 30 months to 14 years on a forgery charge. Her earliest parole release would be September 20", 2020. She was also ordered to pay restitution of more than $175,103.71, which will go directly to the vietims in the case as well as an insurance company, His final words directed to Jenifer were, "the collateral effects of the Defendant's actions in the matter are huge. I feel sorry for her children. I feel sorry for her husband. I empathize with the victims in this matter. It's not just the owners of the business, it's the other employees, it's the vendors, and it's the customers of a 77-year-old business that questioned whether they should go back there. The 7 collateral effects of your actions are massive. So, t find that the sentence is definitely proportionate to the seriousness of the matter." TODAY The lunch the four women shared after the sentencing marked a new beginning for) Murray and Company, LLC. Although everyone has now learned first-hand how important accounting internal controls are, it is still difficult to implement and maintain them in a small business. I Murray has retained Tina to review the bank reconciliations and financial statements on a monthly basis. Kim and Julie are always on high alert for embezzlement. They realize that they must keep business and personal Payroll Embezzlement Case - Summer 2020 - THE ASSIGNMENT Small Businesses and Trust; A Payroll Embezzlement Case THE ASSIGNMENT After reading the case and the newspaper articles, thoroughly answer the following questions College level writing including proper grammar, punctuation, and sentence structure is expected. Assignment Questions: 1. The Fraud Triangle has 3 main factors that contribute to fraudulent activity. Identify those 3 factors and write about how they specifically related to Jenifer and her embezzlement Fraud Factor How did this contribute to Jenifer's embezzlement? 1 2. 3. 2. There are six principles of internal control activities List those sx principles and include one example of all the specific internal controls that could have been in place to prevent this embezzlement Internal Control Principle Specific process to prevent this embezzlement 1 2 3. 3. 4 5 6. Small Businesses and Trust; A Payroll Embezzlement Case THE STORY BEGINS The four women all left the courtroom with med emotions that day in March 2018. It was a relief the sentencing was over, and the judge gave the maximum sentence allowed, but it was heart breaking to hear a crying child as her mother is being taken to jail. They all still struggle to believe that someone could be so deceitful; but she was that deceitful and she never showed any remorse in the courtroom. As they sat down at the restaurant to eat lunch, Jole began the conversation with, "we will never see a cent of that $150,000 she took from us and they all agreed. At least the judge sentenced her to the maximum allowed", Kim said with a sigh. The case began 9 months earlier when Jackie made a phone call to a professional CPA and CMA she has known for years. Tina, would you be able to just take a look, I don't think the company's financial statements are correct, I think the CPA firm has made a mistake?" Jackie felt that the net income being reported on the financial statements was too high because they were always short on cash to pay their bills. "How can they say we have net income, when we don't have any money?" In fact, she had recently pulled money out of her personal 401k plan to loan to Murray & Co, LLC in order to keep the company going for her daughters sake, Jackie would do anything for her daughters, and they would do anything for Jackie THE COMPANY AND THE OFFICE Murray & Company is a privately heild LLC that has been in business for over 77 years. The two partners are sisters, Julie Bontrager and Kim Price. They inherited the business from their father several Payroll Embezzlement Case - Summer 2020 - THE CASE years ago and have been managing the business full time. The company is a wholesale tobacco, candy and novelties distributor in Mt. Pieasant, Mi and they service over 300 local small businesses. it is a family owned and operated business. Julie and Kim wear many different hats and manage everything from purchasing to customer service. Their mother, Jackie, along with Julie's daughter, both work in the office in accounts receivable. There is one bookkeeper at the company. She is not family, but they treat her as if she were She performs several duties, including payroll, accounts payable, processing credit card payments, making bank deposits, helping walk-in customers, and recording all cash transactions (payments and receipts) in their accounting software called Peachtree The bookkeeper also prepares the bank reconciliations and keep track of the cash budget in an Excel spreadsheet. Julie and Kim rely heavily on her and the Excel spreadsheet to determine how much product they can order and what bills they can pay. They make sure this spreadsheet balances to their bank balance on a regular basis. Their cash flow has been low lately and they don't want to bounce any checks. The bookkeeper also gives the financial transaction and payroll records that are in Peachtree to a local CPA firm. The CPA firm prepares reviewed financial statements from these records as well as the quarterly payroll tax returns and the annual federal income tax return from these same records. The bookkeeper's name is Jenifer Jerman and she is the mother of 3 children plus 2 step children. Jenifer has worked at ) Murray for 6 years and although occasionally there was some turmoil and stress in the office, she was trusted by everyone. She became a best friend to Kim and Jackie treated her like a 3* daughter. She was just like family. Payroll Embezzlement Case - Summer 2020 - THE CASE The main office is made up of a small room where all of them work: Julie, Kim, Jackie, Jenifer and Julie's daughter. For the most part, there are no walls or cubicles to separate them, so there is very little privacy. They work very closely together both physical and professionally THE DISCOVERY Tina, who is a practicing CPA and CMA, agreed to look at Murray's financials. She requested a balance sheet, income statement, the prior years' tax return, and a current bank reconciliation. One look at the most recent bank reconciliation from Peachtree and Tina knew something was wrong. The reconciliation, which should show $0 unreconciled differences, showed over $200,000 as an unreconciled difference". Tina's initial thought was that it was just human errors, so she told Jenifer they would need to figure it out and correct it. Tina offered to come back in a few weeks to work on it Then Jenifer quit. When Tina returned and began to investigate the "unreconciled difference", she compared the latest bank statement and bank reconciliation with the transactions that were recorded in Peachtret. It was immediately clear that there were checks that cleared the bank but not recorded in Peachtree. She requested to see copies of the cleared checks for that month and found that they were made out to the bookkeeper, Jenifer Jerman, Tina immediately talked to Julie and said, "I think you have an embezzlement". They both agreed to look at the next prior month to make sure, and again there were checks that cleared the bank made out to Jenifer Jerman that were not recorded in Peachtree. When they told Kim, she was so shocked, and she didn't really believe it for a couple of days. "Are you sure? Can you double check again?" How could her best friend steal from her? 3 Payroll Embezzlement Case - Summer 2020 - THE CASE - > The local police were contacted and statements were made by ste, kim, lackie and Tina, Tina began to perform the forensic accounting work which first involved preparing new bank reconciliations for each month for the last 5 years and tracking transactions throughout the financial statements. The Peachtree system was backed up and a copy was saved as evidence. The audit function of the Peachtree software was reviewed and it was found that there were hundreds of transactions that had been deleted. Upon further investigation, the items that were deleted from Peachtree were the extra payroll checks that were cashed by Jenifer. The forensic work to involved comparing Kim's signature to the signature on those checks. It appeared Jenifer forged the signature of Kim Price Tina concluded that Jenifer had entered additional firmous payroll hours to herselt in Peachtree, printed payroll checks in her name and then deleted the payroll records and the checks from Peachtree so that no record of them remained. She then forged Price's signature on those checks and cashed them. Jenifer covered up her embezzlement by making it appear as though she had performed a bank reconciliation, but she left "unreconciled differences be also covered up her embezled checks on the Excel spreadsheet by entering different employees' names for the checks that she had printed and cashed herself. This is the same Excel spreadsheet that lie and Kim rely on for cash management, the one that did te to the bank balance. As a result of the forensic accounting work, Tina's written statement to police included this appears that Jenifer Jerman prepared extra payroll checks to hersel, printed them, signed them as Kim Price, cashed them, and deleted those transactions out of Peachtree so that no one would know they were ever printed. These checkstanged in dollar amount from $220.28 to $420.85." She prepared up Payroll Embezzlement Case - Summer 2020 - THE CASE to 12 extra checks per month to herself. In a span of four years, Jenifer Jerman printed and cashed approximately 480 embezzled checks totaling $148,338 87. Jenifer Jerman was paying herselt mare than the salary amount of each of the owners When called in and questioned by police, Jenifer admitted on video to the embezzlement. She was arrested in July 2017 but posted bail and only spent a couple of hours in the county jail. Tina worked with the prosecuting attorney to help determine all the crimes that were committed and the resulting damages. Jenifer was charged in September 2017 with one felony count of embezzlement of $100,000 or more and with one felony count of forgery. She pled no contest in January 2018 and was sentenced on March 22, 2018 Kim said, "Now I understand how she could afford all the stuff she always bought for her kids and herself. We actually paid for all those cell phones, braces, and pedicures!" THE MANIPULATION Jenifer manipulated both the financial records and the people she worked with. She built up their trust and lied to their faces every day. While employed at / Murray, Jenifer became Kim's best friend and participated in their parties, took food to their homes, and shared stories about their kids. They completely trusted her. In 2014, well before the discovery of the embezzlement, Julie became extremely ill and was not expected to live. She lapsed into a coma and was placed on life support. During this time, Kim depended immensely on the staff at 1 Murray, especially Jenifer, to keep the business running Unfortunately, everyone now realizes that this dependence and trust gave Jenifer more opportunity They thought Jenifer had stepped up to the plate and was helping run the business in their absence, Payroll Embezzlement Case - Summer 2020 - THE CASE when she decided to accelerate her embezzlement by writing more checks to herself. After many months in the hospital, Julle recovered and was released to come home under the care of numerous therapists Shockingly, Jenifer printed all those extra checks for herself on a printer they all shared in the one room office. How could this have happened? Why didn't Kim and Julie realize so many checks were missing? Why didn't their outside CPA firm realize the cash balance was not correct on the balance sheet? In court, her attorney indicated that Jenifer had been undergoing psychiatric treatment for a long time due to the ansiety of committing the embezzlement, and yet she continued to embezzle. It came to light that she was manipulating her husband as well. He is the director of the 911 dispatch in the county which serves under the local Police department. When interviewed by a fellow police officer, he said he didn't know anything about her taking the money. Why didn't he realize she was spending three times as much money as she was supposed to be earning? THE DAY IN COURT Julie, Kim and Jackie were given the opportunity to give their victim's statement to the judge at the sentencing proceedings. They each told how the embezzlement hurt their business and their families, as well as the families of their employees. They told the judge that she was like family. I would have done anything for her, her family, and her kids" Kim expressed, "My hope is that her sentence sets an example and is a deterrent to her in the future and for many others who may try this type of behavior." Payroll Embezzlement Case - Summer 2020 - THE CASE Before giving his sentence, the Judge said in court, "what the defendant did in this matter was calculated. It was deceit- manipulative. This is someone that purposefully, intentionally and deceitfully created a system to take money for her own." He also said, Jenifer's sentence memorandum indicates that some of this could have been brought on by the financial toll of her husband's bankruptcy filing." but he explained that bankruptcy filing was not an excuse to steal. He continued to communicate his disgust by saying "the fact that the the owner was sick, and she stepped up her activity. The fact that she knowingly allowed the owner's mother to loan the company $140,000 to keep it afloat while she took money and continued to take money. It's just beyond imagination." In Jerman's sentence memorandum, it also stated that, "Ms. Jerman's priority became helping her family to live the life that she believed they deserved." The judge responded to that by saying that struck me as unbelievable to live the life that her family deserved, above and beyond their means after filing bankruptey and at the expense of the victims." "She decided that she and her family deserved to live a better lifestyle. That's just appalling to me." The judge sentenced her to the maximum amount he could, which was 30 months to 20 years for one count of embezzlement of $100,000 or more and 30 months to 14 years on a forgery charge. Her earliest parole release would be September 20", 2020. She was also ordered to pay restitution of more than $175,103.71, which will go directly to the victims in the case as well as an insurance company His final words directed to Jenifer were, the collateral effects of the Defendant's actions in the matter are huge. I feel sorry for her children. I feel sorry for her husband. I empathize with the victims in this matter. It's not just the owners of the business, it's the other employees, it's the vendors, and it's the customers of a 77-year-old business that questioned whether they should go back there. The 7 Payroll Embezzlement Case - Summer 2020 - THE CASE live a better lifestyle. That's just appalling to me." The judge sentenced her to the maximum amount he could, which was 30 months to 20 years for one count of embezzlement of $100,000 or more and 30 months to 14 years on a forgery charge. Her earliest parole release would be September 20", 2020. She was also ordered to pay restitution of more than $175,103.71, which will go directly to the vietims in the case as well as an insurance company, His final words directed to Jenifer were, "the collateral effects of the Defendant's actions in the matter are huge. I feel sorry for her children. I feel sorry for her husband. I empathize with the victims in this matter. It's not just the owners of the business, it's the other employees, it's the vendors, and it's the customers of a 77-year-old business that questioned whether they should go back there. The 7 collateral effects of your actions are massive. So, t find that the sentence is definitely proportionate to the seriousness of the matter." TODAY The lunch the four women shared after the sentencing marked a new beginning for) Murray and Company, LLC. Although everyone has now learned first-hand how important accounting internal controls are, it is still difficult to implement and maintain them in a small business. I Murray has retained Tina to review the bank reconciliations and financial statements on a monthly basis. Kim and Julie are always on high alert for embezzlement. They realize that they must keep business and personal Payroll Embezzlement Case - Summer 2020 - THE ASSIGNMENT Small Businesses and Trust; A Payroll Embezzlement Case THE ASSIGNMENT After reading the case and the newspaper articles, thoroughly answer the following questions College level writing including proper grammar, punctuation, and sentence structure is expected. Assignment Questions: 1. The Fraud Triangle has 3 main factors that contribute to fraudulent activity. Identify those 3 factors and write about how they specifically related to Jenifer and her embezzlement Fraud Factor How did this contribute to Jenifer's embezzlement? 1 2. 3. 2. There are six principles of internal control activities List those sx principles and include one example of all the specific internal controls that could have been in place to prevent this embezzlement Internal Control Principle Specific process to prevent this embezzlement 1 2 3. 3. 4 5 6.