Answered step by step

Verified Expert Solution

Question

1 Approved Answer

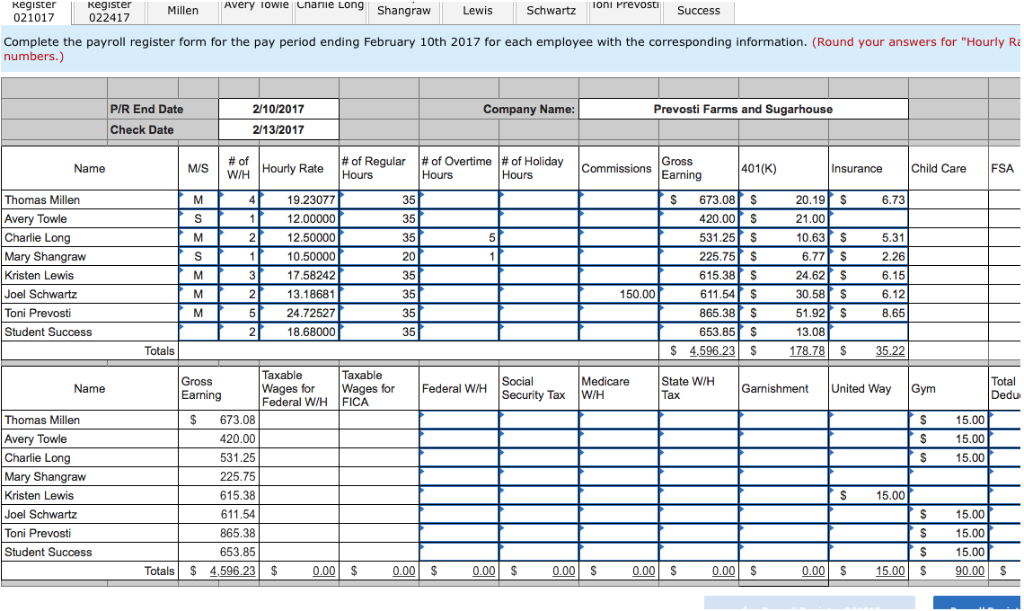

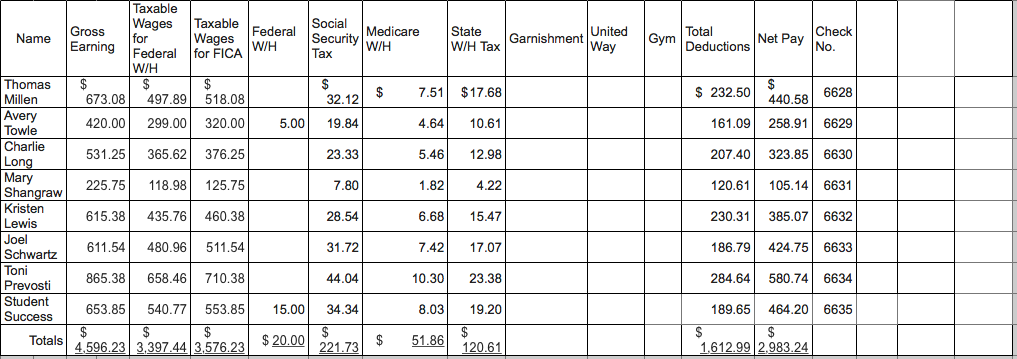

Payroll register for the Prevosti Farms and Sugarhouse February and March biweekly pay periods have been provided to assist you in completing the requirements below.

Payroll register for the Prevosti Farms and Sugarhouse February and March biweekly pay periods have been provided to assist you in completing the requirements below. Required: 1. Using the payroll registers, complete the General Journal entries as follows:

| February | 10 | Journalize the employee pay. | ||

| February | 10 | Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. | ||

| February | 13 | Issue the employee pay. | ||

| February | 24 | Journalize the employee pay. | ||

| February | 24 | Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. | ||

| February | 27 | Issue the employee pay. | ||

| February | 27 | Journalize the payment of the employer payroll tax liability for the February 10 and February 24 payroll periods. | ||

| March | 10 | Journalize employee pay. | ||

| March | 10 | Journalize employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. | ||

| March | 14 | Issue employee pay. | ||

| March | 24 | Journalize employee pay. | ||

| March | 24 | Journalize employer payroll tax for the March 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed FUTA or SUTA wage base. | ||

| March | 28 | Issue employee pay. |

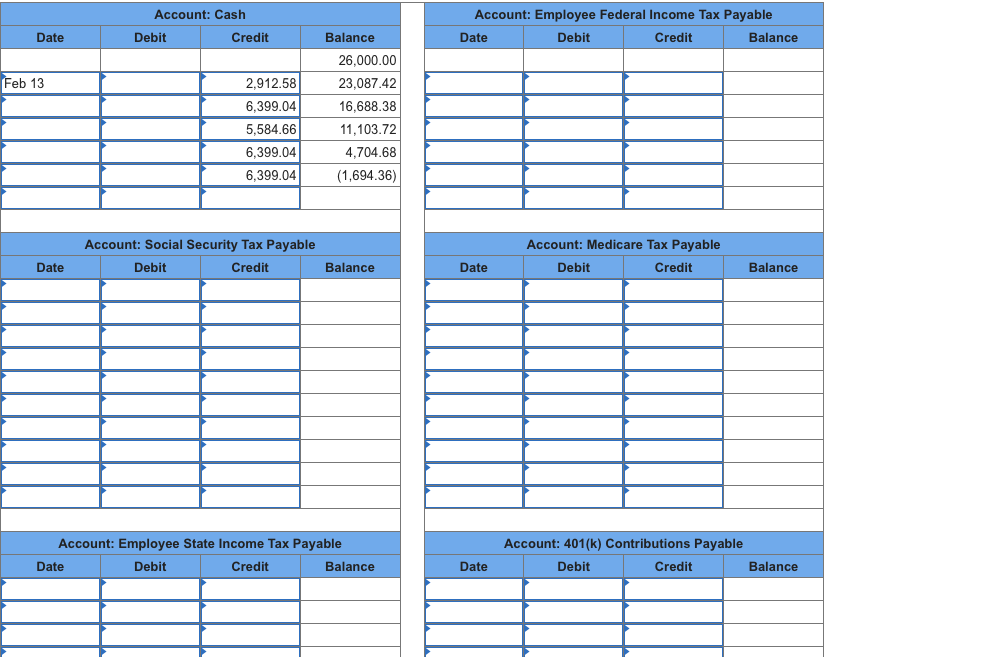

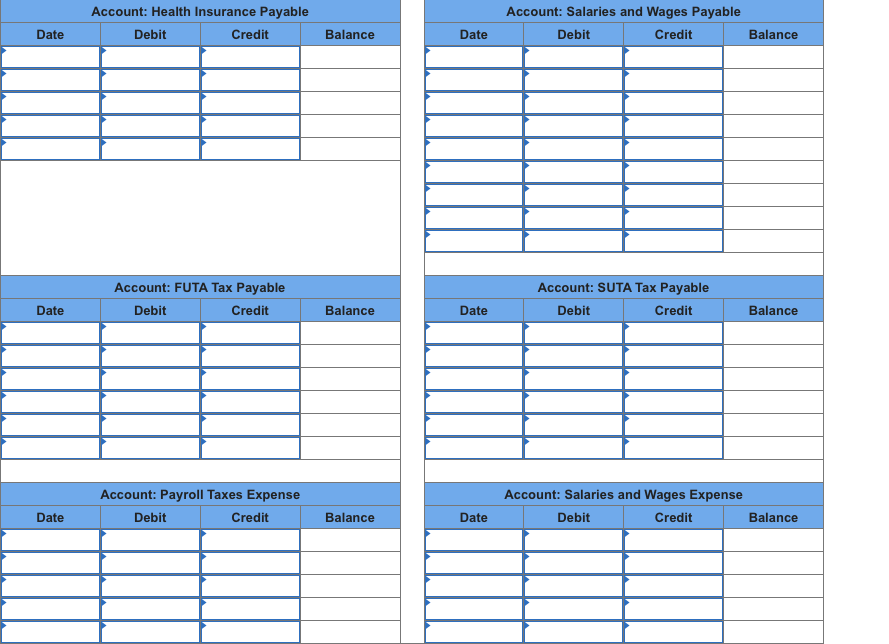

2. Post all journal entries to the appropriate accounts on the General Ledger.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started