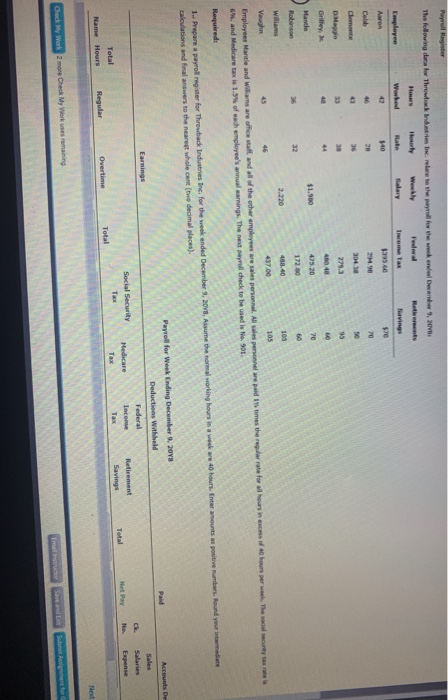

Payroll Register The following dea for Threck Industries Inc. to the payroll for the weekended December 9, 2018 F Keteran Employee Bate Salary Income Tax Havings $40 39540 $ Cobb 46 28 Clemente 4 304 30 Maggio 38 27.3 Griffey, 4 480 40 Manche $1.50 475.20 70 Robinson 1720 Williams 458.40 103 Vaughn 437.00 105 Employees Mantle and Williams are office stall and all of the other employees are sales personnal. All sales personnel are paid 19 times the reparate for all hours in excess of 40 hours per week. The social security taxes 6%, and Medicare taxis 1.5 of each employee's annual earnings. The next payroll check to be used is No.901 Required: 1... Prepare a payrol register for Throwback Industries Inc. for the week ended December 3, 2016. Asume the normal working hours in a www40 hours. En amounts as positivenes. Round your calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December 9, 2018 Deductions withheld PM Accounts De Earnings Federal Incon Social Security Tax Salaries Expense Retirement Savings N Medicare Tas Net Pay Total Tax Total Name Hours Total Overtime Regular Net Ce My Work 2 more Check My Works remaining Sand Sutligen for Payroll Register The following dea for Threck Industries Inc. to the payroll for the weekended December 9, 2018 F Keteran Employee Bate Salary Income Tax Havings $40 39540 $ Cobb 46 28 Clemente 4 304 30 Maggio 38 27.3 Griffey, 4 480 40 Manche $1.50 475.20 70 Robinson 1720 Williams 458.40 103 Vaughn 437.00 105 Employees Mantle and Williams are office stall and all of the other employees are sales personnal. All sales personnel are paid 19 times the reparate for all hours in excess of 40 hours per week. The social security taxes 6%, and Medicare taxis 1.5 of each employee's annual earnings. The next payroll check to be used is No.901 Required: 1... Prepare a payrol register for Throwback Industries Inc. for the week ended December 3, 2016. Asume the normal working hours in a www40 hours. En amounts as positivenes. Round your calculations and final answers to the nearest whole cent (two decimal places). Payroll for Week Ending December 9, 2018 Deductions withheld PM Accounts De Earnings Federal Incon Social Security Tax Salaries Expense Retirement Savings N Medicare Tas Net Pay Total Tax Total Name Hours Total Overtime Regular Net Ce My Work 2 more Check My Works remaining Sand Sutligen for