Answered step by step

Verified Expert Solution

Question

1 Approved Answer

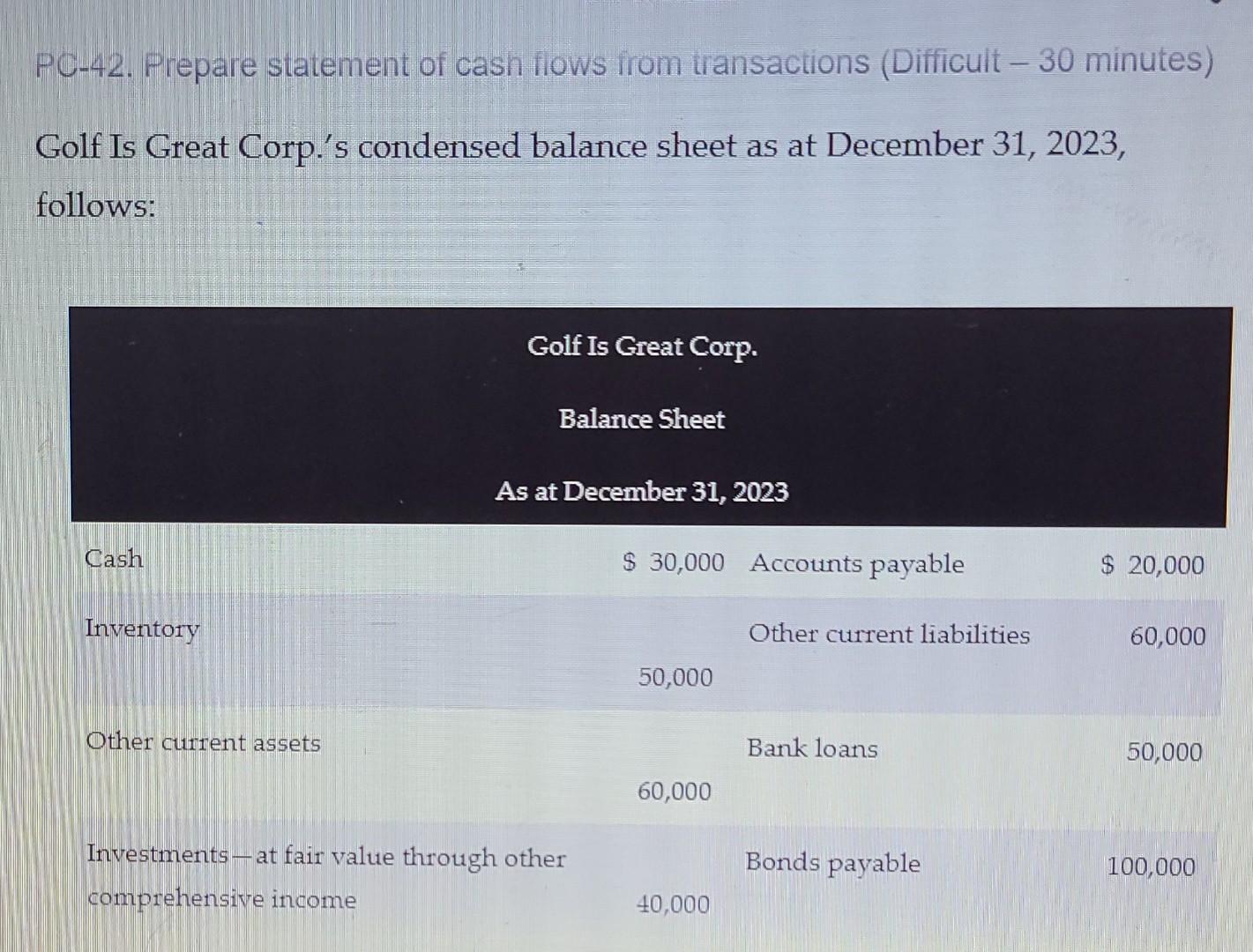

PC-42. Prepare statement of cash flows from transactions (Difficult 30 minutes) Golf Is Great Corp.'s condensed balance sheet as at December 31, 2023, follows: Golf

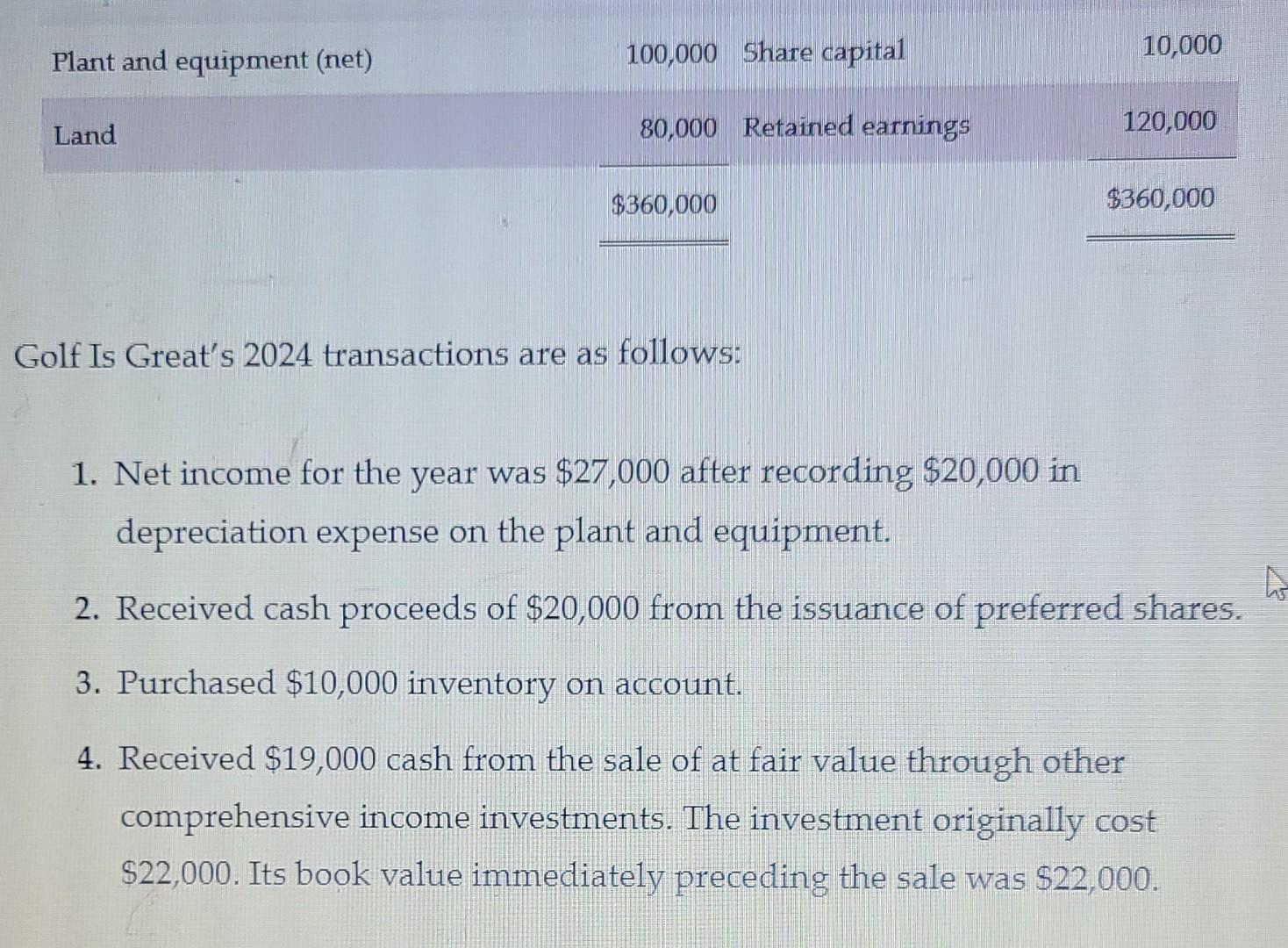

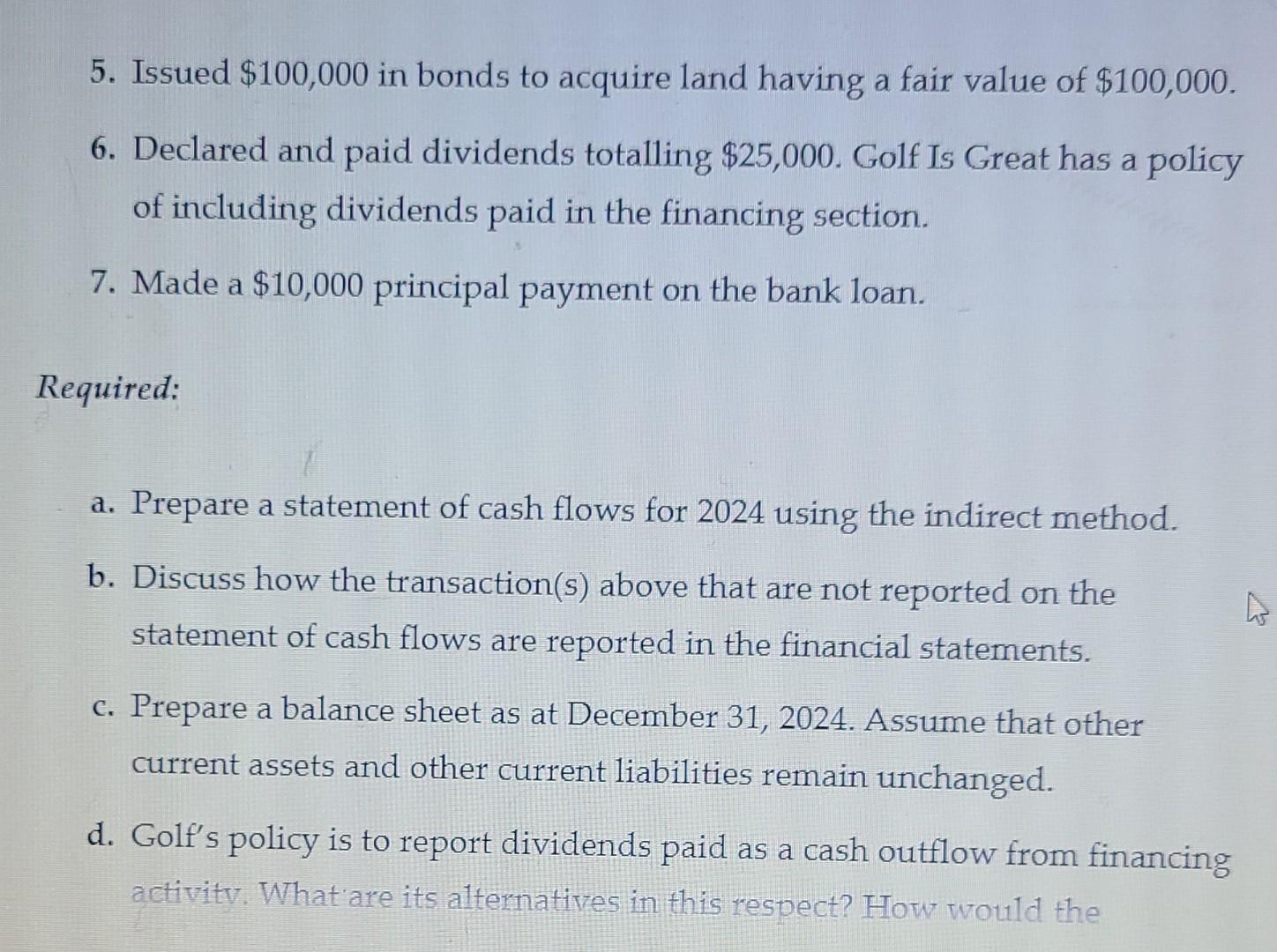

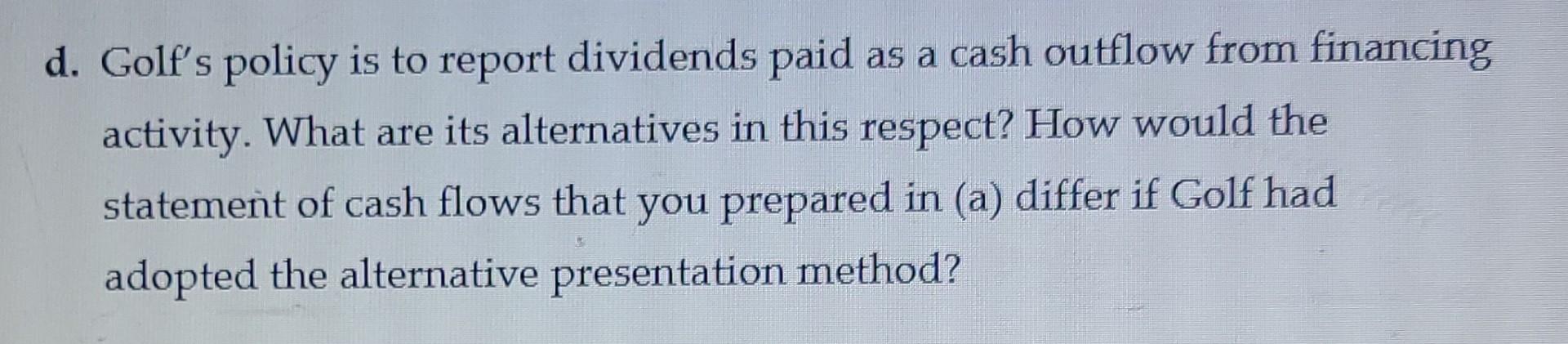

PC-42. Prepare statement of cash flows from transactions (Difficult 30 minutes) Golf Is Great Corp.'s condensed balance sheet as at December 31, 2023, follows: Golf Is Great's 2024 transactions are as follows: 1. Net income for the year was $27,000 after recording $20,000 in depreciation expense on the plant and equipment. 2. Received cash proceeds of $20,000 from the issuance of preferred shares. 3. Purchased $10,000 inventory on account. 4. Received $19,000 cash from the sale of at fair value through other comprehensive income investments. The investment originally cost $22,000. Its book value immediately preceding the sale was $22,000. 5. Issued $100,000 in bonds to acquire land having a fair value of $100,000. 6. Declared and paid dividends totalling $25,000. Golf Is Great has a policy of including dividends paid in the financing section. 7. Made a $10,000 principal payment on the bank loan. Required: a. Prepare a statement of cash flows for 2024 using the indirect method. b. Discuss how the transaction(s) above that are not reported on the statement of cash flows are reported in the financial statements. c. Prepare a balance sheet as at December 31, 2024. Assume that other current assets and other current liabilities remain unchanged. d. Golf's policy is to report dividends paid as a cash outflow from financing activity. What are its alternatives in this respect? How would the d. Golf's policy is to report dividends paid as a cash outflow from financing activity. What are its alternatives in this respect? How would the statement of cash flows that you prepared in (a) differ if Golf had adopted the alternative presentation method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started