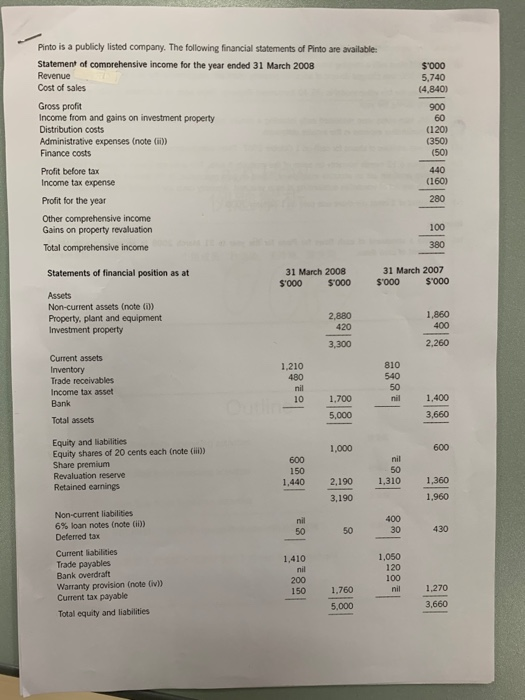

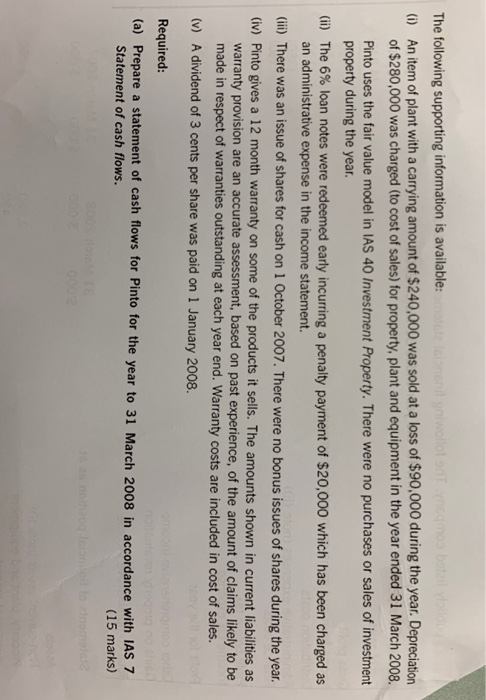

Pinto is a publicly listed company. The following financial statements of Pinto are available Statement of comorehensive income for the year ended 31 March 2008 $000 Revenue 5,740 (4,840) Cost of sales Gross profit Income from and gains on investment property 900 60 Distribution costs (120) (350) (50) Administrative expenses (note (il) Finance costs 440 (160) Profit before tax Income tax expense 280 Profit for the year Other comprehensive income Gains on property revaluation 100 380 Total comprehensive income 31 March 2007 31 March 2008 $'000 Statements of financial position as at $000 $000 $000 Assets Non-current assets (note (i) 1,860 400 2,880 420 Property, plant and equipment Investment property 2,260 3,300 Current assets 810 1,210 480 Inventory Trade receivables 540 50 nil Income tax asset 1,400 1,700 nil 10 Outln Bank 3,660 5,000 Total assets Equity and liabilities Equity shares of 20 cents each (note (ili) Share premium 600 1,000 nil 600 50 150 Revaluation reserve 1,310 1,360 1,440 2,190 Retained earnings 1,960 3,190 Non-current liabilities 6% loan notes (note (ii) Deferred tax 400 nil 430 30 50 50 Current liabilities Trade payables Bank overdraft Warranty provision (note (iv) Current tax payable 1,050 120 1,410 nil 100 200 1,270 1,760 nil 150 3,660 5,000 Total equity and liabilities 8 The following supporting information is available: snnt gniwollot T nmos botil v (i) An item of plant with a carrying amount of $240,000 was sold at a loss of $90,000 during the year. Depreciation of $280,000 was charged (to cost of sales) for property, plant and equipment in the year ended 31 March 2008. Pinto uses the fair value model in IAS 40 Investment Property. There were no purchases or sales of investment property during the year. (ii) The 6% loan notes were redeemed early incurring a penalty payment of $20,000 which has been charged as an administrative expense in the income statement. (ii) There was an issue of shares for cash on 1 October 2007. There were no bonus issues of shares during the year. (iv) Pinto gives a 12 month warranty on some of the products it sells. The amounts shown in current liabilities as warranty provision are an accurate assessment, based on past experience, of the amount of claims likely to be made in respect of warranties outstanding at each year end. Warranty costs are included in cost of sales. (v) A dividend of 3 cents per share was paid on 1 January 2008. Required: (a) Prepare a statement of cash flows for Pinto for the year to 31 March 2008 in accordance with IAS 7 Statement of cash flows. (15 marks) 1e 2 noiiaoq foant to nem