Question

PCGelco Manufacturing produces and sells oil filters for $ 3.35 each. A retailer has offered to purchase 25,000 oil filters for $ 1.40 per filter.

PCGelco Manufacturing produces and sells oil filters for $ 3.35 each. A retailer has offered to purchase 25,000 oil filters for $ 1.40 per filter. Of the total manufacturing cost per filter of $ 1.95, $ 1.35 is the variable manufacturing cost per filter. For this special order, PCGelco would have to buy a special stamping machine that costs $ 7,500 to mark the customer's logo on the special-order oil filters. The machine would be scrapped when the special order is complete. This special order would use manufacturing capacity that would otherwise be idle. No variable nonmanufacturing costs would be incurred by the special order. Regular sales would not be affected by the special order. Would you recommend that PCGelco accept the special order under these conditions?

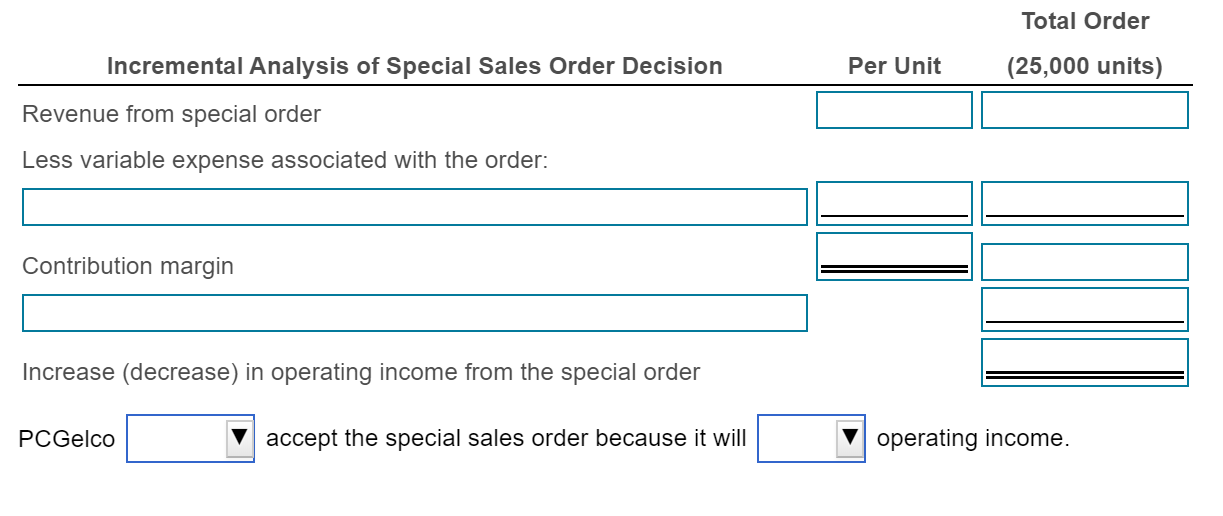

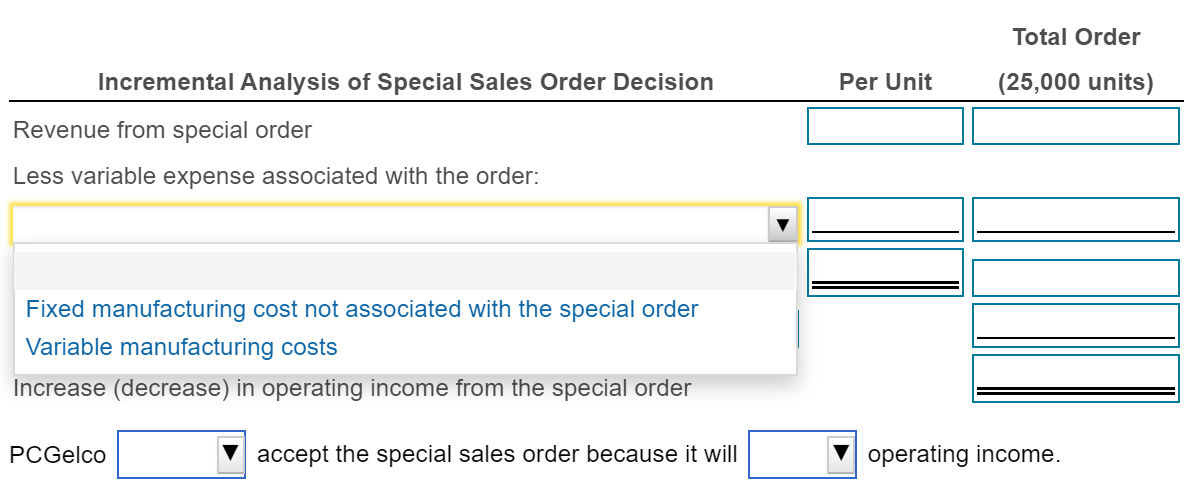

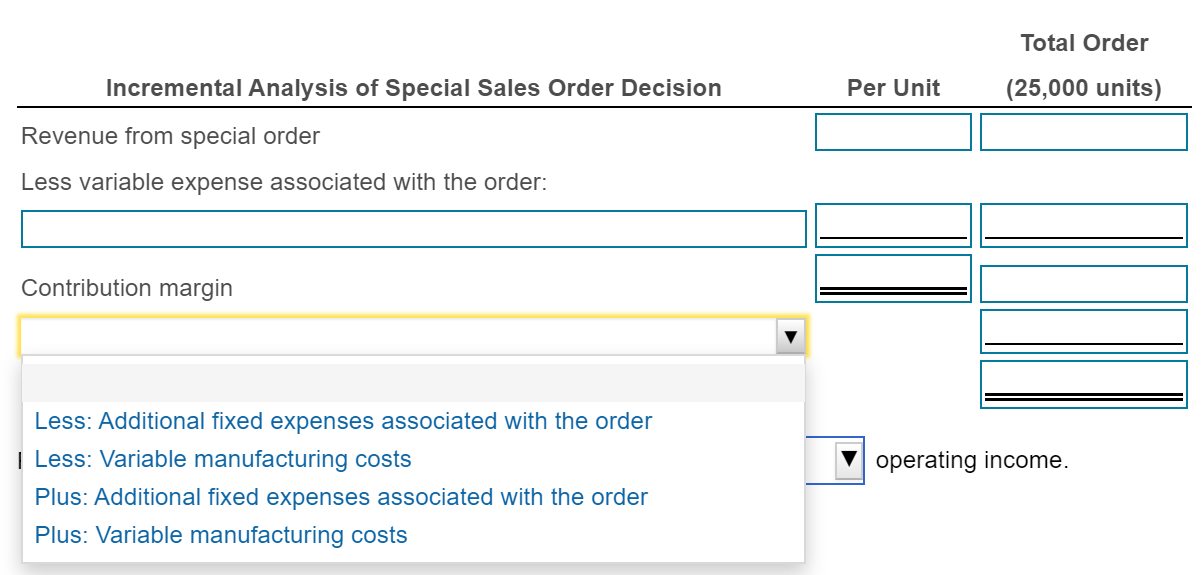

Complete the following incremental analysis to help you make your recommendation. (Use parentheses or a minus sign to indicate a decrease in operating income from the special order.)

Total Order (25,000 units) Incremental Analysis of Special Sales Order Decision Per Unit Revenue from special order Less variable expense associated with the order: Contribution margin Increase (decrease) in operating income from the special order PCGelco accept the special sales order because it will operating income. Total Order (25,000 units) Incremental Analysis of Special Sales Order Decision Per Unit Revenue from special order Less variable expense associated with the order: Fixed manufacturing cost not associated with the special order Variable manufacturing costs Increase (decrease) in operating income from the special order PCGelco accept the special sales order because it will operating income. Total Order (25,000 units) Incremental Analysis of Special Sales Order Decision Per Unit Revenue from special order Less variable expense associated with the order: Contribution margin operating income. Less: Additional fixed expenses associated with the order Less: Variable manufacturing costs Plus: Additional fixed expenses associated with the order Plus: Variable manufacturing costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started