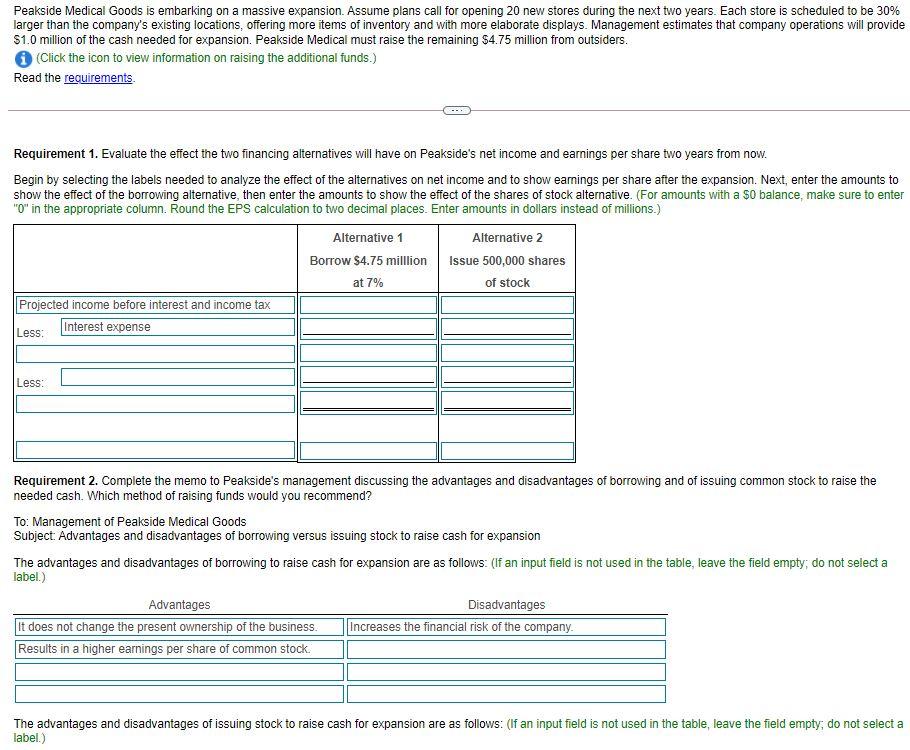

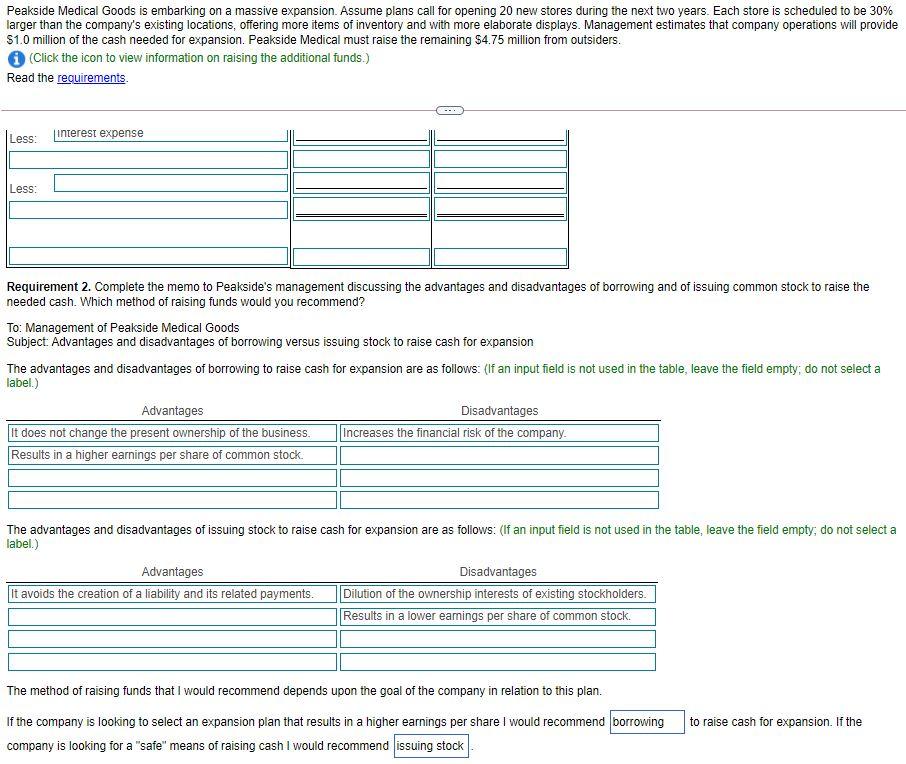

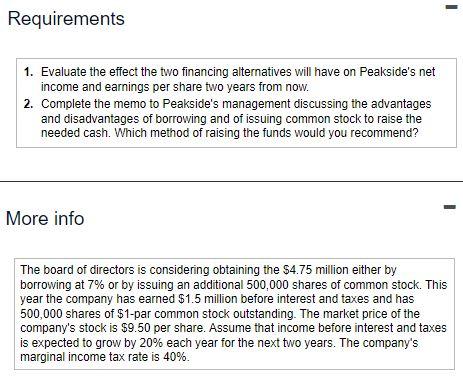

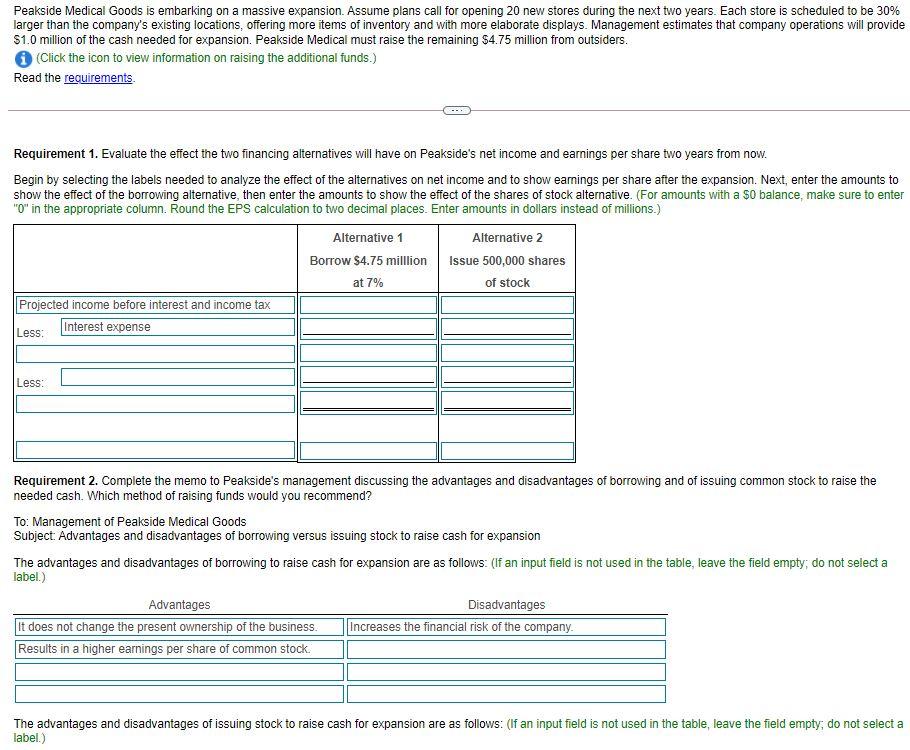

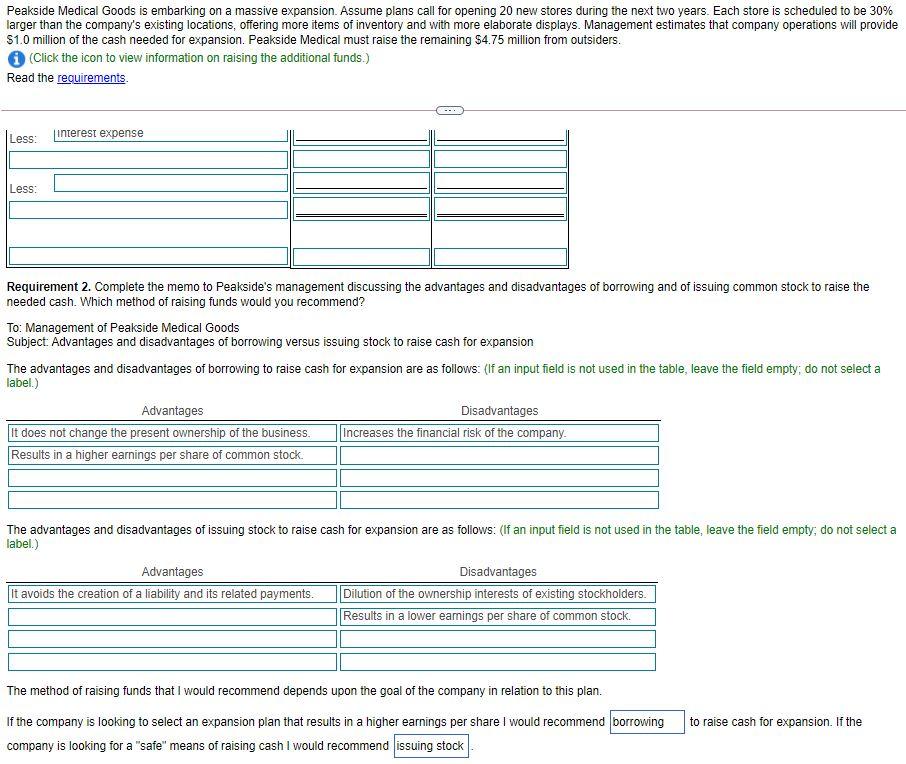

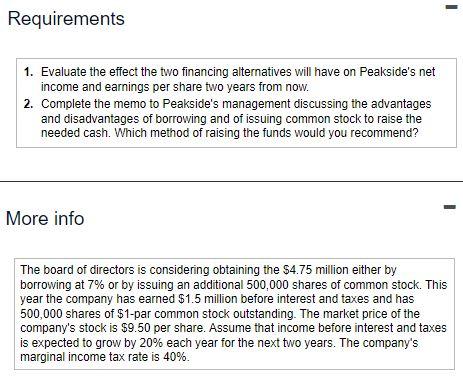

Peakside Medical Goods is embarking on a massive expansion. Assume plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company's existing locations, offering more items of inventory and with more elaborate displays. Management estimates that company operations will provide $1.0 million of the cash needed for expansion. Peakside Medical must raise the remaining $4.75 million from outsiders. Click the icon to view information on raising the additional funds.) Read the requirements. Requirement 1. Evaluate the effect the two financing alternatives will have on Peakside's net income and earnings per share two years from now. Begin by selecting the labels needed to analyze the effect of the alternatives on net income and to show earnings per share after the expansion. Next, enter the amounts to show the effect of the borrowing alternative, then enter the amounts to show the effect of the shares of stock alternative. (For amounts with a $0 balance, make sure to enter "O" in the appropriate column. Round the EPS calculation to two decimal places. Enter amounts in dollars instead of millions.) Alternative 1 Alternative 2 Borrow $4.75 milllion Issue 500,000 shares at 7% of stock Projected income before interest and income tax Interest expense Less: Less: Requirement 2. Complete the memo to Peakside's management discussing the advantages and disadvantages of borrowing and of issuing common stock to raise the needed cash. Which method of raising funds would you recommend? To: Management of Peakside Medical Goods Subject: Advantages and disadvantages of borrowing versus issuing stock to raise cash for expansion The advantages and disadvantages of borrowing to raise cash for expansion are as follows: (If an input field is not used in the table, leave the field empty, do not select a label.) Advantages Disadvantages It does not change the present ownership of the business. Increases the financial risk of the company. Results in a higher earnings per share of common stock The advantages and disadvantages of issuing stock to raise cash for expansion are as follows: (If an input field is not used in the table, leave the field empty, do not select a label.) Peakside Medical Goods is embarking on a massive expansion. Assume plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the company's existing locations, offering more items of inventory and with more elaborate displays. Management estimates that company operations will provide $1.0 million of the cash needed for expansion. Peakside Medical must raise the remaining $4.75 million from outsiders. (Click the icon to view information on raising the additional funds.) Read the requirements Less: Interest expense Less: Requirement 2. Complete the memo to Peakside's management discussing the advantages and disadvantages of borrowing and of issuing common stock to raise the needed cash. Which method of raising funds would you recommend? To: Management of Peakside Medical Goods Subject: Advantages and disadvantages of borrowing versus issuing stock to raise cash for expansion The advantages and disadvantages of borrowing to raise cash for expansion are as follows: (If an input field is not used in the table, leave the field empty, do not select a label.) Advantages Disadvantages It does not change the present ownership of the business. Increases the financial risk of the company. Results in a higher earnings per share of common stock The advantages and disadvantages of issuing stock to raise cash for expansion are as follows: (If an input field is not used in the table, leave the field empty, do not select a label.) Advantages It avoids the creation of a liability and its related payments. Disadvantages Dilution of the ownership interests of existing stockholders. Results in a lower earings per share of common stock. The method of raising funds that I would recommend depends upon the goal of the company in relation to this plan. If the company is looking to select an expansion plan that results in a higher earnings per share I would recommend borrowing company is looking for a "safe" means of raising cash I would recommend issuing stock to raise cash for expansion. If the Requirements 1. Evaluate the effect the two financing alternatives will have on Peakside's net income and earnings per share two years from now. 2. Complete the memo to Peakside's management discussing the advantages and disadvantages of borrowing and of issuing common stock to raise the needed cash. Which method of raising the funds would you recommend? More info The board of directors is considering obtaining the $4.75 million either by borrowing at 7% or by issuing an additional 500,000 shares of common stock. This year the company has earned $1.5 million before interest and taxes and has 500,000 shares of $1-par common stock outstanding. The market price of the company's stock is $9.50 per share. Assume that income before interest and taxes is expected to grow by 20% each year for the next two years. The company's marginal income tax rate is 40%