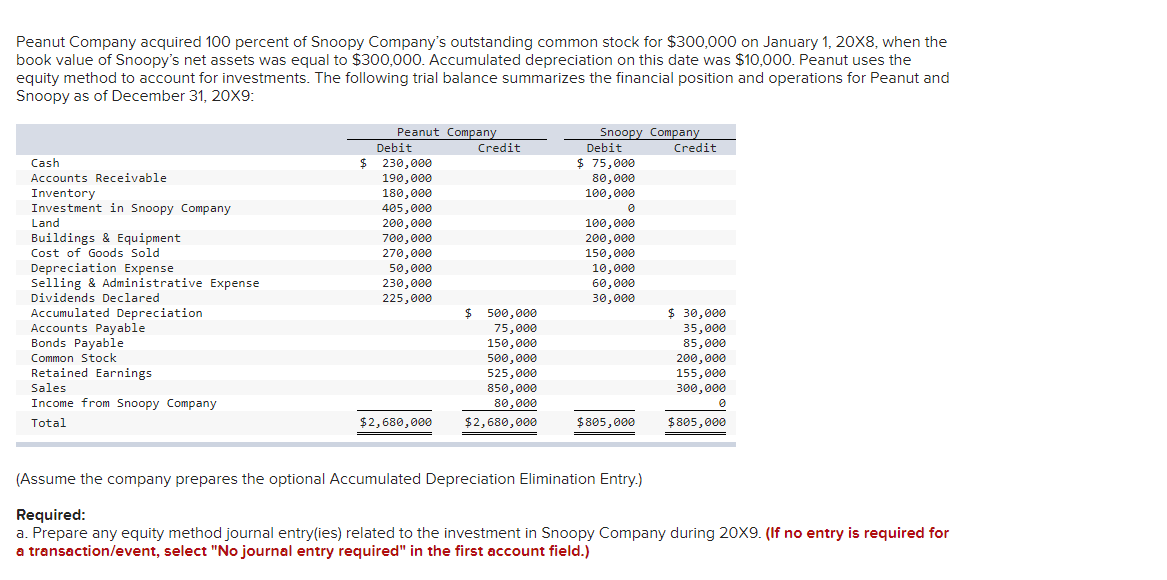

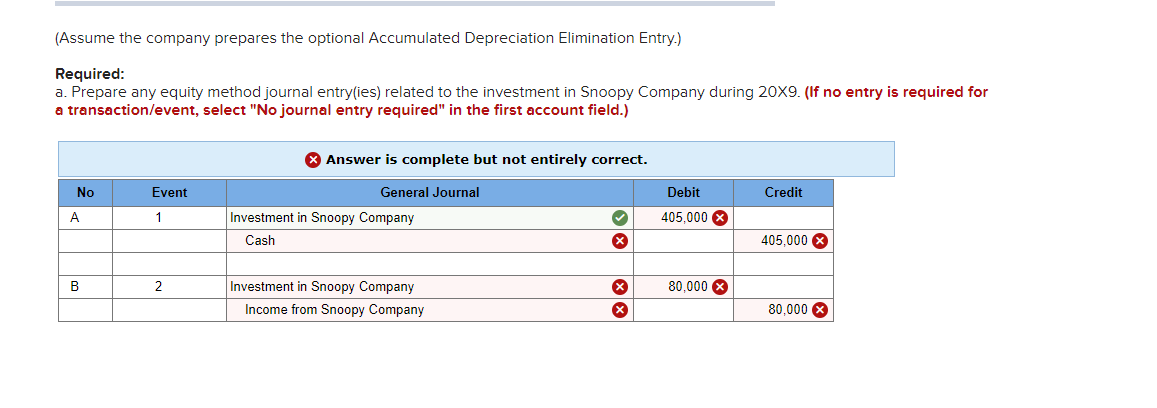

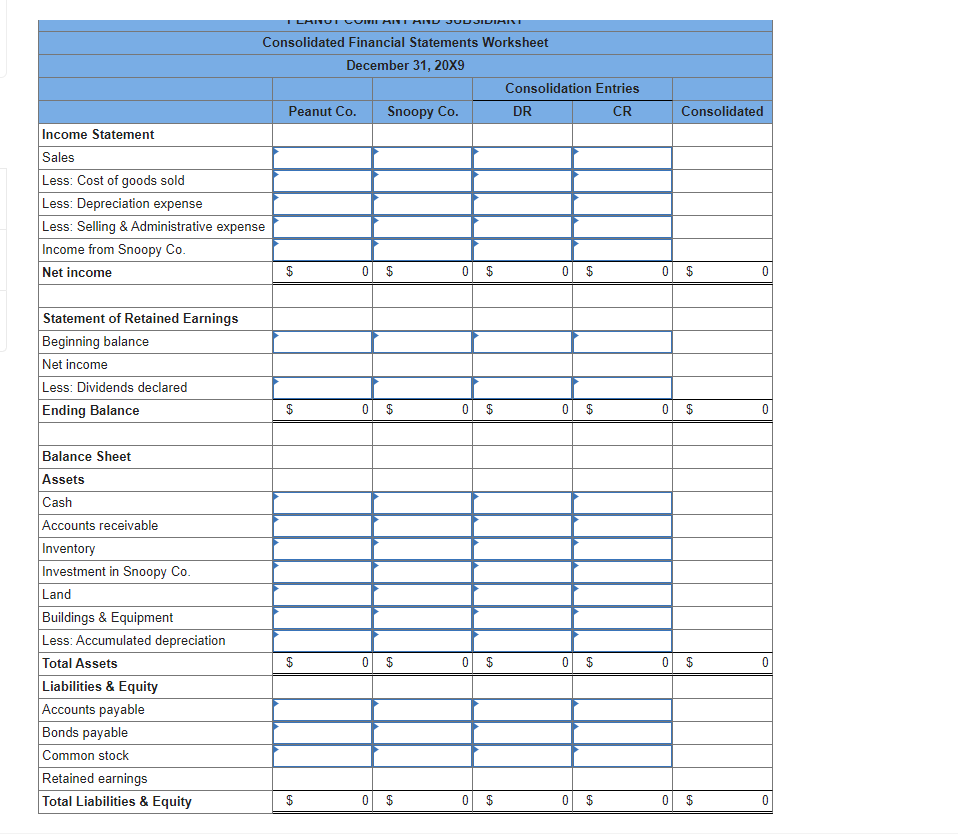

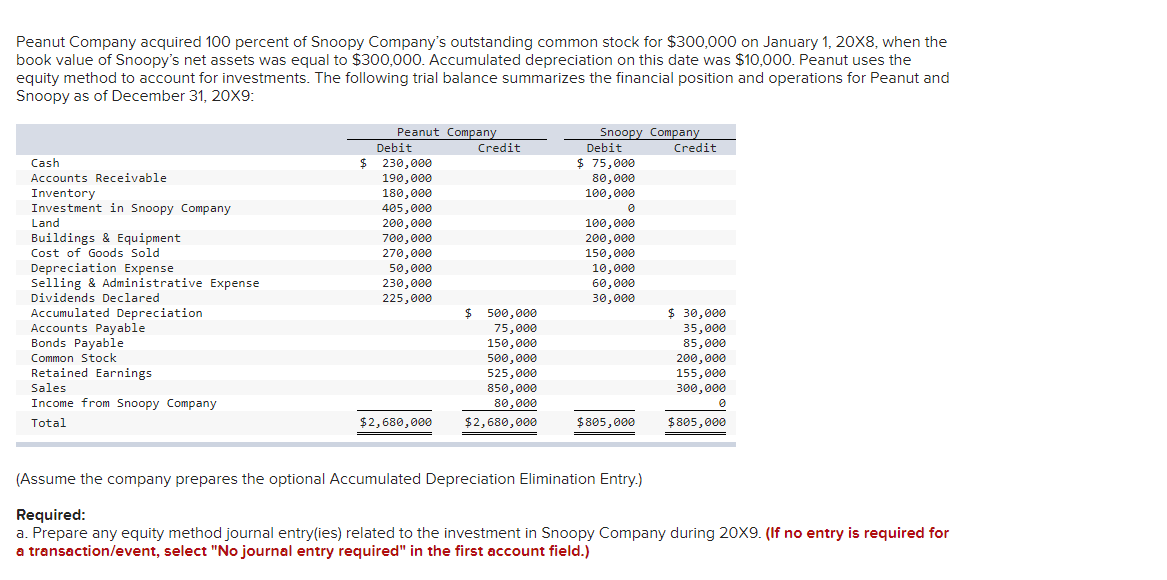

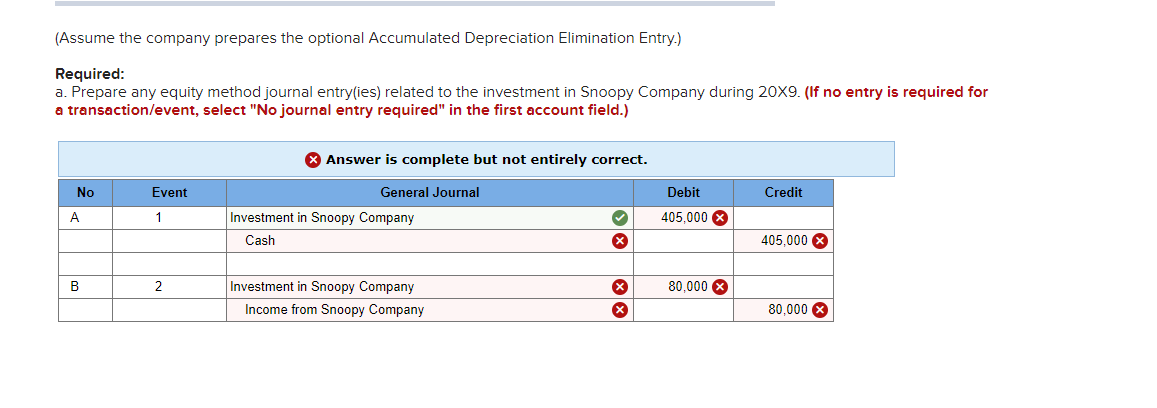

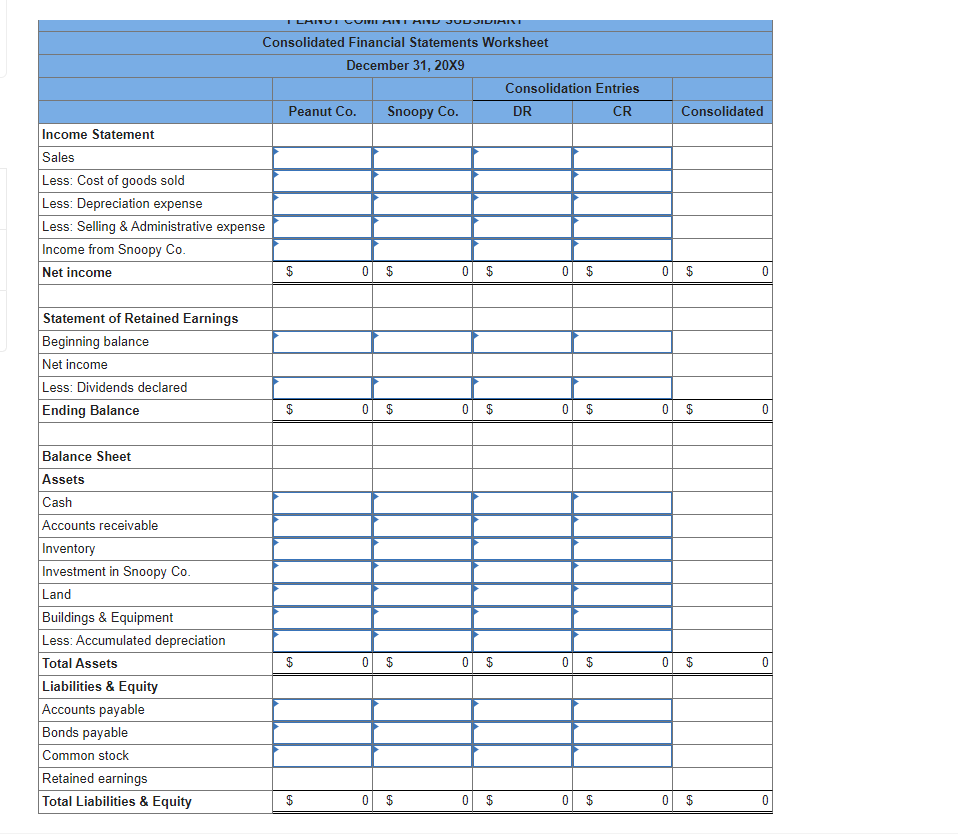

Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $300,000. Accumulated depreciation on this date was $10,000. Peanut uses the equity method to account for investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Snoopy Company Debit Credit $ 75,000 80,000 100,000 Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings & Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit Credit $ 230,000 190,000 180,000 405,000 200,000 700,000 270,000 50,000 230,000 225,000 $ 500,000 75,000 150,000 500,000 525,000 850,000 80,000 $2,680,000 $2,680,000 100,000 200,000 150,000 10,000 60,000 30,000 $ 30,000 35,000 85,000 200,000 155,000 300,000 $805,000 $805,000 (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required: a. Prepare any equity method journal entry(ies) related to the investment in Snoopy Company during 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required: a. Prepare any equity method journal entry(ies) related to the investment in Snoopy Company during 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Event Credit Debit 405,000 X General Journal Investment in Snoopy Company Cash 1 X 405,000 B 2 80,000 X Investment in Snoopy Company Income from Snoopy Company X x 80,000 ILMITUT LUI RI RIV JUDJIVIMIVE Consolidated Consolidated Financial Statements Worksheet December 31, 20X9 Consolidation Entries Peanut Co. Snoopy Co. DR CR Income Statement Sales Less: Cost of goods sold Less: Depreciation expense Less: Selling & Administrative expense Income from Snoopy Co. Net income $ 0 $ 0 $ 0 $ 0 $ 0 Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance 0 $ 0 $ 0 0 $ 0 Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land Buildings & Equipment Less: Accumulated depreciation Total Assets Liabilities & Equity Accounts payable Bonds payable Common stock Retained earnings Total Liabilities & Equity $ 0 $ 0 0 $ 0 $ 0 HA 0 $ 0 $ 0 $ 0 $ 0