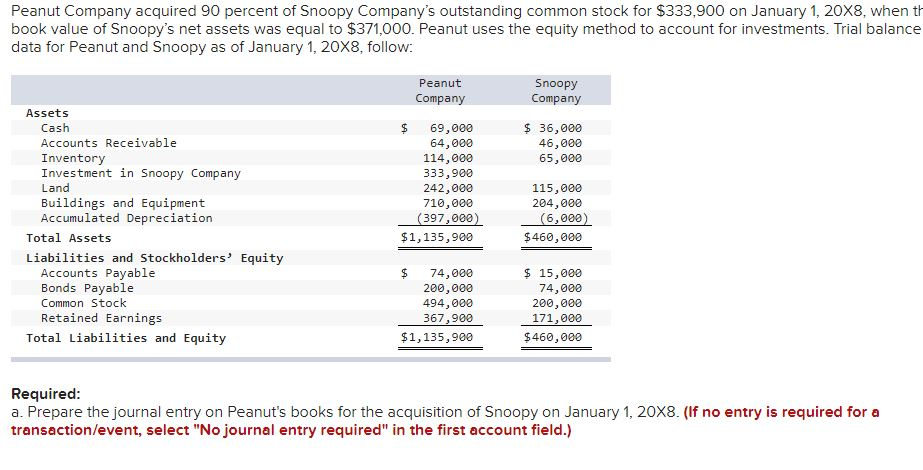

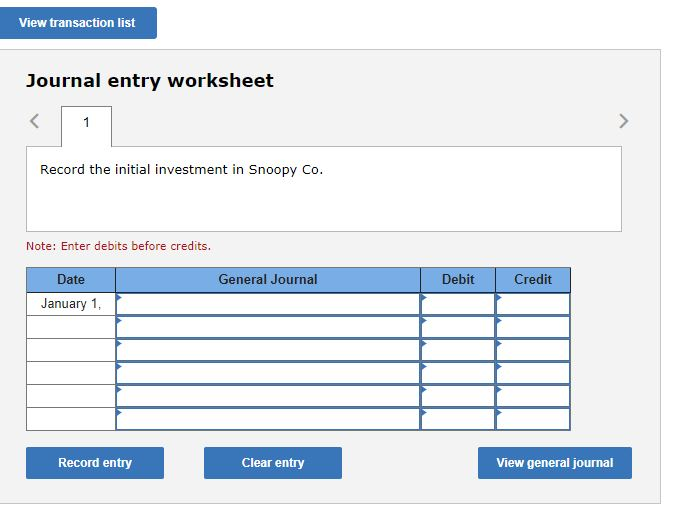

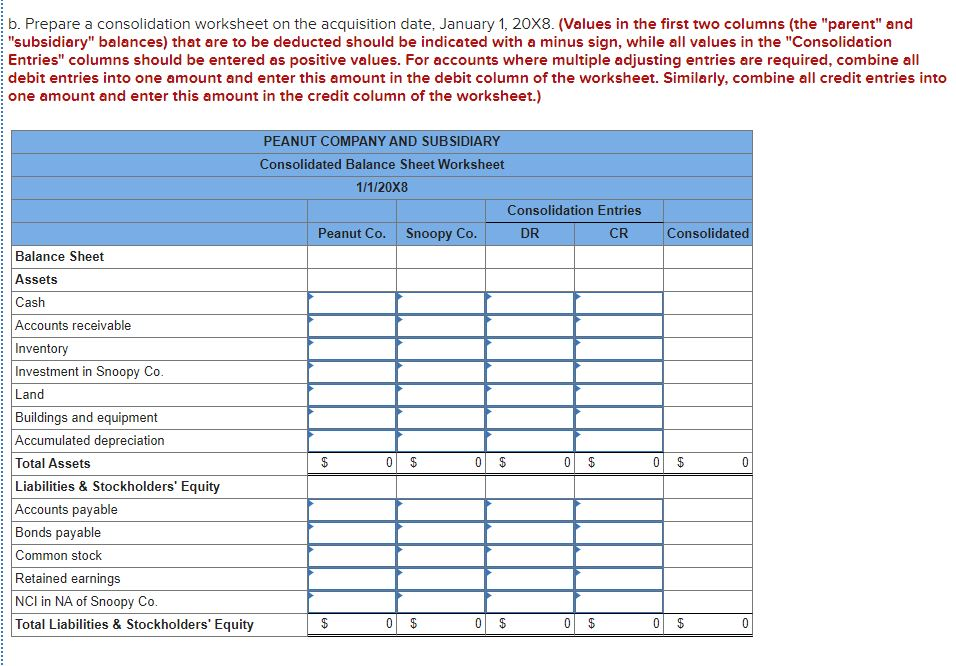

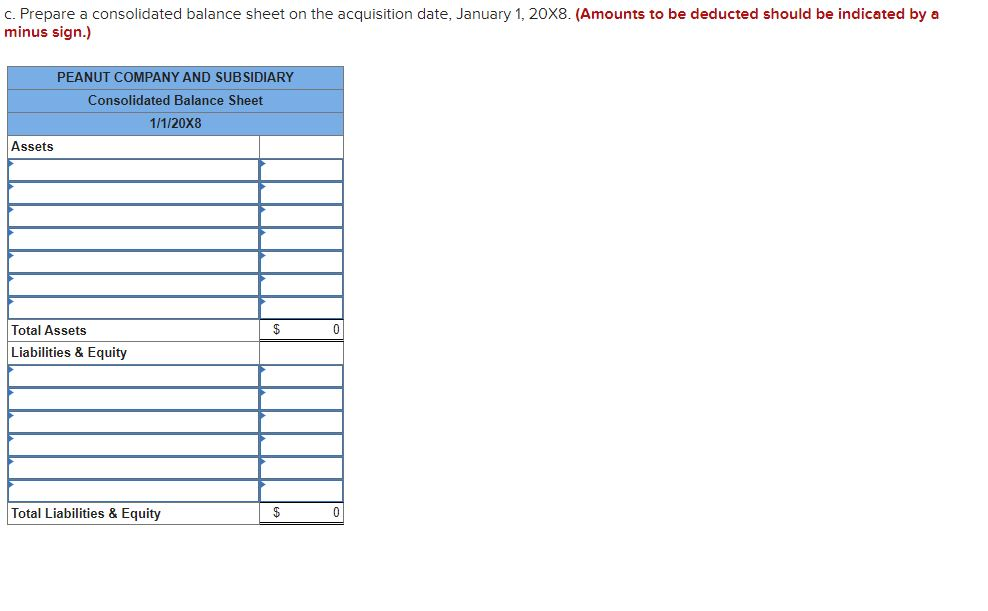

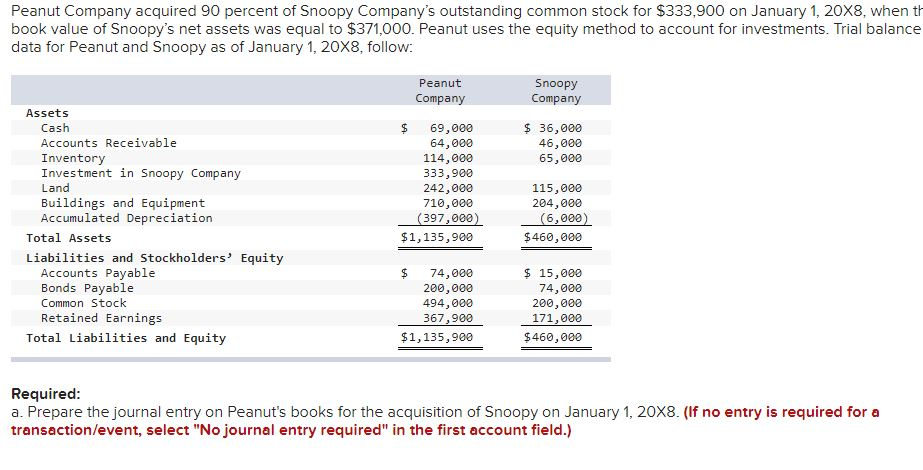

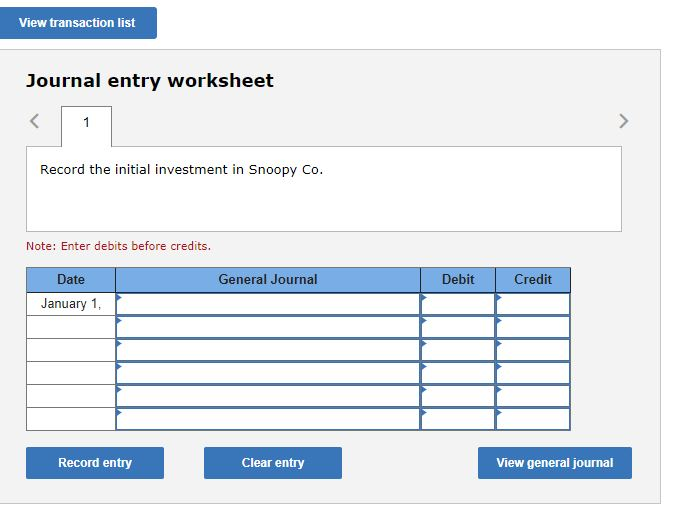

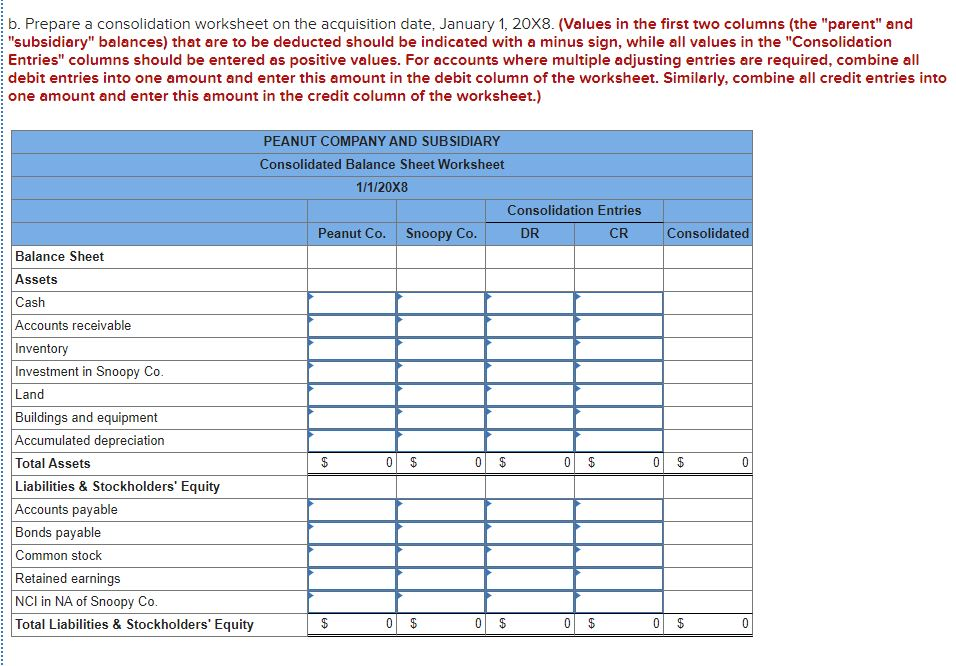

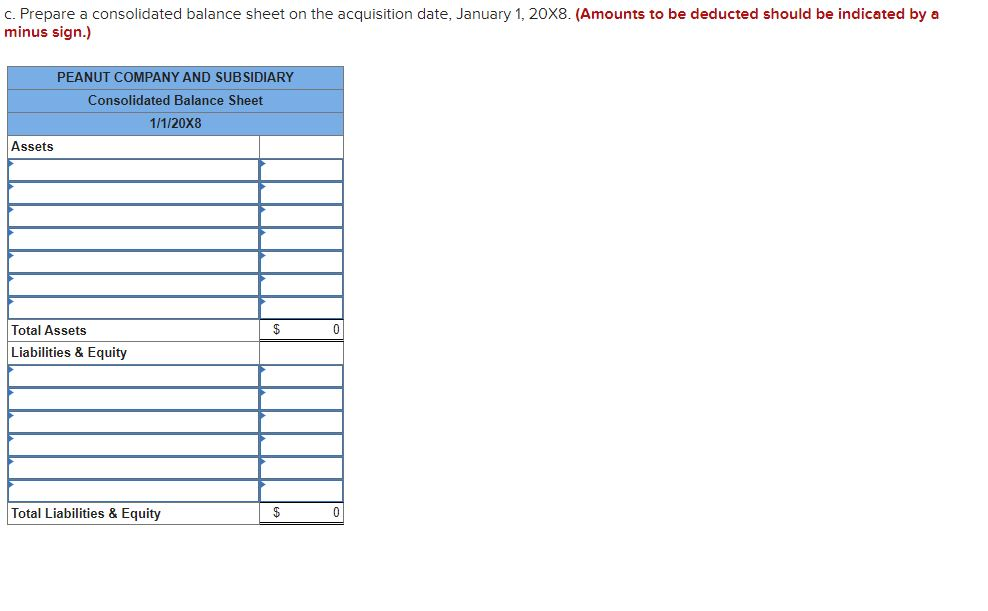

Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $333,900 on January 1, 20X8, when th book value of Snoopy's net assets was equal to $371,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of January 1, 20X8, follow: Peanut Company Snoopy Company $ 36,000 46,000 65,000 Assets Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Accumulated Depreciation Total Assets Liabilities and Stockholders' Equity Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Equity 69,000 64,000 114,000 333,900 242,000 710,000 (397,000) $1,135,900 115,000 204,000 (6,000) $ 460,000 $ 74,000 200,000 494,000 367,900 $1,135,900 $ 15,000 74,000 200,000 171,000 $460,000 Required: a. Prepare the journal entry on Peanut's books for the acquisition of Snoopy on January 1, 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the initial investment in Snoopy Co. Note: Enter debits before credits. General Journal Debit Credit Date January 1, Record entry Clear entry View general journal b. Prepare a consolidation worksheet on the acquisition date, January 1, 20X8. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) Consolidated PEANUT COMPANY AND SUBSIDIARY Consolidated Balance Sheet Worksheet 1/1/20X8 Consolidation Entries Peanut Co. Snoopy Co. DR CR Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land Buildings and equipment Accumulated depreciation Total Assets 0 $ $ 0 $ Liabilities & Stockholders' Equity Accounts payable Bonds payable Common stock Retained earnings NCI in NA of Snoopy Co. Total Liabilities & Stockholders' Equity 0 0 $ 0 0 $ 0 $ 0 $ HA 0 $ 0 c. Prepare a consolidated balance sheet on the acquisition date, January 1, 20X8. (Amounts to be deducted should be indicated by a minus sign.) PEANUT COMPANY AND SUBSIDIARY Consolidated Balance Sheet 1/1/20X8 Assets $ Total Assets Liabilities & Equity Total Liabilities & Equity $ 0