Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pear Inc has an equity beta of 2. The expected market return is 20%, and the risk free rate ids 5%. the firm is financed

Pear Inc has an equity beta of 2. The expected market return is 20%, and the risk free rate ids 5%. the firm is financed half through equity and half through debt. assume perfect capital markets.

the firm is 50/50 structure, 1/2 debt, 1/2 equity

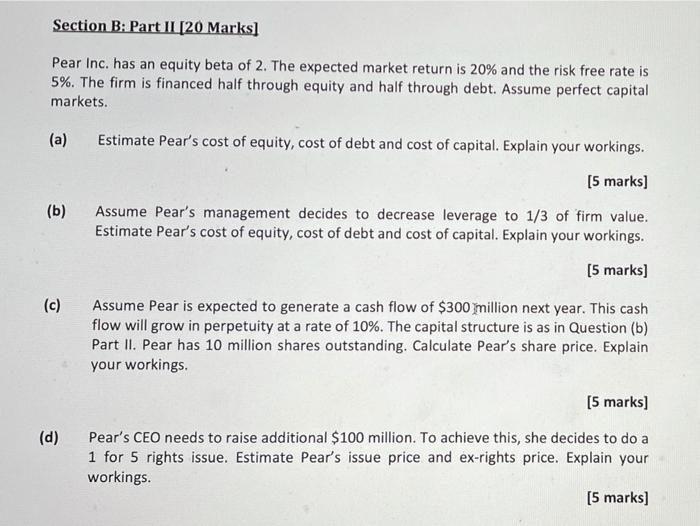

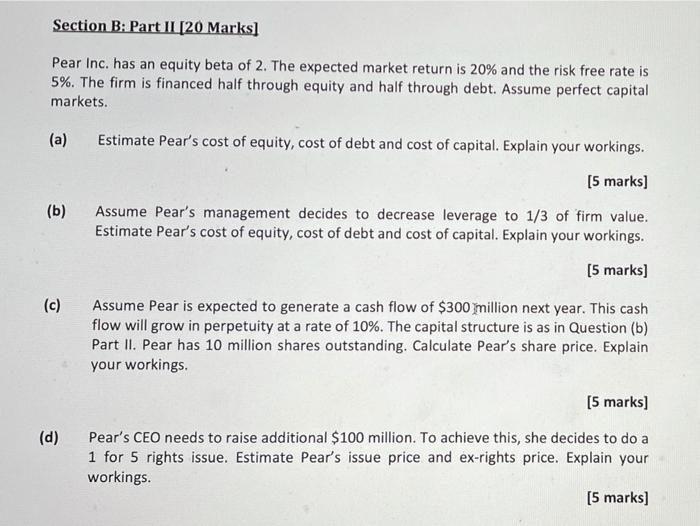

Section B: Part II [20 Marks] Pear Inc. has an equity beta of 2. The expected market return is 20% and the risk free rate is 5%. The firm is financed half through equity and half through debt. Assume perfect capital markets. (a) Estimate Pear's cost of equity, cost of debt and cost of capital. Explain your workings. [5 marks] Assume Pear's management decides to decrease leverage to 1/3 of firm value. Estimate Pear's cost of equity, cost of debt and cost of capital. Explain your workings. (5 marks] (b) (c) Assume Pear is expected to generate a cash flow of $300 million next year. This cash flow will grow in perpetuity at a rate of 10%. The capital structure is as in Question (b) Part II. Pear has 10 million shares outstanding. Calculate Pear's share price. Explain your workings. [5 marks] Pear's CEO needs to raise additional $100 million. To achieve this, she decides to do a 1 for 5 rights issue. Estimate Pear's issue price and ex-rights price. Explain your workings. [5 marks] (d) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started