Answered step by step

Verified Expert Solution

Question

1 Approved Answer

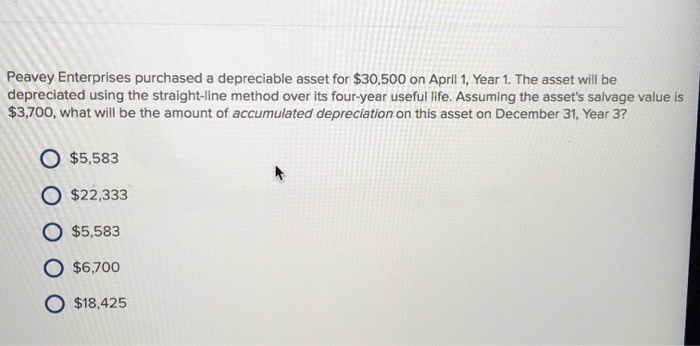

Peavey Enterprises purchased a depreciable asset for $30,500 on April 1, Year 1. The asset will be depreciated using the straight-line method over its four-year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started