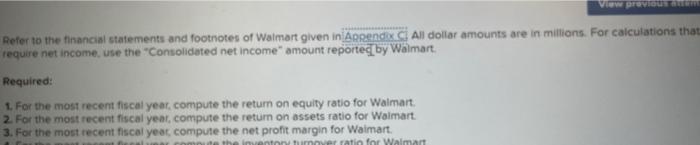

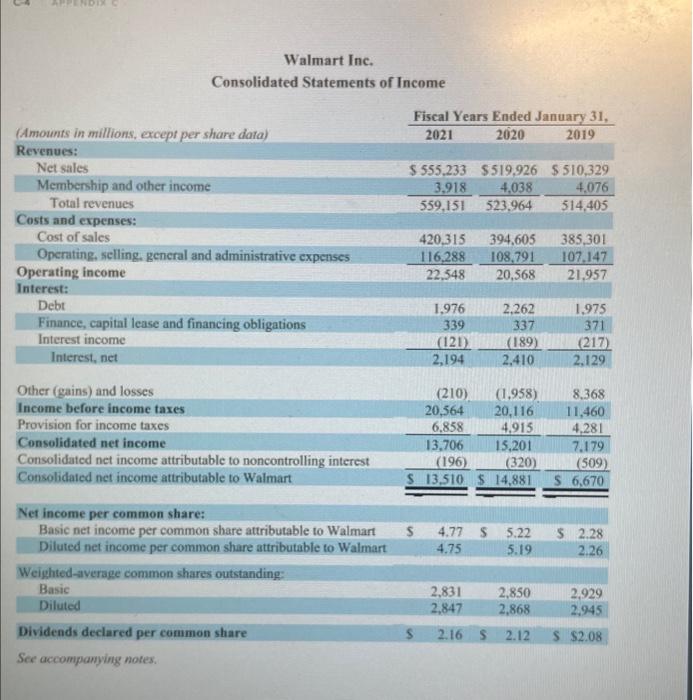

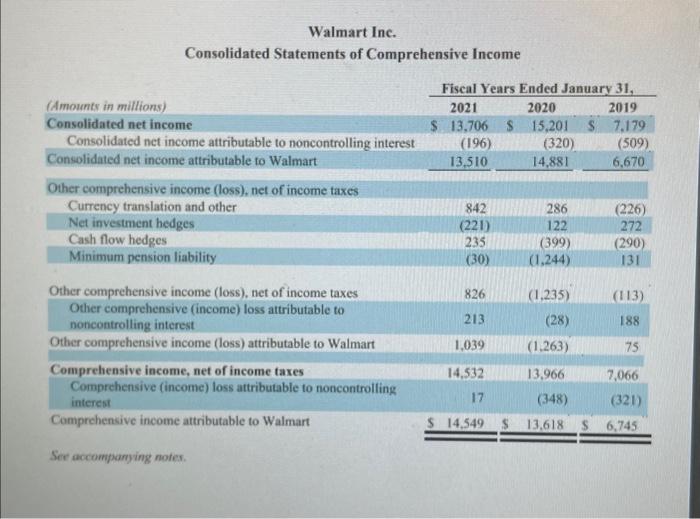

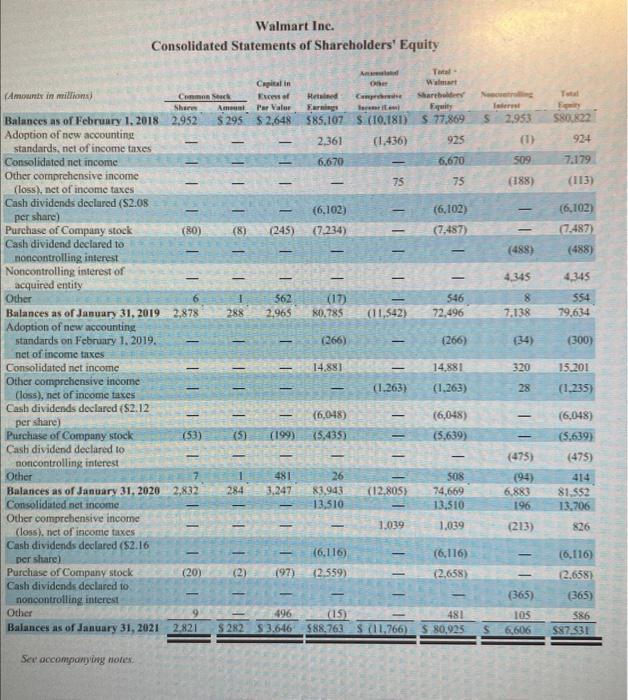

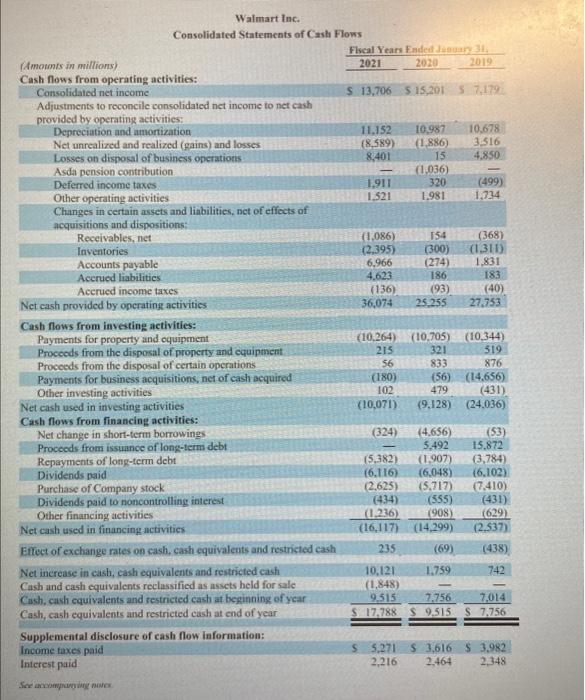

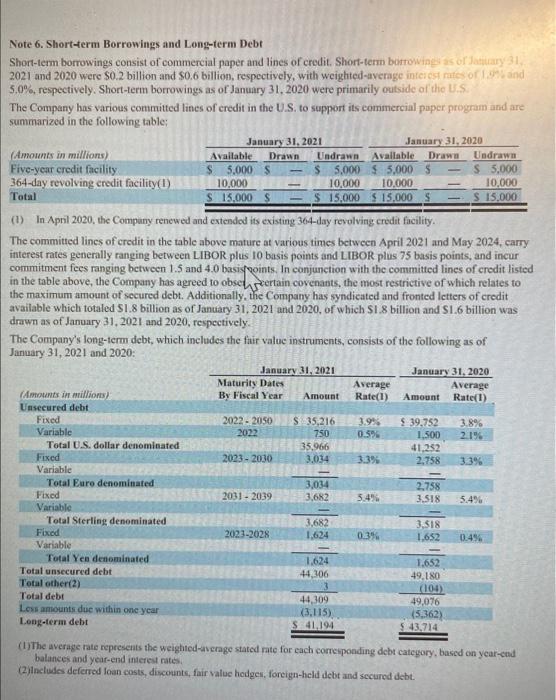

Pefer to the financisi statements and footnotes of Walmart given in All doliar amounts are in milions. For calculations that require net income. use the "Consolidated net income" amount reportech by Walmart. Required: 1. For the most recent fiscal year, compute the return on equity ratio for Walmart. 2. For the most recent fiscal year, compute the retum on assets ratio for Walmart. 3. For the most tecent fiscal yeat, compule the net profit margin for Waimart. Walmart Inc. Consolidated Statements of Income Walmart Inc. Consolidated Statements of Comprehensive Income Walmart Inc. Consolidated Balance Sheets Walmart Inc. Walmart lnc. Consolidated Statements of Cash Flows Note 6. Short-term Borrowings and Long-term Debt Short-term borrowings consist of commercial paper and lines of credit. Short-term botrowinges as of Jatifary 31. 2021 and 2020 were $0.2 billion and $0.6 billion, respectiyely, with weighted-average interca rutes of 1.9 thand 5,0%, respectively. Short-term borrowings as of January 31,2020 were primarily outside of the U.S. The Company has various committed lines of eredit in the U.S. to support its commercial puper program and are summarized in the following table: (1) In April 2020, the Compuny renewed and extended its existing 364-day revolving credit facility. The committed lines of credit in the table above mature at various times between April 2021 and May 2024, carry interest rates generally ranging between LIBOR plus 10 basis points and LIBOR plus 75 basis points, and incur commitment fees ranging between 1.5 and 4.0 basigpoints. In conjunction with the committed lines of credit listed in the table above, the Company has agreed to obsem Scertain covenasts, the most restrictive of which relates to the maximum amount of secured debt. Additionally, the Company has syndicated and fronted letters of credit available which totaled $1.8 billion as of January 31,2021 and 2020 , of which $1.8 billion and $1.6 billion was drawn as of January 31,2021 and 2020 , respectively. The Company's long-term debt, which includes the fuir value instruments, consists of the following as of January 31,2021 and 2020: (1)The average rate represents the weighited-average stated rate for each conceponding debr category, based on year-ead balunces and year-end interea nates. (2)lineluales defered loan costs, discounts, fair value hodgen, foreign-held debt and secured debt