Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pen a general journal for the City of Monroe Water and Sewer Utility Fund and record te following transactions. (1) During the year, sales of

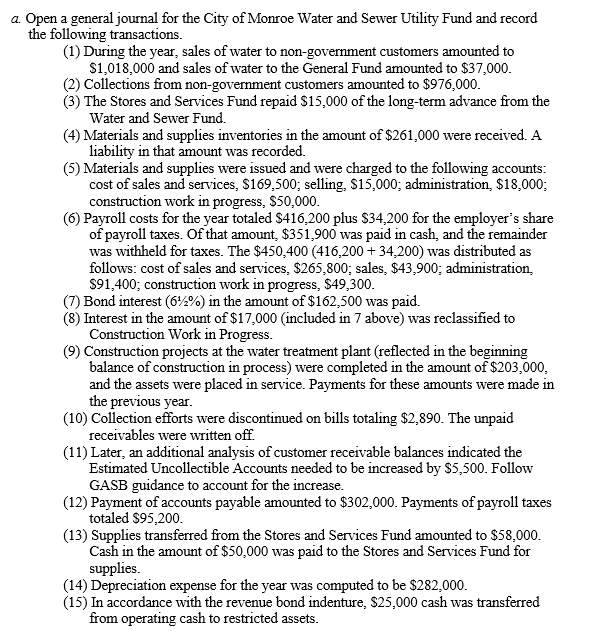

pen a general journal for the City of Monroe Water and Sewer Utility Fund and record te following transactions. (1) During the year, sales of water to non-government customers amounted to $1,018,000 and sales of water to the General Fund amounted to $37,000. (2) Collections from non-government customers amounted to $976,000. (3) The Stores and Services Fund repaid $15,000 of the long-term advance from the Water and Sewer Fund. (4) Materials and supplies inventories in the amount of $261,000 were received. A liability in that amount was recorded. (5) Materials and supplies were issued and were charged to the following accounts: cost of sales and services, $169,500; selling, $15,000; administration, $18,000; construction work in progress, $50,000. (6) Payroll costs for the year totaled $416,200 plus $34,200 for the employer's share of payroll taxes. Of that amount, $351,900 was paid in cash, and the remainder was withheld for taxes. The $450,400(416,200+34,200) was distributed as follows: cost of sales and services, $265,800; sales, $43,900; administration, $91,400; construction work in progress, $49,300. (7) Bond interest (621%) in the amount of $162,500 was paid. (8) Interest in the amount of $17,000 (included in 7 above) was reclassified to Construction Work in Progress. (9) Construction projects at the water treatment plant (reflected in the beginning balance of construction in process) were completed in the amount of $203,000, and the assets were placed in service. Payments for these amounts were made in the previous year. (10) Collection efforts were discontinued on bills totaling $2,890. The unpaid receivables were written off. (11) Later, an additional analysis of customer receivable balances indicated the Estimated Uncollectible Accounts needed to be increased by $5,500. Follow GASB guidance to account for the increase. (12) Payment of accounts payable amounted to $302,000. Payments of payroll taxes totaled $95,200. (13) Supplies transferred from the Stores and Services Fund amounted to $58,000. Cash in the amount of $50,000 was paid to the Stores and Services Fund for supplies. (14) Depreciation expense for the year was computed to be $282,000. (15) In accordance with the revenue bond indenture, $25,000 cash was transferred from operating cash to restricted assets

pen a general journal for the City of Monroe Water and Sewer Utility Fund and record te following transactions. (1) During the year, sales of water to non-government customers amounted to $1,018,000 and sales of water to the General Fund amounted to $37,000. (2) Collections from non-government customers amounted to $976,000. (3) The Stores and Services Fund repaid $15,000 of the long-term advance from the Water and Sewer Fund. (4) Materials and supplies inventories in the amount of $261,000 were received. A liability in that amount was recorded. (5) Materials and supplies were issued and were charged to the following accounts: cost of sales and services, $169,500; selling, $15,000; administration, $18,000; construction work in progress, $50,000. (6) Payroll costs for the year totaled $416,200 plus $34,200 for the employer's share of payroll taxes. Of that amount, $351,900 was paid in cash, and the remainder was withheld for taxes. The $450,400(416,200+34,200) was distributed as follows: cost of sales and services, $265,800; sales, $43,900; administration, $91,400; construction work in progress, $49,300. (7) Bond interest (621%) in the amount of $162,500 was paid. (8) Interest in the amount of $17,000 (included in 7 above) was reclassified to Construction Work in Progress. (9) Construction projects at the water treatment plant (reflected in the beginning balance of construction in process) were completed in the amount of $203,000, and the assets were placed in service. Payments for these amounts were made in the previous year. (10) Collection efforts were discontinued on bills totaling $2,890. The unpaid receivables were written off. (11) Later, an additional analysis of customer receivable balances indicated the Estimated Uncollectible Accounts needed to be increased by $5,500. Follow GASB guidance to account for the increase. (12) Payment of accounts payable amounted to $302,000. Payments of payroll taxes totaled $95,200. (13) Supplies transferred from the Stores and Services Fund amounted to $58,000. Cash in the amount of $50,000 was paid to the Stores and Services Fund for supplies. (14) Depreciation expense for the year was computed to be $282,000. (15) In accordance with the revenue bond indenture, $25,000 cash was transferred from operating cash to restricted assets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started