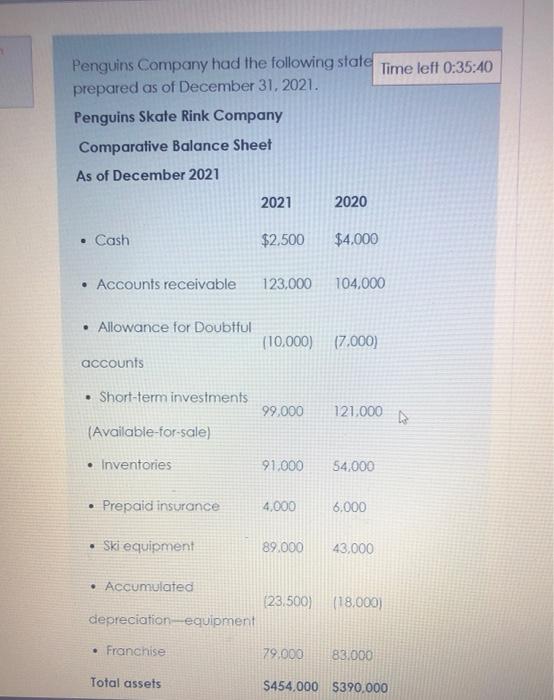

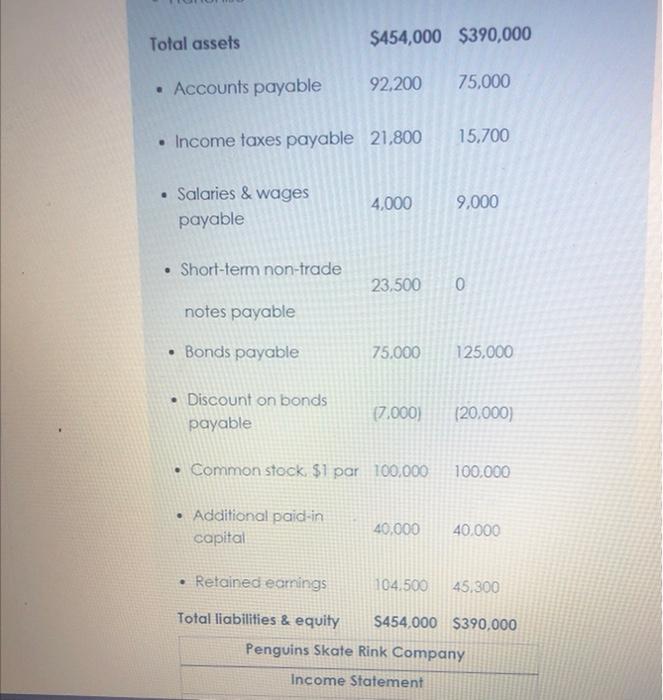

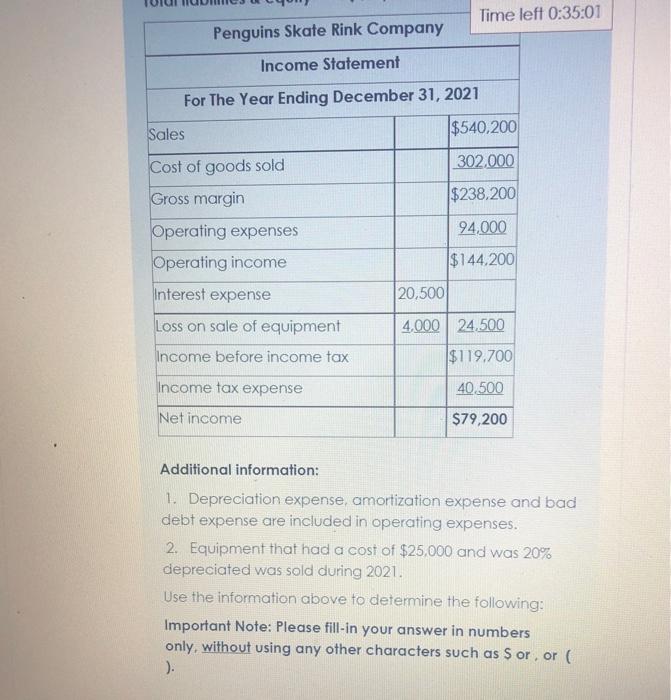

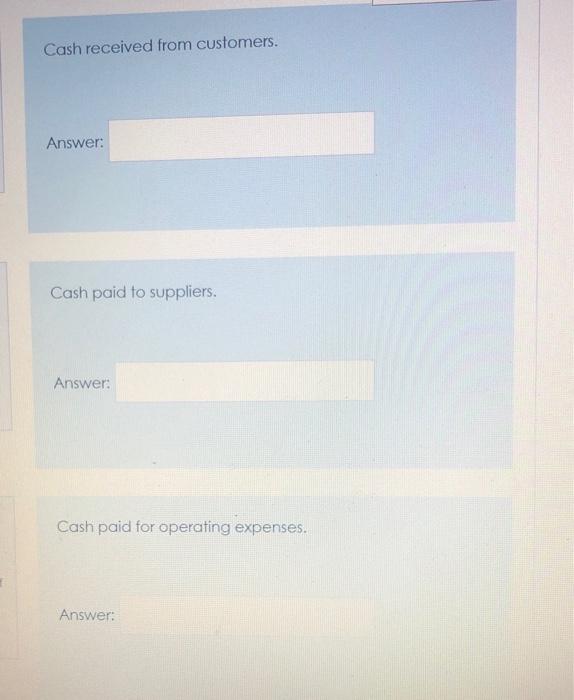

Penguins Company had the following state Time left 0:35:40 prepared as of December 31, 2021. Penguins Skate Rink Company Comparative Balance Sheet As of December 2021 2021 2020 Cash $2.500 $4.000 Accounts receivable 123.000 104.000 Allowance for Doubtful (10,000) (7.000) accounts . Short-term investments 99,000 121.000 (Available-for-sale) Inventories 91.000 54,000 Prepaid insurance 4,000 6.000 Ski equipment 89.000 43,000 Accumulated (23,500) (18.000) depreciation equipment Franchise 79.000 83.000 Total assets 5454,000 $390,000 Total assets $454,000 $390,000 Accounts payable 92,200 75,000 Income taxes payable 21,800 15.700 Salaries & wages payable 4,000 9,000 Short-term non-trade 23.500 0 notes payable Bonds payable 75.000 125,000 Discount on bonds payable (7.000) (20,000) Common stock $1 par 100,000 100,000 Additional paid-in capital 40.000 40.000 Retained earnings 104.500 45.300 Total liabilities & equity S454,000 $390,000 Penguins Skate Rink Company Income Statement Time left 0:35:01 Penguins Skate Rink Company Income Statement For The Year Ending December 31, 2021 Sales $540,200 Cost of goods sold 302.000 Gross margin $238.200 94,000 Operating expenses Operating income $144,200 20,500 Interest expense Loss on sale of equipment Income before income tax 4,000 24.500 $119.700 Income tax expense 40.500 Net income $79,200 Additional information: 1. Depreciation expense, amortization expense and bad debt expense are included in operating expenses. 2. Equipment that had a cost of $25,000 and was 20% depreciated was sold during 2021. Use the information above to determine the following: Important Note: Please fill-in your answer in numbers only, without using any other characters such as S or or ). Cash received from customers. Answer: Cash paid to suppliers. Answer: Cash paid for operating expenses. Answer: hp?attempt=631248&cmid=245553&page Cash paid for interest. Time left 0:34:14 Answer: Cash paid for taxes Answer: Net cash used by investing activities. Answer: Net cash used by financing activities