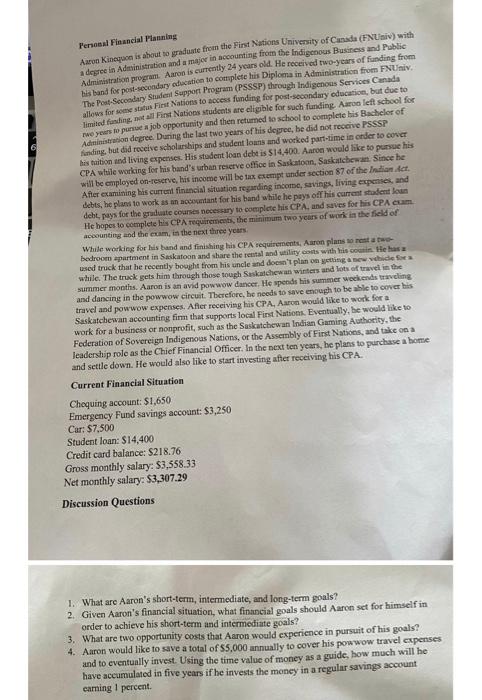

Penoedl Financial Planning Aason Kinequon is abeut to graduate from the Finst Nutions Univensity of Candad (FNU ariv) with a drogree in Adtrinistabion and a majer in accounting from the Indigcoous Busines and Public Administration pregram. Auron is currently. 24 years old. He received two-years of funding from his band for post-yecondary odstation to cottrplete his Diploena in Administration from FNUniv. The Post-Socondary Studetil Support Program (PSSSP) thecugh lradigenous Services Canada : allows for wene status Firt Nations to sccess fundine foe nost secondary oducation, but cue to rwe yeirs to punve a job opportunity and then retirned to school to complete tis Bacheler of Adtininisteston degree. Duning the last twe years of lis degec, be dad not reserive PSSSP Anding, but did receive scholurklips and student loants and worked part-lime in order to cover CPA wattic wotising for his band's urban reserve oftice in Saskatoan, Saskatchen at Since he will be employed on-eserve, bis income will be tax ecempt under section 87 of the lntian iet. After examining his current finencial situation regarding incorbe, savings, living eyperises, and Lebts, he plans to work as an noterantant for his band while he pays off his carrent stadent lown deht, pays for the gratuate coures noeessary to coenplete his CPA, and saves for his CPA eLam. He hopes to cotrolete his CPA Tequiremerts, the minimeum two years of work in the ficld of accounting and the eum, it the next three years: Whule working for his band and finishing liis CPA sequirenents, Aaron pilans wo rest a twebedroom opartment in Sackatoon and ahare the rental and weility cons with lits coniin the has a used trick that he recently bought trom his uncle and doen't plan on yetisig a sew velide fie a while. The truok gets him through those tough Siskatehewan winters asd lots of tuwet in the summer months. Aaron is an avid powwow dancer. He spends his summer weckends trweling and dancing in the powwow circuit. Tberefore, be nects to save enought to be able to cever bis travel and powwow expenses. Affer receivittg his CPA, Aaroa would like to work for a Seskatchewan accounting fim that supports local First Natioms. Eventually, be would like to work for a business or nonprofit, such as the Saskatchewan Indian Gaming Authority, the Federation of Sovereign Indigenous Nations, of the Assembly of Finst Nations, and take on a leadership role as the Chief Finanicial Officer. In the next ten years, be plans to purchase a bome and settle down. He would also like to start investing after receiving his CPA. Current Financial Situation Chequing account: 51,650 Emergency Fund savings account: $3,250 Car: $7,500 Student loan: S14,400 Credit card balance: $218.76 Gross monthly salary: $3,558.33 Net monthly salary: $3,307.29 Discussion Questions 1. What are Aaron's short-term, intermediate, and long-term goals? 2. Given Aaron's financial situation, what financial goals should Aaren set for himself in order to achieve his short-term and intermediate goals? 3. What are two opportunity costs that Aaron would experience in pursuit of his goals? 4. Aaron would like to save a total of 55,000 annually to cover his powwow travel expenses and to eventually invest. Using the time value of money as a guide, how much will he have accumulated in five years if he invests the money in a regular savings account earning 1 percent