Question

Pension Plans Aylmer has two pension plans for employees: A. Defined Contribution Plan : For this plan, payments are made to the plan in January

Pension Plans

Aylmer has two pension plans for employees:

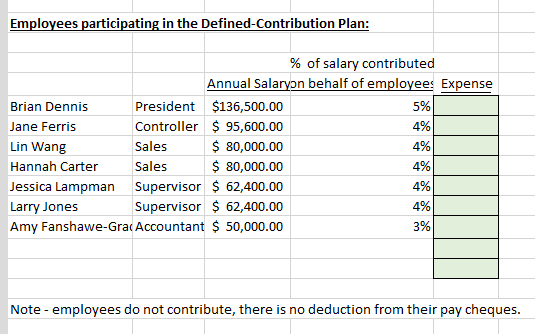

A. Defined Contribution Plan: For this plan, payments are made to the plan in January for the prior year. Aylmer contributes to this plan, on behalf of qualified employees. The employees do not contribute. A payment will be made in January 2021 for all of 2020 defined contribution pension related expenses. Remittances are only required to be made annually as is the corresponding accrual. The entry for accruing the pension expense for 2020 is to be made in December 2020.

In the Excel spreadsheet, see the tab labelled Defined Contribution Plan for calculations.

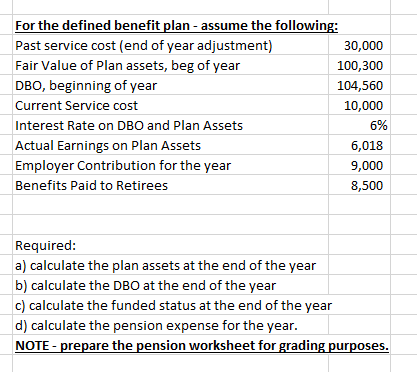

B. Defined Benefit Plan: For this plan, NOTE for 2020, the payment and expense have not been recorded on the trial balance.

In the Excel spreadsheet, see the tab labelled Defined Benefit Plan for calculations and requirements for reconciling the pension amounts (calculate/complete the worksheet).

TRIAL BALANCE 2019 2020

| Pension Liability (Defined Contribution) | 21,500 | - | ||

| Net Defined Pension Asset/Liability (Defined Benefit) | 4,260 | 4,260 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started