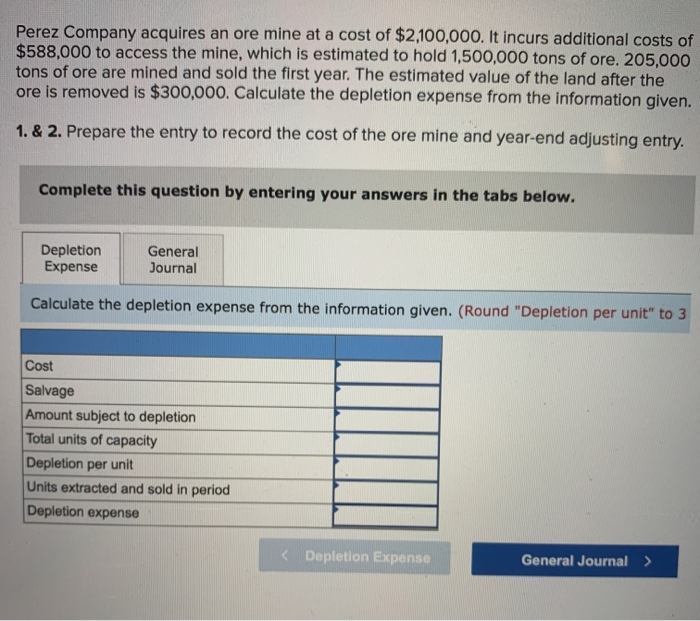

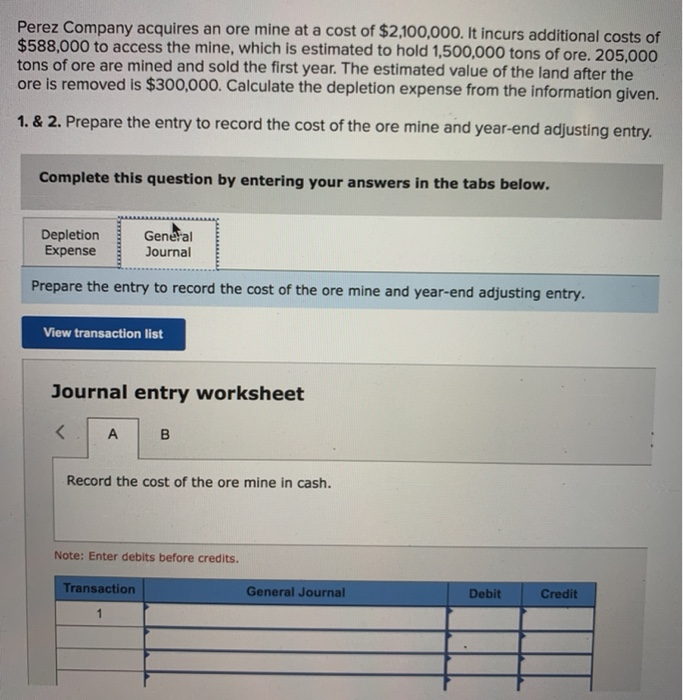

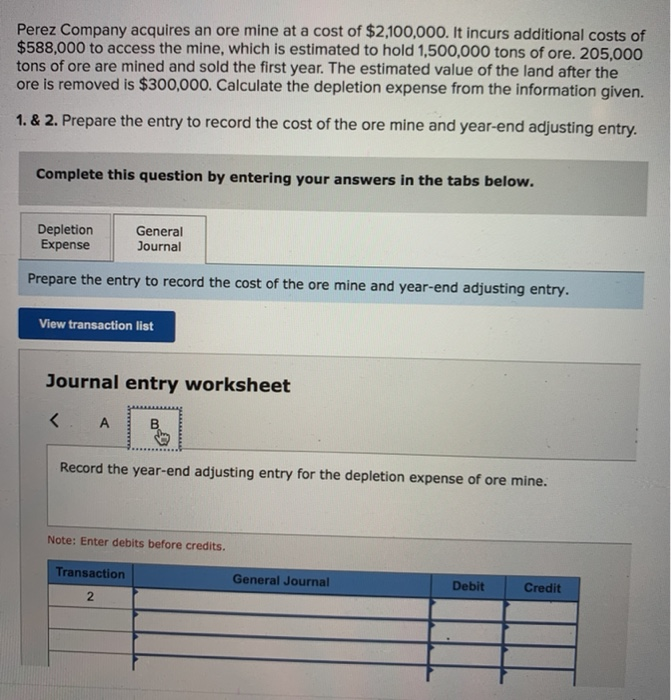

Perez Company acquires an ore mine at a cost of $2,100,000. It incurs additional costs of $588,000 to access the mine, which is estimated to hold 1,500,000 tons of ore. 205,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $300,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. Depletion Expense General Journal Calculate the depletion expense from the information given. (Round "Depletion per unit" to 3 Cost Salvage Amount subject to depletion Total units of capacity Depletion per unit Units extracted and sold in period Depletion expense Perez Company acquires an ore mine at a cost of $2,100,000. It incurs additional costs of $588,000 to access the mine, which is estimated to hold 1,500,000 tons of ore. 205,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $300,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. Depletion Expense General Journal Prepare the entry to record the cost of the ore mine and year-end adjusting entry. View transaction list Journal entry worksheet A B Record the cost of the ore mine in cash. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Perez Company acquires an ore mine at a cost of $2,100,000. It incurs additional costs of $588,000 to access the mine, which is estimated to hold 1,500,000 tons of ore. 205,000 tons of ore are mined and sold the first year. The estimated value of the land after the ore is removed is $300,000. Calculate the depletion expense from the information given. 1. & 2. Prepare the entry to record the cost of the ore mine and year-end adjusting entry. Complete this question by entering your answers in the tabs below. Depletion Expense General Journal Prepare the entry to record the cost of the ore mine and year-end adjusting entry. View transaction list Journal entry worksheet A B Record the year-end adjusting entry for the depletion expense of ore mine. Note: Enter debits before credits. Transaction General Journal Debit Credit 2