Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Perez Manufacturing Company has an opportunity to purchase some technologically advanced equipment that will reduce the company's cash outflow for operating expenses by $1,281,000

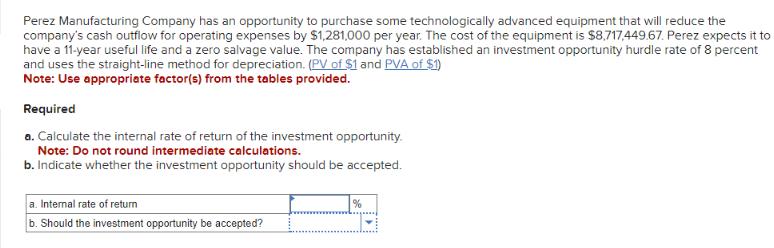

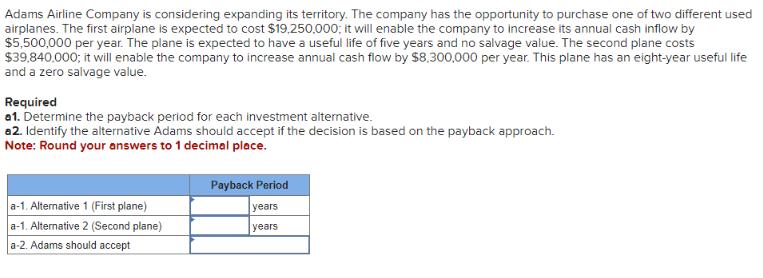

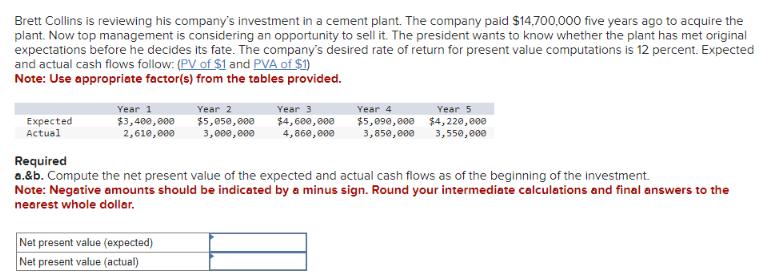

Perez Manufacturing Company has an opportunity to purchase some technologically advanced equipment that will reduce the company's cash outflow for operating expenses by $1,281,000 per year. The cost of the equipment is $8,717,449.67. Perez expects it to have a 11-year useful life and a zero salvage value. The company has established an investment opportunity hurdle rate of 8 percent and uses the straight-line method for depreciation. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required a. Calculate the internal rate of return of the investment opportunity. Note: Do not round intermediate calculations. b. Indicate whether the investment opportunity should be accepted. a. Internal rate of return b. Should the investment opportunity be accepted? % Adams Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $19,250,000; it will enable the company to increase its annual cash inflow by $5,500,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $39,840.000; it will enable the company to increase annual cash flow by $8,300,000 per year. This plane has an eight-year useful life and a zero salvage value. Required a1. Determine the payback period for each investment alternative. a2. Identify the alternative Adams should accept if the decision is based on the payback approach. Note: Round your answers to 1 decimal place. a-1. Alternative 1 (First plane) a-1. Alternative 2 (Second plane) a-2. Adams should accept Payback Period years years Gibson Company has an opportunity to purchase a forklift to use in its heavy equipment rental business. The forklift would be leased on an annual basis during its first two years of operation. Thereafter, it would be leased to the general public on demand. Gibson would sell it at the end of the fifth year of its useful life. The expected cash inflows and outflows follow: Cash Inflow Nature of Item Purchase price Revenue Revenue Revenue Year Year 1 Year 1 Year 2 Year 3 Year 3 Major overhaul Year 4 Year 5 Year 5 Revenue Revenue Salvage value $34,000 34,000 29,000 20,000 18,000 7,600 Cash Outflow $88,200 a. Payback period (accumulated cash flows) b. Payback period (average cash flows) Required a.&b. Determine the payback period using the accumulated and average cash flows approaches. Note: Round your answers to 1 decimal place. 8,800 years years Gibson Rentals can purchase a van that costs $140,000; it has an expected useful life of five years and no salvage value. Gibson uses straight-line depreciation. Expected revenue is $51,870 per year. Assume that depreciation is the only expense associated with this investment. Required a. Determine the payback period. Note: Round your answer to 1 decimal place. b. Determine the unadjusted rate of return based on the average cost of the investment. Note: Round your answer to 1 decimal place. (i.e., .234 should be entered as 23.4). a. Payback period b. Unadjusted rate of return years % Brett Collins is reviewing his company's investment in a cement plant. The company paid $14,700,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's desired rate of return for present value computations is 12 percent. Expected and actual cash flows follow: (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Expected Actual Year 1 $3,400,000 2,610,000 Year 2 $5,050,000 3,000,000 Net present value (expected) Net present value (actual) Year 3 $4,600,000 4,860,000 Year 4 $5,090,000 3,850,000 Year 5 $4,220,000 3,550,000 Required a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment. Note: Negative amounts should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

PEREZ CALCULATION OF IRR 0 1 2 3 4 5 6 7 8 9 10 11 NCF 871744967 128100000 128100000 128100000 128100000 128100000 128100000 128100000 128100000 12810...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started