Answered step by step

Verified Expert Solution

Question

1 Approved Answer

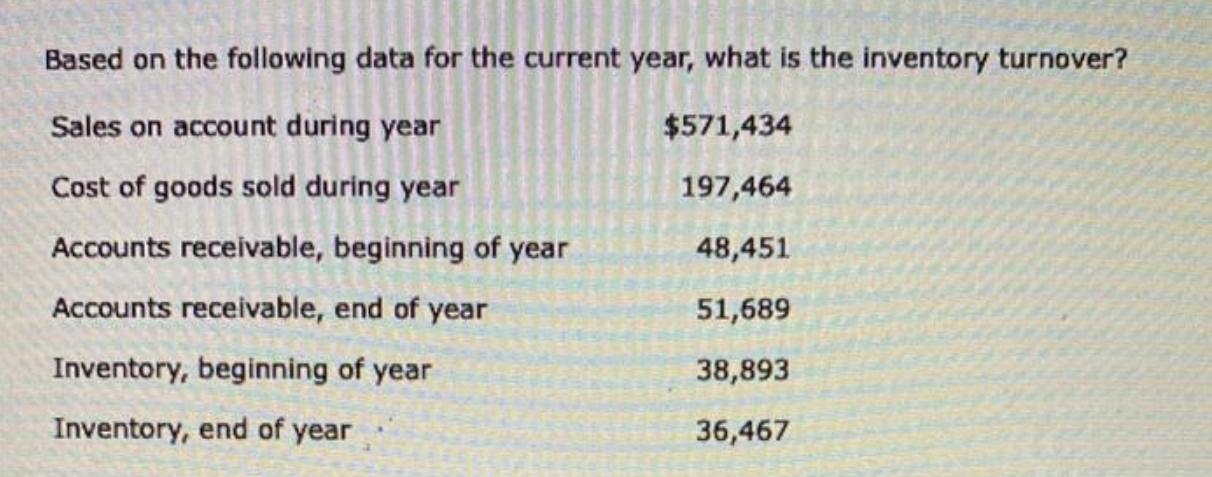

Based on the following data for the current year, what is the inventory turnover? Sales on account during year $571,434 Cost of goods sold

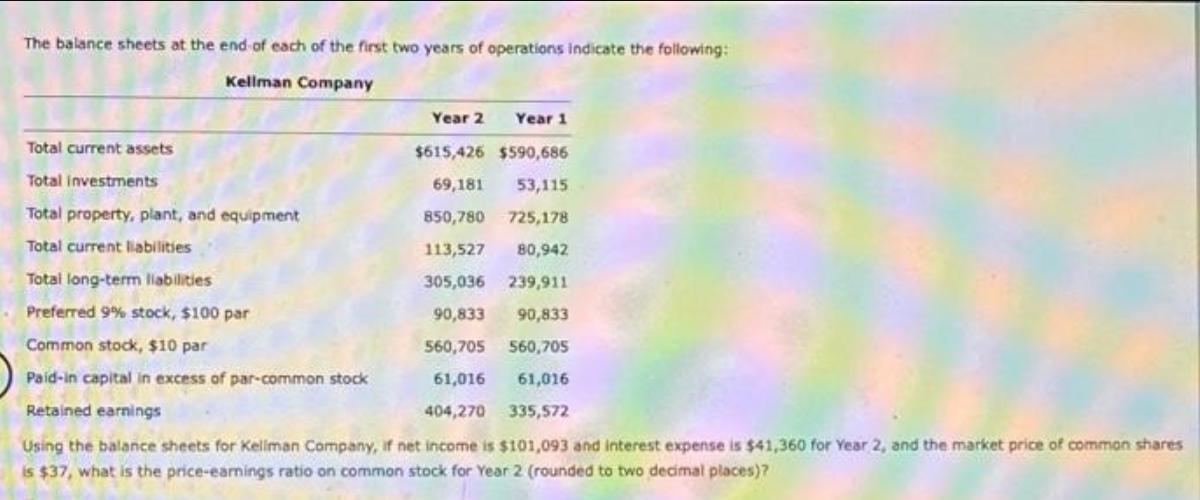

Based on the following data for the current year, what is the inventory turnover? Sales on account during year $571,434 Cost of goods sold during year 197,464 Accounts receivable, beginning of year 48,451 Accounts receivable, end of year 51,689 Inventory, beginning of year 38,893 Inventory, end of year 36,467 The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $615,426 $590,686 Total investments 69,181 53,115 Total property, plant, and equipment 850,780 725,178 Total current liabilities 113,527 80,942 Total long-term liabilities 305,036 239,911 Preferred 9% stock, $100 par 90,833 90,833 Common stock, $10 par 560,705 560,705 Paid-in capital in excess of par-common stock 61,016 61,016 Retained earnings 404,270 335,572 Using the balance sheets for Kellman Company, if net income is $101,093 and interest expense is $41,360 for Year 2, and the market price of common shares is $37, what is the price-earnings ratio on common stock for Year 2 (rounded to two decimal places)?

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Inventory turnover It is a financial ratio that indicates how frequently a companys inventory is sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started