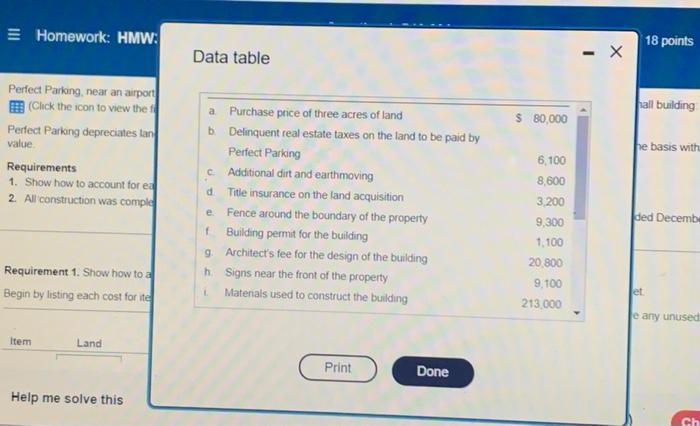

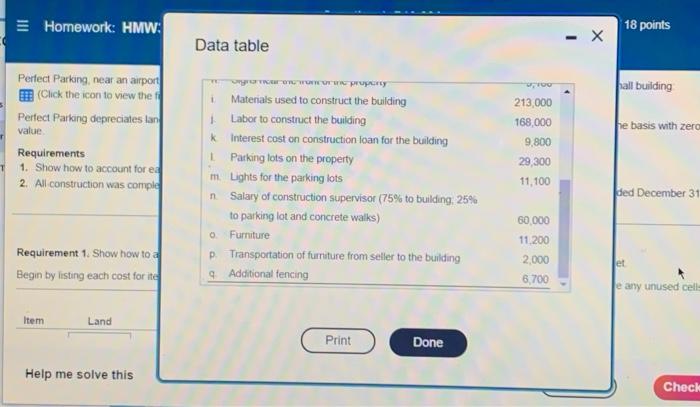

Perfect Parking near an airport incurred the following costs to acquire land, make land improvements, and construct and furnish a small building Chok the sconto vw the funcial data) Perfect Parking deprecates tand improvements over 15 years, buildings over 30 years, and furniture over 12 years, all on a straight-line basis with zero residual value Requirements 1. Show how to account for each cost by fisting the cost under the correct account Determine the total cost of each asset 2. Al construction was complete and the assets were placed in service on August 1. Record partial year depreciation for the year ended December 31 Requirement 1. Show how to account for each cost by listing the cost under the correct account Determine the total cost of each asset Begin by listing each cost for tres a through liest, followed by items through a Then determine the total cost of each asset (leave any used cells blank) Land Item Land Improvements Building Furniture Homework: HMW: 18 points Data table - X all building a $ 80.000 Perfect Parlong, near an airport (Click the icon to view the Perfed Parking depreciates tan value Requirements 1. Show how to account for ed 2. All construction was comple he basis with c 6.100 8,600 Purchase price of three acres of land b. Delinquent real estate taxes on the land to be paid by Perfect Parking Additional dirt and earthmoving d Title insurance on the land acquisition Fence around the boundary of the property Building permit for the building 9 Architect's fee for the design of the building h. Signs near the front of the property Materials used to construct the building 3.200 e 9,300 ded Decembe Requirement 1. Show how to a Begin by listing each cost for it 1.100 20.800 9.100 213 000 et e any unused Item Land Print Done Help me solve this Ch Homework: HMW: 18 points Data table w pro all building Perfect Parking near an airport Click the icon to view the fil Perfect Parking depreciates lan value he basis with zero K 10 213,000 168,000 9,800 29,300 11,100 Materials used to construct the building 1 Labor to construct the building Interest cost on construction loan for the building Parking lots on the property m Lights for the parking lots n Salary of construction supervisor (75% to building, 25% to parking lot and concrete walks) Furniture p. Transportation of furniture from seller to the building 9 Additional fencing Requirements 1. Show how to account for et 2. All construction was comple sed December 31 0 Requirement 1. Show how to a Begin by listing each cost for it 60.000 11.200 2,000 6,700 et e any unused cell Item Land Print Done Help me solve this Check